Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play at either angle. For this edition of Bull vs. Bear, Evan Harp and Elle Caruso debate the investment case for frontier markets.

Evan Harp: Hello Elle; I hope you had a fantastic holiday season that did not involve getting stranded in Denver. Speaking of locations, we are discussing frontier markets, which I think make an excellent addition for your investment portfolio. Diversification means having a wide range of investments across multiple axes. Home country bias paid off well in the U.S. over the past decade or so, but the markets are changing now.

Elle Caruso: Hi Evan, well, thanks for bringing up something that’s clearly sensitive and I’m trying to forget (getting stranded for a week in Denver, that is.)

I hope your vacation didn’t involve taking a tumble in front of a Crown Fried Chicken!

Harp: How oddly specific!

Caruso: So while I’ll clearly not be traveling to any frontier market countries any time soon (or anywhere farther than the grocery store, actually), I also don’t believe frontier markets are an essential part of a portfolio. In fact, I think they add more risk than upside potential. Investors are better off instead creating a more significant allocation to emerging markets or developed international markets, depending on their risk tolerance.

Harp: I agree that an expanded emerging markets allocation makes sense; valuations in that market are very attractive right now. But if you’re doubling down on emerging markets in general, then it seems short-sighted to cut out frontier markets, as they have even more upside potential. Just look at Vietnam, which had a rough year in 2022 (as did many countries) but which still has a lot of great fundamentals going for it. Investors can get that access through funds like Global X MSCI Vietnam ETF (VNAM) and the VanEck Vietnam ETF (VNM).

Caruso: While emerging markets are a good buy right now, I don’t think that should include frontier markets. The current headwinds facing frontier markets offers a truly bleak outlook for the asset class, including unique risks such as liquidity risk, capital control risk, governance risk, and foreign exchange risk.

I’m glad you highlighted Vietnam because it’s a perfect example of capital control risk leading to distorted performance. The Vietnamese government opened the country’s market to more foreign investors and incentivized business reactions while simultaneously limiting the percentage a company could be owned by foreign investors. That resulted in stocks selling at a premium. If the limit had been reached for foreign ownership of a company, then foreign buyers would have to purchase from another foreign investor who already owned stock, leading to distorted performance. Meaning stocks were selling at differing rates within the domestic market.

The chart below shows that VNAM and VNM are underperforming the iShares MSCI Emerging Markets ETF (EEM) by over 2,479 basis points in the past 12 months — even in a period where EEM is outperforming the S&P 500 (albeit not by much).

Harp: Fair, but I think last year will be an anomaly on multiple fronts.

Caruso: Sure, but I’d argue that the challenging economic environment frontier markets face will ensure their underperformance lasts a long time. Many frontier economies remain in constant crisis mode, fighting rising food and energy costs and political unrest. And with the asset class’s inherent illiquidity, it could be challenging for investors to unwind positions in frontier markets investments. Few frontier investments have the trading volume of an EEM or even a Vanguard FTSE Emerging Markets ETF (VWO) or Schwab Emerging Markets Equity ETF (SCHE).

Vietnam has been considered the “epitome of a frontier tiger country,” with a deep and liquid market compared to its frontier market peers, but the recent struggles I mentioned previously highlight the heightened vulnerability even this poster child faces.

