On Monday, VettaFi wrote that equal weight sector ETFs were better positioned to hold steady if Big Tech companies were to report disappointing third-quarter earnings. So far, they have.

An equal weight approach is particularly impactful for indexes comprising Big Tech companies, as they tend to dominate market cap-weighted indexes and have an outsized impact.

Big Tech companies Alphabet (GOOGL), Microsoft (MSFT), Intel (INTC), Apple (AAPL), Meta Platforms (META), and Amazon (AMZN) have or will report third-quarter earnings this week.

Microsoft, Apple, and Intel are the only Big Tech companies that fall into the S&P 500 Information Technology sector. Shares of Microsoft fell 8% after the company reported disappointing fourth-quarter guidance. Microsoft’s sales rose at their slowest rate in five years during the third quarter, as rising energy costs and a strong dollar ate into profits.

Apple and Intel both report third quarter earnings on Thursday.

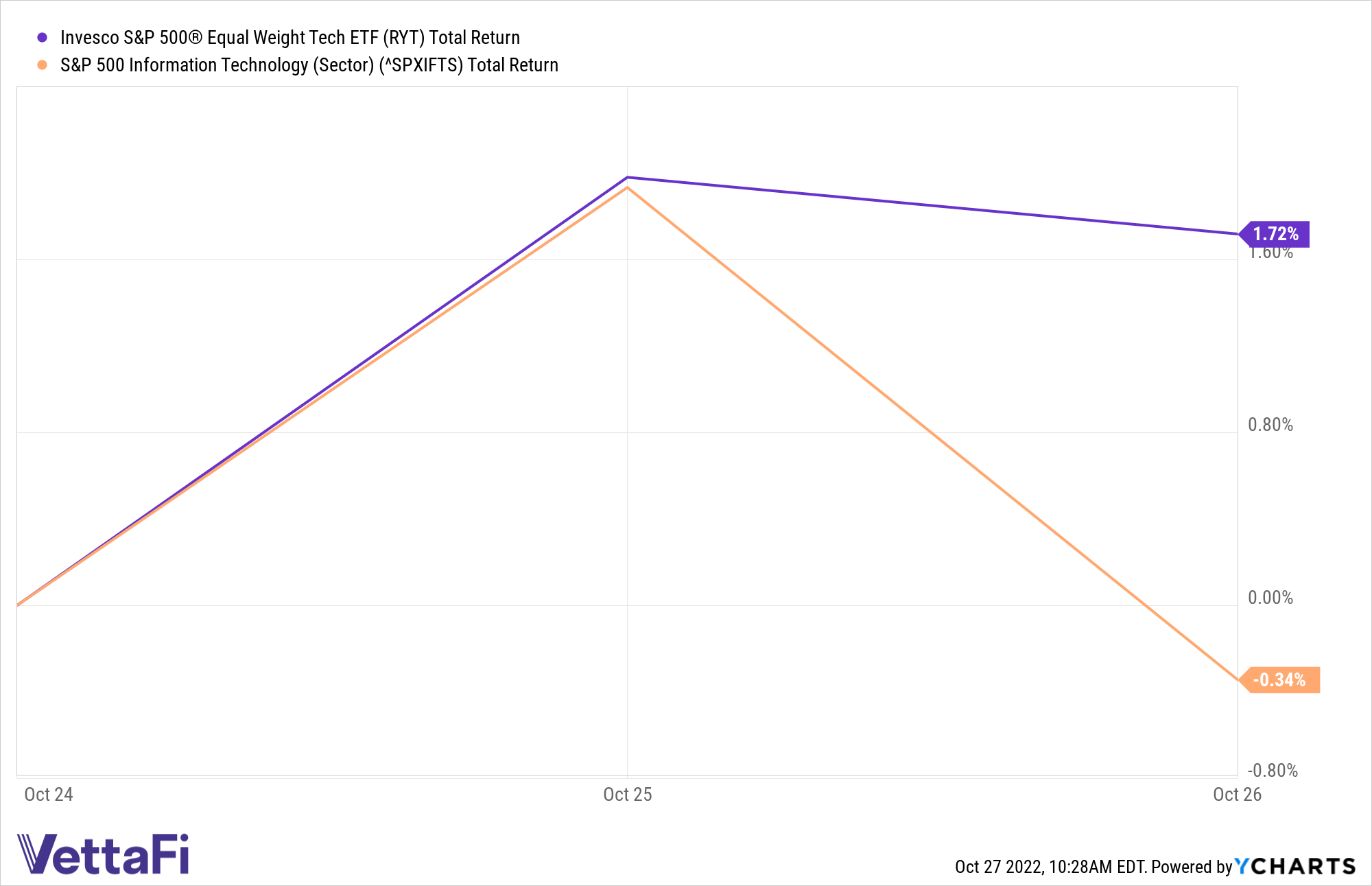

From the beginning of the week through Wednesday, the Invesco S&P 500 Equal Weight Technology ETF (RYT) has increased 1.72% on a total return basis while the cap-weighted S&P 500 Information Technology index has declined 0.34%.

