Recent reports are confirming that the pace of U.S. economic growth has clearly slowed as evidenced by the graph in exhibit 1 of the economically weighted Purchasing Manager Index. Still, the Index remains above the theoretical growth versus contraction level of 50. In addition, both retail sales and industrial production continue to increase even with slowing economic growth.

Meanwhile, jobs growth remains strong and inflation-adjusted income growth persists, albeit slowly. If inflationary pressures ease like we expect, inflation-adjusted income should accelerate in the coming months as inflation becomes less of a headwind (exhibit 2). The Fed is nearing a critical point in their approach.

Leading inflationary pressures, such as broad money growth and commodity prices, are easing (exhibits 3 and 4). It appears that the combination of fundamental market pressures and actions by the U.S. Federal Reserve (Fed) to fight inflation are having a positive impact. History tells us that Fed action can take time to be fully reflected in the economy.

As a result, and based on our work with leading inflation indicators, we think the Fed should pause rate hikes and allow the current business cycle to continue to grow while previous rate hikes move through the economy. It will be important to watch the upcoming jobs report for August and the August Consumer Price Index, which will be released prior to the Fed’s next policy meeting. These and other important data points should help provide us with more clarity regarding the Fed’s decision-making process.

Our base case scenario is that the slow pace of economic growth, along with corporate revenue and earnings growth, should continue over the near-term, provided the Fed does not act too aggressively. However, orchestrating a soft landing is going to take some finesse. We will continue to monitor our forward-looking indicators and adjust accordingly as we manage risk in real time.

INVESTMENT IMPLICATIONS

While we think that interest rates can move higher, the bulk of the rise is likely behind us. Therefore, we have been adding to core fixed income positions that we think offer attractive current yield and can potentially help offset equity volatility. Furthermore, the recent equity market rally has broadened. Combined, this suggests that bond prices will stabilize, and U.S. equities can make further gains, especially in the areas that we favor, such as financials, health care, information technology, and small cap value.

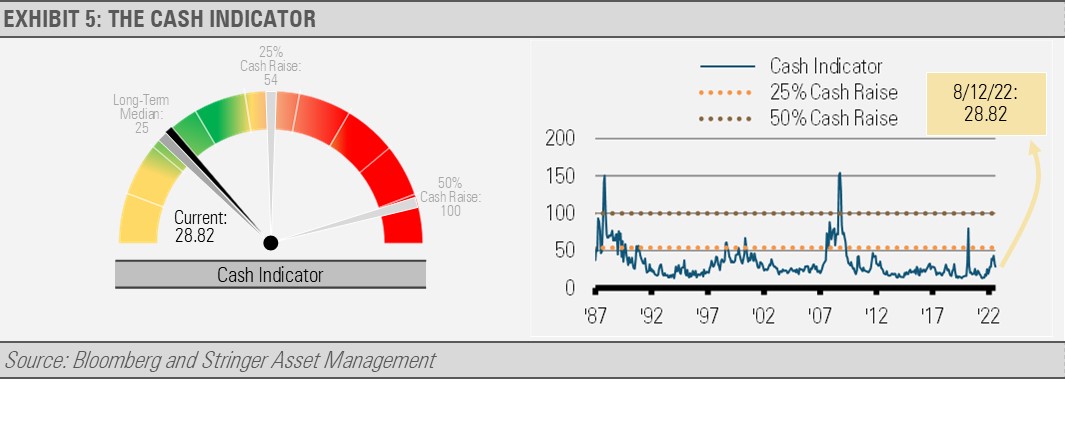

THE CASH INDICATOR

The Cash Indicator (CI) has been stabilizing within its historically normal range. This suggests that markets are functioning properly and there is little chance of a near-term shock. Similar to our fundamental work, the current level of the CI suggests that equity markets can continue to recover.

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management, LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested.

Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable.

Data is provided by various sources and prepared by Stringer Asset Management, LLC and has not been verified or audited by an independent accountant.