Decarbonization is happening globally at increasing trajectories as countries and regulatory bodies work to bring emissions in line with a sustainable future. The transition to net-zero emissions by 2050 is already putting a strain on the core metals integral to renewable energy and green technologies, and with increasing demand, transitional commodities provide a unique investment opportunity for advisors and investors.

Mineral demand for the metals necessary for the “low-carbon power generation sector” is expected to triple by 2040 according to KraneShares in a recent paper, creating a supply and demand imbalance in electrification metals that could drive the value of these specific metals ever higher.

So what exactly are electrification metals? They’re the specific metals necessary for the energy transition and include lithium, aluminum, copper, zinc, nickel, and cobalt.

Aluminum

Aluminum is one of the most abundant metals on earth and is used across a variety of industries and sectors. It’s valuable because of its lighter weight and durability and is anticipated to play an increasing roll in EV batteries as well as its vital role in solar panels and wind turbines. Currently, concerns about international supply constraints (the Biden Administration’s proposed ban on aluminum imports from Russia and China’s annual aluminum capacity cap of 45 million metric tons MMT) could create to upward price pressure for aluminum in the next year.

Copper

Copper is a metal with the widest current use and may be the most important metal in the decarbonization transition. It is used in construction, transportation, and infrastructure as well as green technologies that include energy storage, EVs, and renewable energy technology.

“The supply-demand gap in copper is massive. Copper demand is projected to grow from 25 MMT today to about 50 MMT by 2035, a record-high level that is projected to be sustained and continue to grow to 53 MMT by 2050,” wrote KraneShares. “Supply may not be able to catch up with increasing demand, creating a medium to long-term ‘structural deficit’.”

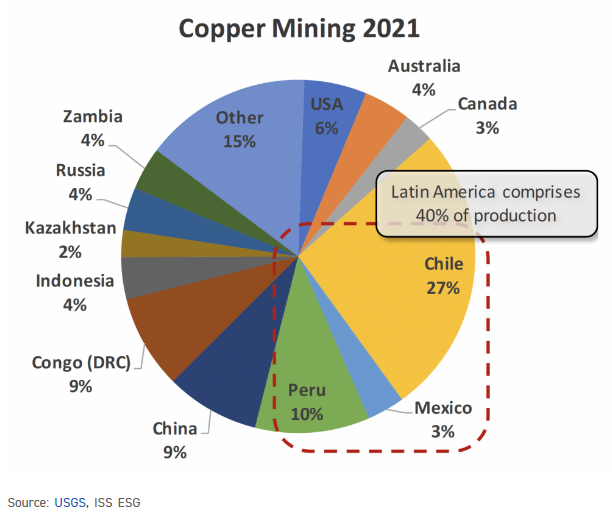

Chile, Peru, and the Democratic Republic of the Congo (DRC) are the three largest producers of copper by country and all are experiencing both political and fiscal uncertainty. Chile’s public debt to GDP ratio reached a 30-year high last year, and both Peru and DRC are fighting high and rising inflation. Peru also recently underwent a failed coup attempt by former President Pedro Castillo. This added risk and uncertainty of supply are currently not priced into copper futures contracts, KraneShares believe, and could result in sharp price inflation looking ahead.

Image source: Institutional Shareholder Services

Zinc

Zinc supply and demand have dropped off recently as demand from China’s real estate and construction sector dropped significantly in 2022. Zinc is used in tandem with other metals as an anti-corrosive for galvanizing as well as a stabilizer in batteries. Zinc batteries could prove to be an attractive alternative to more costly lithium batteries in the energy transition and with China’s recent regulatory support of its real estate sector, demand is anticipated to increase in 2023 and beyond.

Lithium

One of the most well-known metals associated with the energy transition, lithium remains in high demand for EV batteries and electricity storage because it’s both the lightest metal and the least dense one. Demand last year for lithium carbonate equivalent (LCE) was about 500k metric tons and is projected to grow to 3-4 million metric tons by 2030 while lithium supply is projected to grow more than 300% in the same period.

“Supply and demand seem to be balanced for the short term; however, long-term forecasts state that a chronic shortage is possible. Current capacity growth is projected to meet anticipated demand until 2025 and potentially through 2030 if enough recycling programs become available. After 2030, expectations are that a noticeable imbalance between supply and demand may drive lithium prices higher,” KraneShares wrote.

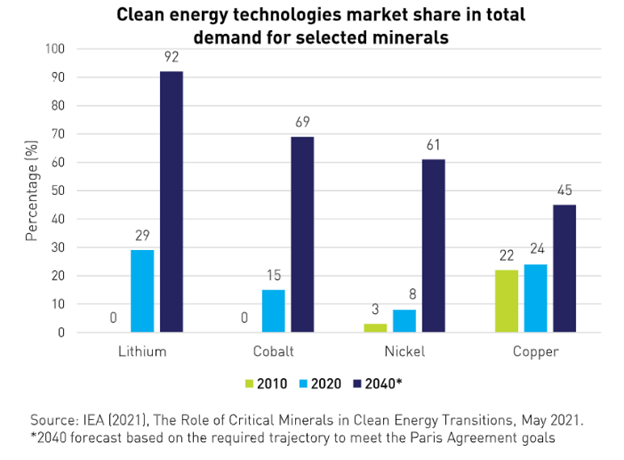

Image source: KraneShares’ “Electrification: 6 Essential Metals to Watch”

Nickel

Nickel is heavily used in electronics and stainless steel manufacturing and has a growing role in rechargeable battery systems as well as energy storage solutions. Nickel is primarily produced in Indonesia but Russia accounts for 9% of the global nickel supply and 33% of nickel sulfide ore that’s used to make nickel sulfate, a component of EV batteries. Supply concerns surrounding Russia play a role in the supply/demand balance for this metal when the global demand for nickel is expected to increase 44% by 2030.

Cobalt

Cobalt is the final electrification metal to watch and is used mostly in batteries and alloys to bring stability to batteries as well as longevity. Demand for cobalt grew 22% in 2021 because of the boom in EVs and lithium-ion batteries and that demand is anticipated to grow sharply in the coming years, creating positive price pressures. KraneShares noted that an important fact regarding cobalt is that it’s not a metal that has a dedicated mine: instead it’s a byproduct of nickel and copper mines and therefore suffers from any supply constraints that impact those metals as well as supply restrictions as a byproduct.

Investing in Electrification Metals With KMET

“As technology and environmental awareness rapidly develop, the supply for these metals will not be able to keep up with demand, creating an imbalance over the short to medium term, from which the investors can potentially benefit,” KraneShares wrote.

The KraneShares Electrification Metals ETF (KMET) offers targeted exposure to the metals necessary for the electrification and clean energy transition of the world’s economy in the pivot to net-zero emissions.

The fund seeks to track the Bloomberg Electrification Metals Index and is comprised of futures contracts on copper, nickel, zinc, aluminum, cobalt, and lithium. These metals are all core components for batteries, electric vehicles, and the renewable energy infrastructure being created and expanded as countries aim for net-zero emissions by 2050 to curtail global warming.

KMET has an expense ratio of 0.79% and is part of the climate-focused lineup of funds from KraneShares.

For more news, information, and analysis, visit the Climate Insights Channel.