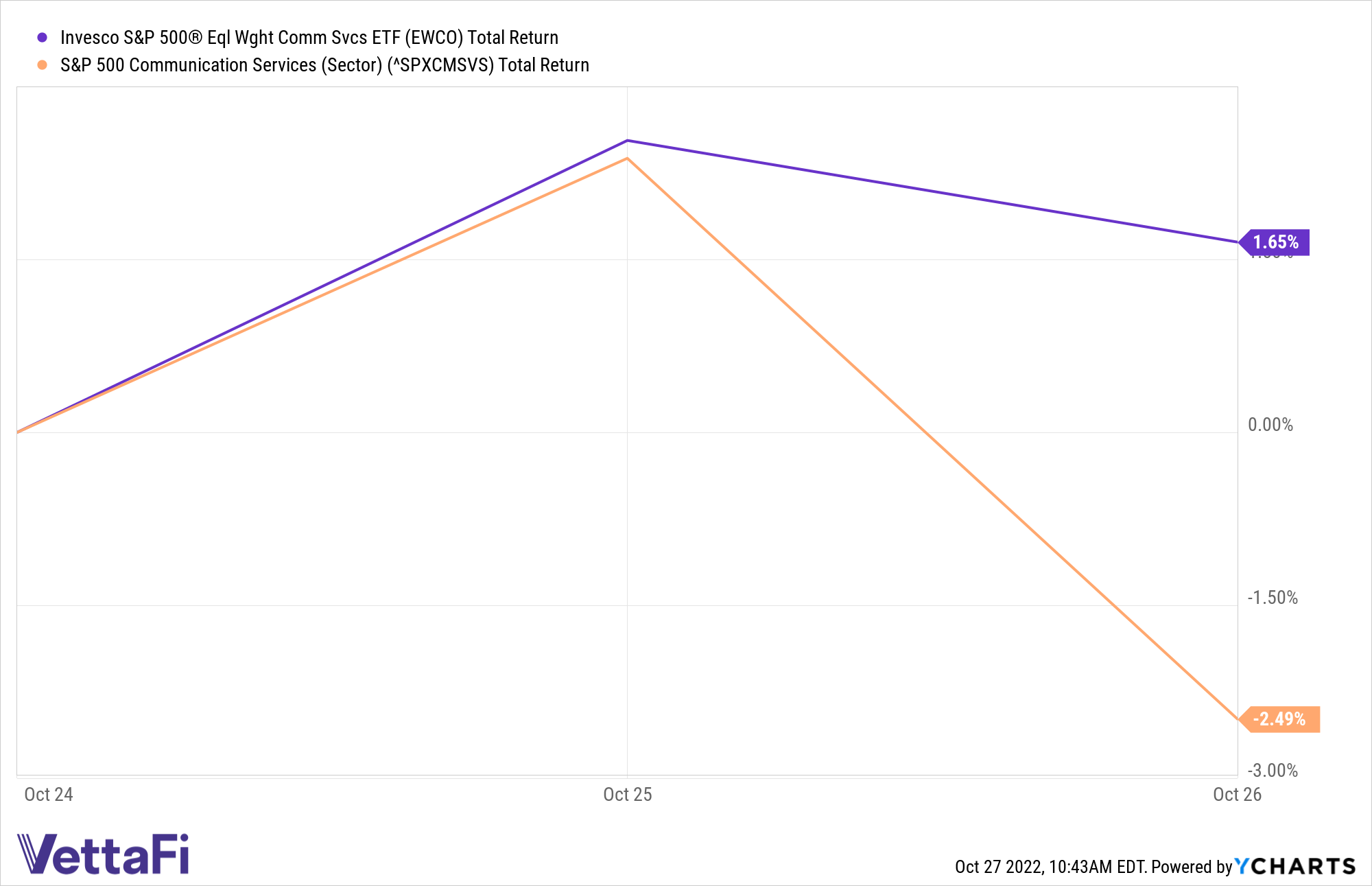

The Invesco S&P 500 Equal Weight Communication Services ETF (EWCO) holds Alphabet and Meta Platforms, which reported earnings on Tuesday and Wednesday, respectively.

Google parent company Alphabet missed analyst expectations and said during its earnings call that growth in its core advertising business had slowed to its weakest point since 2013 (apart from a short period at the start of the pandemic), as companies slashed marketing budgets, The New York Times reported.