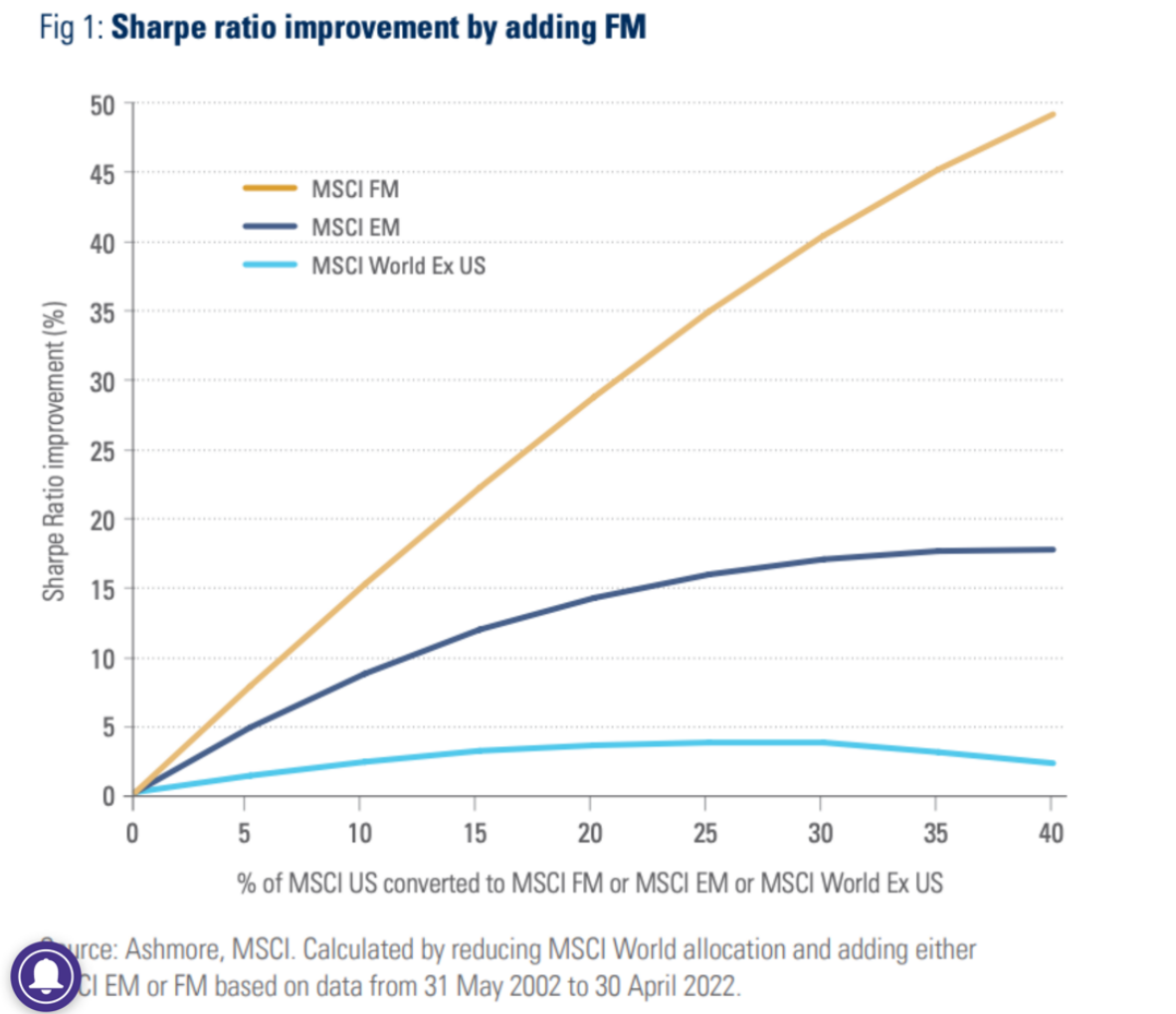

Harp: While it’s true that last year emerging markets outperformed frontier markets, if we look at the larger picture, frontier markets exposure adds a lot of diversification benefits. Their companies’ growth tends to be domestic, meaning correlation between frontier markets tends to be low, and correlation of frontier markets to other portfolio assets tends to be low as well. They also do a better job improving a portfolio’s Sharpe ratio than emerging markets alone.

