By Dan Suzuki, CFA

Deputy Chief Investment Officer

Fortune actually does favor the brave

Plenty of pundits have already lambasted the cryptocurrency exchange commercial that aired in late 2021, days before the peak in the price of bitcoin. The ad infamously featured the slogan, “fortune favors the brave.” While this ad was most likely a misapplication of the slogan, there’s nothing wrong with the slogan itself. Historically, fortune does favor the brave, but there is a difference between courage and blind faith. The heart of the issue with crypto and any of these other “blind faith” trades was that there simply was no fear. Here the classic parenting line seems very applicable: “That’s not brave, that’s just unsafe.”

You had to truly be brave to buy emerging markets in 2000 and the US in 2010

Investing money into something simply based on a story and on hope, without an analysis of cash flows or valuation, is the very opposite of fear. Thus, it’s no coincidence that as the cost of capital began to rise and liquidity started to tighten, that the market began to re-rate these “blind faith” investments. The biggest investment opportunities in recent history did not, at their outset, have their names on stadiums, their own dedicated segments on the business networks or dominate the biggest market caps in the major stock market indices. Consider the last two market cycles:

- Emerging markets emerge (2000-2010)

- The setup: The foundation for emerging market leadership was laid in the 1990s, where similar to today, the US had come off of a decade of outperformance driven by US innovation.

- Market perception: Why would anybody bother to deal with the added headache of currency fluctuations and geopolitics when all the innovation was happening in the US? Especially when we were fresh off the Asian Financial Crisis in 1997 and the Russian Debt Crisis in 1998.

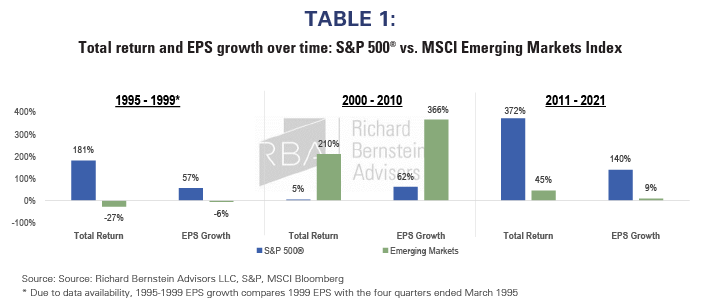

- Market reality: Emerging markets grew EPS by 6x the rate of the US and were rewarded by 210% returns during 2000 – 2010, dwarfing the 5% returns of the S&P 500®.

- US disrupts the world (2011 – 2021)

- The Setup: At the time, the US had led the world into a financial crisis, government debt levels had surged, lending was going to be constrained by regulation, US manufacturing continued to lose share to emerging markets and the US was coming off a lost decade of returns.

- Market perception: US investors had too much “home bias,” and were therefore underinvested in the economies driving global growth.

- Market reality: US earnings outgrew emerging markets by sixteen-fold, helping to drive 372% returns during 2011 – 2021 vs. 45% for emerging markets.

The “obvious” trades are rarely obvious at the time

There are countless reasons to avoid the past cycle’s losers. The old economy is being disrupted away, and conventional energy sources are in secular decline. International stocks always seem to disappoint, and the US dollar always seems to go up. Meanwhile, bigger companies continue to use their scale to dominate smaller companies. But with cheap valuations and low expectations, maybe the “obvious” investments to avoid aren’t so obvious.

Originally published 20 December, 2022.

For more news, information, and analysis, visit the ETF Strategist Channel.

Dan Suzuki is registered with Foreside Fund Services, LLC which is not affiliated with Richard Bernstein Advisors LLC or its affiliates.

Nothing contained herein constitutes tax, legal, insurance or investment advice, or the recommendation of or an offer to sell, or the solicitation of an offer to buy or invest in any investment product, vehicle, service or instrument. Such an offer or solicitation may only be made by delivery to a prospective investor of formal offering materials, including subscription or account documents or forms, which include detailed discussions of the terms of the respective product, vehicle, service or instrument, including the principal risk factors that might impact such a purchase or investment, and which should be reviewed carefully by any such investor before making the decision to invest. RBA information may include statements concerning financial market trends and/or individual stocks, and are based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially and should not be relied upon as such. The investment strategy and broad themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information contained in the material has been obtained from sources believed to be reliable, but not guaranteed. You should note that the materials are provided “as is” without any express or implied warranties. Past performance is not a guarantee of future results. All investments involve a degree of risk, including the risk of loss. No part of RBA’s materials may be reproduced in any form, or referred to in any other publication, without express written permission from RBA. Links to appearances and articles by Richard Bernstein, whether in the press, on television or otherwise, are provided for informational purposes only and in no way should be considered a recommendation of any particular investment product, vehicle, service or instrument or the rendering of investment advice, which must always be evaluated by a prospective investor in consultation with his or her own financial adviser and in light of his or her own circumstances, including the investor’s investment horizon, appetite for risk, and ability to withstand a potential loss of some or all of an investment’s value. Investing is subject to market risks. Investors acknowledge and accept the potential loss of some or all of an investment’s value. Views represented are subject to change at the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC does not undertake to advise you of any changes in the views expressed herein.