Meta was down 3.4% ahead of its own earnings release on Wednesday. While not captured in the graph below (graph is through Wednesday), Meta continued to decline, plunging more than 22% on Thursday morning, following the company’s reports that its revenue declined last quarter.

Between Monday and Wednesday, the S&P 500 Communication Services sector had declined 2.49% while EWCO had increased 1.65%.

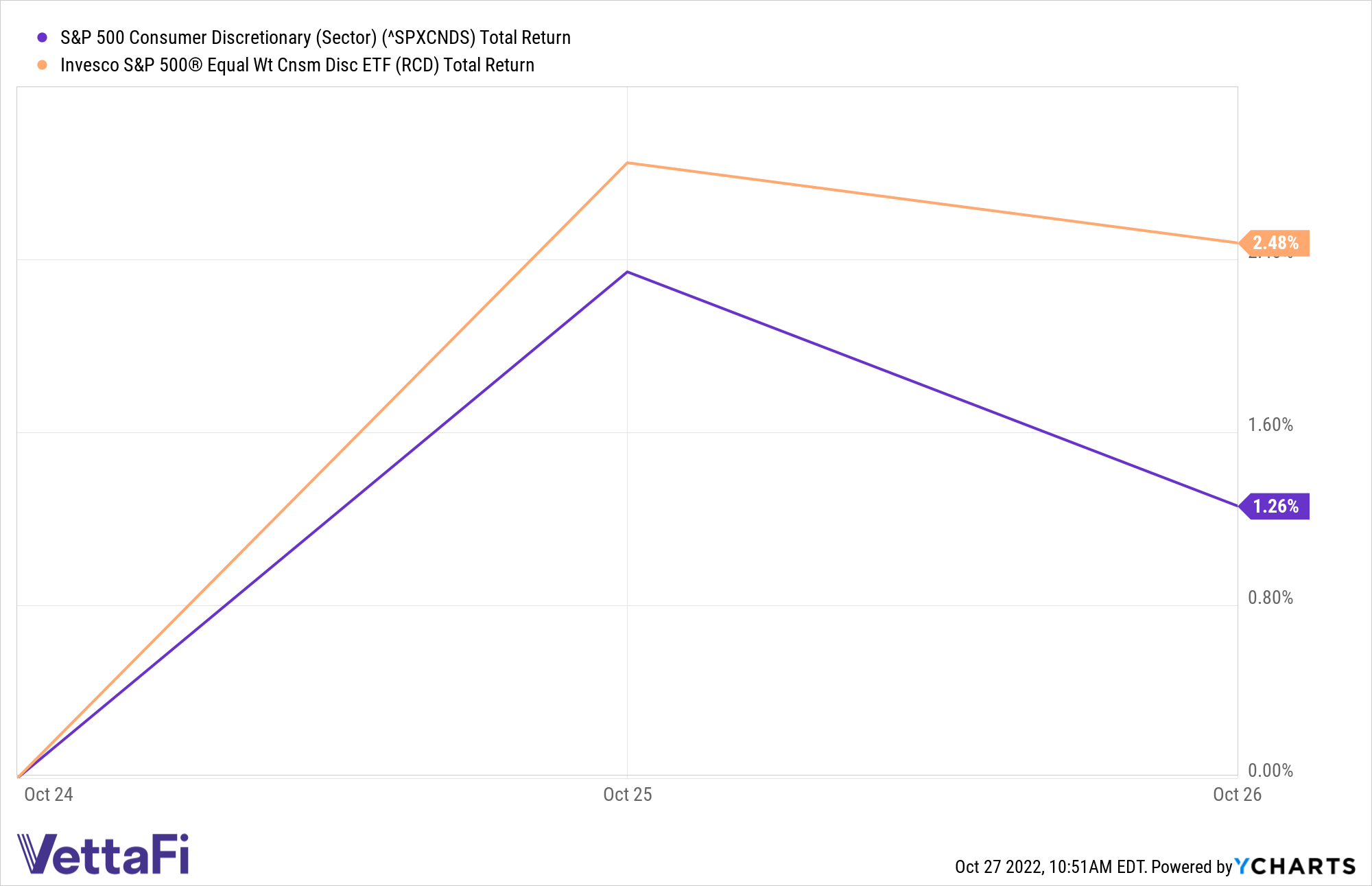

Finally, Amazon, which reports earnings on Thursday, can be found in the S&P 500 Equal Weight Consumer Discretionary sector.

Through Wednesday, the Consumer Discretionary sector was holding up better than others. However, the Invesco S&P 500® Equal Weight Consumer Discretionary ETF (RCD) is still outperforming, returning 2.48% compared to the cap-weighted index’s 1.26%.

For more news, information, and strategy, visit our Portfolio Strategies Channel.