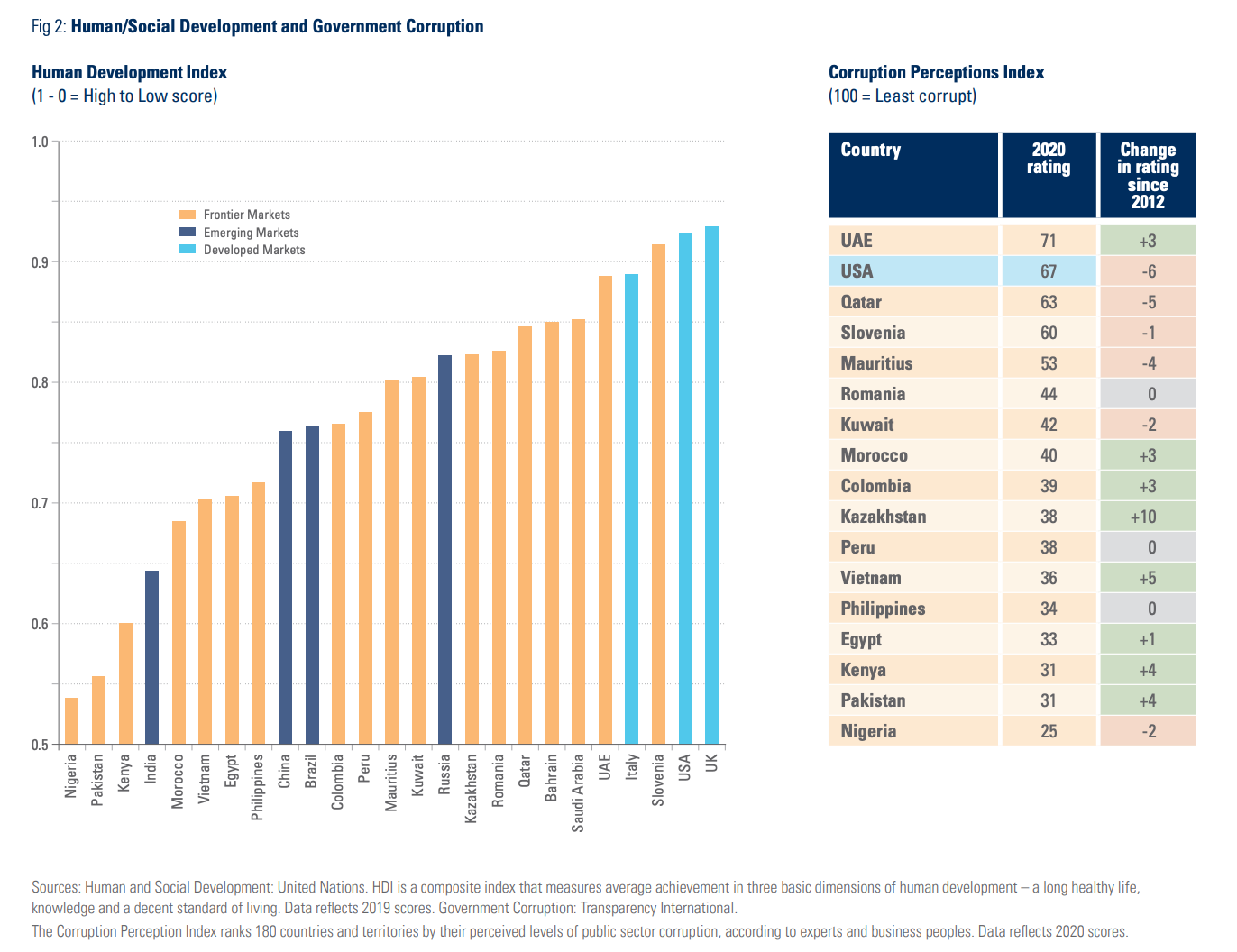

Also worth noting is that frontier markets are structurally changing all the time. If you feel squishy about Vietnam’s capital control, then the good news is that those capital controls are likely to shift as their economy evolves, and other frontier markets can cover you. The UAE and Qatar recently liberalized their markets and now permit 100% foreign-owned companies. This is up from the limits of 49% prior. What’s more, these kinds of trends are likely to continue as governments look for capital and push to make reforms to promote economic diversification and increase foreign investment comfort.

Caruso: Well, the UAE and Qatar are complicated examples because — while other indexes may classify them as frontier markets — FTSE Russell and MSCI classify both economies as emerging markets. So, yes, I expect liberalization as a trend we’ll see in other frontier markets, but I also expect those same markets will be reclassified as “emerging” if and when they do make the changes.

Harp: Certainly there’s some ambiguity about what is considered frontier and emerging. This article from September 2018 puts Qatar in the frontier category, while this one talks about the upgrade happening in 2014. The one I linked earlier was from early 2022 and had Qatar and UAE as frontier markets.

It’s a challenge to parse, yes, but as you pointed out: When frontier markets graduate to emerging markets, they tend to graduate fast. Relatedly, they are also more likely to commit to improving their ESG scores more readily than emerging markets.

From a fundamental perspective, frontier markets are poised to benefit as supply chains look to strengthen. Many of these countries are strategically placed to have important roles in larger distribution networks. Their low-cost, skilled workforces are likely to be tapped, increasing structural growth drivers on several fronts. As these markets rapidly emerge, domestic participation in the economy will get a boost. I don’t want to get lost in the weeds of short-term performance and risks and lose sight of long-term diversification potential.

Caruso: You bring up a really good point: Diversification. Country diversification is generally a positive for a portfolio, but some countries are riskier than others, and you don’t want to diversify yourself into a disaster.

For example, Russia was classified as a frontier market until last March, only to be reclassified as a standalone economy after catastrophic economic damage, without any opportunity for U.S. investors to recoup their losses. VanEck had to freeze its two single-country Russia ETFs on March 4, without advanced notice to investors, after the war in Ukraine severed the Russian market from Western investors.

The VanEck Russia ETF (RSX), which had more than $1.3 billion in assets in January 2022, declined 64% in the one week leading up to the fund’s abrupt freeze. VanEck said last week it plans to liquidate the ETF and distribute any proceeds from the liquidation to investors this month; the fund has just $35 million in assets remaining.

I will say, Evan, you are starting to convince me of the merits of allocating a small percentage of a portfolio to frontier markets — for the right investor. While I don’t have the risk tolerance for an allocation myself, and I don’t believe the average investor does either, I do better understand the upside potential and allure of the asset class. However, my view is the risk vastly outweighs any benefits.

Harp: I think you have to do your research and see which countries you are comfortable with. Of course, you should always be doing your research, even if you are investing in a vanilla domestic fund.

Heck, both of us have recent experiences that suggest researching is beneficial beyond investing. You should have researched whether or not Southwest had antiquated systems on the verge of collapse, and I should have researched shoes with better traction.

For more news, information, and analysis, visit VettaFi | ETF Trends.