Stocks appeared to rally after the long Labor Day weekend in the U.S., but what began as upward momentum ended in with markets closing in the red. It’s yet another day to notch onto a string of days, weeks, and months of market volatility and continuing market uncertainty, where equities and bonds have both been challenged by soaring inflation and rising interest rates.

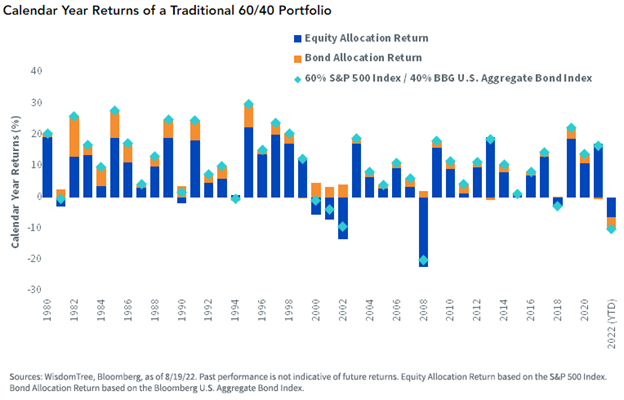

Traditional portfolios had a long run of positive performance for the better part of the last decade. That has now come to an end. While it’s important to remember that negative performance for 60/40 portfolios isn’t unusual, the strong correlation of equities and bonds in their declines this year is much rarer.

Image source: WisdomTree blog

“At WisdomTree, we remain strong believers in equities as a long-term driver of real portfolio growth and bonds as an important source of diversification and income,” wrote Andrew Okrongly, director of model portfolios at WisdomTree, in a recent blog. “But many investors view this year’s relationship between stock and bond returns as potentially the start of a new correlation regime.”

It’s a perspective that history potentially corroborates: the average long-term correlation between equities and bonds over the 20th century was positive, especially when inflation was in play.

Image source: WisdomTree blog

The continued uncertainty surrounding inflation and equity and bond correlations that have occurred this year are strong arguments for the need to diversify beyond just the traditional 60/40.

“While we can all agree that diversification sounds great, most investors still need a healthy allocation to equities and bonds to accomplish long-term return objectives and generate necessary income,” Okrongly wrote.

The “Efficient Core” Strategy

Within a portfolio, a 60/40 representation can be achieved through investment into a fund like the WisdomTree U.S. Efficient Core Fund (NTSX), an ETF that invests in both large-cap U.S. equities as well as U.S. Treasury futures contracts and boosts capital efficiency for a portfolio.

Through the use of a 1.5x leverage by NTSX to provide 60% equity and 40% U.S. Treasuries for the portfolio, investors can capture the performance that the traditional 60/40 portfolio would provide for less, freeing up capital to allocate to diversifiers such as managed futures or other alternatives.

NTSX can be used in tandem with funds like the WisdomTree Managed Futures Strategy Fund (WTMF), an actively managed ETF that seeks non-correlated returns regardless of the directionality of markets by going long and short on a variety of futures, including commodities, currencies, equities, and rates. By investing in NTSX, investors can gain diversifying potential while maintaining more traditional exposures.

“While we believe that traditional 60/40 portfolios remain a viable and effective long-term strategy for many investors, those most focused on volatility and downside protection were likely met with an unwelcome surprise this year,” Okrongly wrote. “If 2022 is a sign of what’s to come, bonds may not provide the level of equity market diversification that investors have come to rely on over the past several decades.“

For more news, information, and strategy, visit the Modern Alpha Channel.