The Bank of England has announced a temporary bond-buyback program to stem the impacts of the strong U.S. dollar, a move that prompted markets to bounce off their recent bear lows. Despite the most recent rally, advisors and investors should beware of the inherent risks, with increasing forecasts of recession on the horizon as early as next year.

There are technical indicators that the current market could be oversold, but there is also increasing concern that stocks do not have earnings reductions and the aggressive rate hikes priced in yet, according to CNBC. One of the key signals that some analysts are evaluating is the recent dip by the S&P 500 to its lowest level in nearly two years, a potential indicator that the equity index, and stocks, could fall more, particularly in a bear market.

“Our central case is a hard landing by the end of ’23,” predicted Stanley Druckenmiller, billionaire investor, at CNBC’s Delivering Alpha Investor Summit on Wednesday. “I will be stunned if we don’t have a recession in ’23. I don’t know the timing, but certainly by the end of ’23. I will not be surprised if it’s not larger than the so-called average garden variety.”

The strong dollar continues to wreak havoc on international currencies and will have an increasing impact on earnings reports for companies that do business overseas. An environment of rising interest rates also takes its toll on the forward cash flow of a company, a fact that has been reflected in the pivot from growth-oriented companies to those on the value end this year.

“A higher interest rate environment is better for companies with strong current earnings than those with potentially strong future earnings. Companies typically found in value funds have strong current profitability not fully reflected in their share prices,” explained Todd Rosenbluth, head of research at VettaFi.

The current market rally will likely bring a measure of relief in the short-term, but the Fed has given clear guidance that it will remain aggressive in its rate-hiking regime through the end of this year and into 2023.

Investing in Value and Dividend Yielding Companies

In a challenging year for equities, advisors and investors have turned to companies generating dividends, focusing more on value, and moving away from growth.

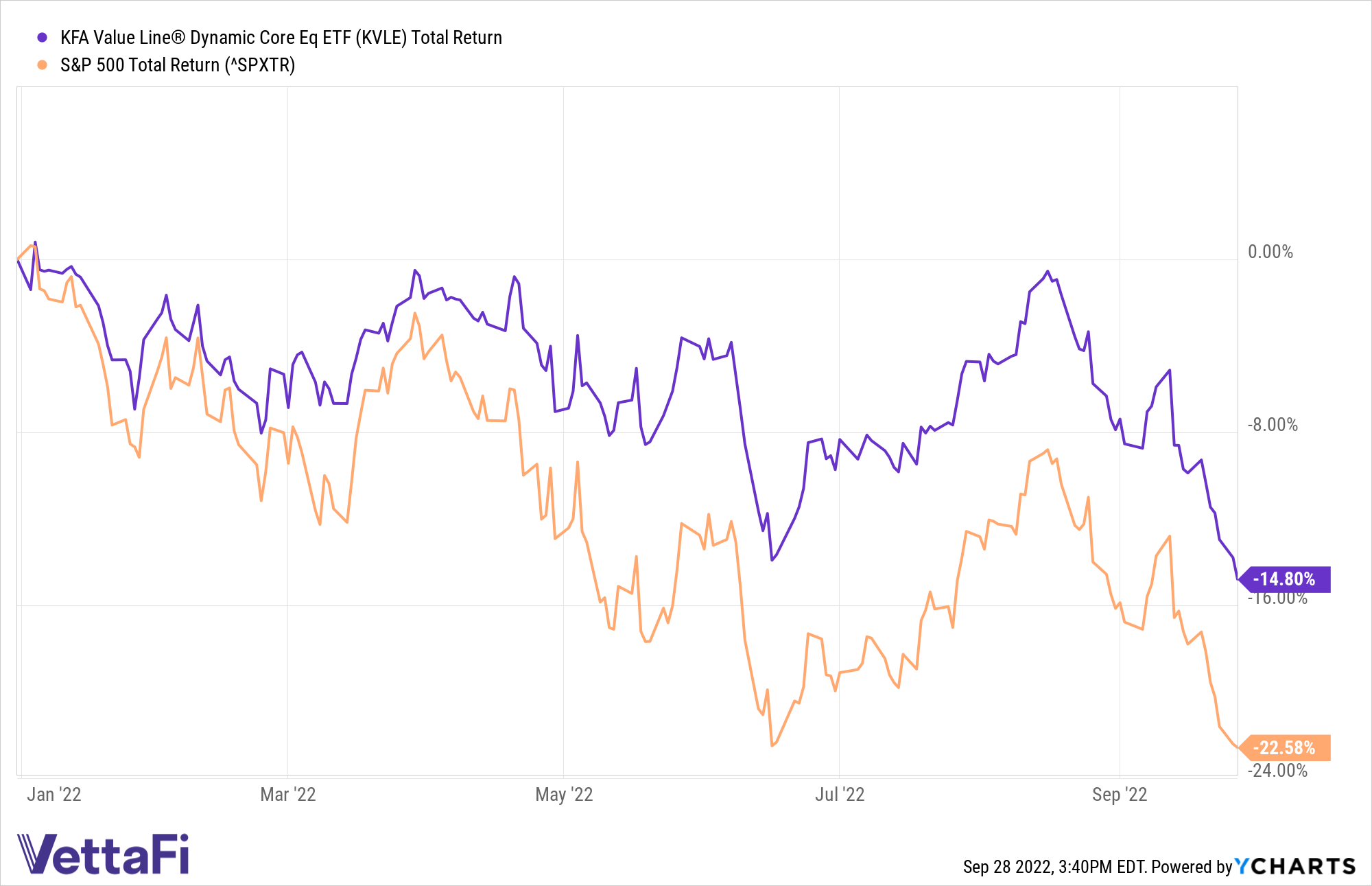

The KFA Value Line Dynamic Core Equity Index ETF (KVLE) captures both strategies within a single fund by investing in higher-yield companies while diversifying in a way that a “theme” portfolio does not. The fund is a core equity portfolio of securities that are tilted to favor dividend yield, and it seeks to increase yield while avoiding investing solely in high-yield sectors and stocks. It’s an approach that has yielded consistently better performance than the S&P 500 in 2022.

KVLE is benchmarked to the 3D/L Value Line Dynamic Core Equity Index and utilizes optimization technology to emphasize securities with solid dividend yields with the highest rankings in Value Line Safety and Timeliness. The fund uses a smart beta strategy in seeking more cost-efficient alpha and a risk-management strategy that seeks to limit the effects of major market declines while also being positioned to capture positive returns.

KVLE carries an expense ratio of 0.55%.

For more news, information, and strategy, visit the China Insights Channel.