By Robert Michaud

Markets are pricing in a potential recession as central banks slow economies to fight inflation. While it is rare to have a recession without investors experiencing some pain, this self-imposed economic slow-down is highly anticipated and may be briefer than most; despite the bear market indicating a potential recession, current employment remains high and supply chains are improving. The question remains whether the planned rate hikes will be sufficient to slow inflation.

Market Performance

This quarter continues the theme of Q1 with markets rapidly incorporating new inflation data and shifts in Fed policy. While inflation remains the top issue for households and investments, attention is shifting towards lower economic growth, which has fueled more uncertainty for equity markets.

Recession concerns were harsh on global markets. Global equity markets went down 15%, following a 5% decline in Q1. The S&P 500 fell into an official bear market on June 13 and regained 1% since then, closing the quarter with a loss of 16%.

Bond markets remained under pressure as central banks raised interest rates, extending their first quarter drawdown, by 4.7%. The 10-year US Treasury yield had a volatile quarter ending at 3% after reaching 3.5% in mid-June. It’s unusual for both asset classes to meaningfully decline two quarters in a row (historically only seen in 1981 and 2008), but it’s not surprising in the context of markets driven by inflation and recession concerns.

The Economy

The dominant economic news is encapsulated in the Fed’s battle with inflation and the collateral damage to the economy. Inflation is undeniable with annual CPI and core inflation rising by 9.1% and 5.9% as of June. The magnitude of inflation caused the Fed to effectively abandon its dual mandate of high employment and low and stable inflation to focus solely on inflation.

The Fed may be right to risk recession to fight inflation. So long as the Fed maintains credibility in its ability to control inflation, high inflation expectations may not become ingrained. Since much of inflation is beyond the control of the Fed, signaling anything less than a willingness to do whatever it takes could be seen as ineffective and risk an inflationary spiral. The aggressive 2% target supports this position. In the classic signaling problem it matters more that people believe you will do what you say than that you actually do it. Similar to cold war games, it can pay to be excessive since the more everyone believes you’ll do anything, the less you have to do. The positive implication is that the more it seems that the Fed is willing to cause a recession, the less likely it will have to do so.

Fortunately, there are signs of inflation moderating without serious intervention. Energy prices have fallen from their peaks mid quarter and raw materials are lower as well. Higher inventory at stores and anecdotes of half-empty restaurants further indicates prices may have peaked and consumer demand is insatiable no longer. Even lingering price pressure from pandemic stimulus has been offset by cheaper imports from the stronger dollar. But the bigger picture for inflation remains—inflation is a global issue. The impact of supply chains and Russia dwarf the policies of the past two presidents, and the still-robust labor market indicates continued investment and growth expectations which may need to be cooled by the Fed.

Other Themes

- The strong dollar dampens inflation for commodities and imports while reducing returns for international investments. The dollar cannot strengthen forever, so these effects cannot persist and may reverse.

- Mutual fund tax inefficiency: Vanguard settled with Massachusetts over “unexpectedly large tax bills” in Target Date mutual funds. The capital gains were a result of share redemptions affecting remaining shareholders. ETFs, on the other hand, generally protect investors from tax consequences of other shareholders.

- China ended major COVID lockdowns and loosened travel policies, which boosted its own economy, supply chains and stock market (and emerging markets indices along with it). However, corporate regulations continue to undermine investing in China.

- Crypto assets fell dramatically, with Bitcoin down 58% over the quarter. The lack of an ETF investing directly in Bitcoin and withdrawal freezes from exchanges such as Celsius and Voyager underscore the poor suitability of crypto in an investment portfolio.

- ESG underperformed broad markets (partially due to energy sector underweights) and saw its first net outflows in May.

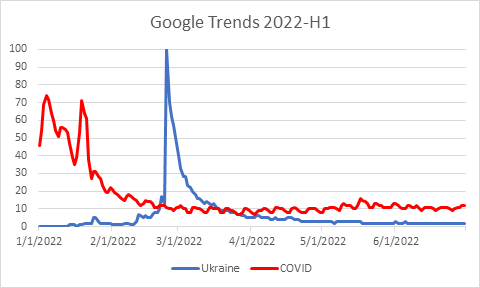

- Ukraine and COVID are still affecting the global economy, but interest is waning.

Look Ahead

As we look ahead, the question is what will happen to fixed income and equity markets in light of the Fed’s plan to bring us to the brink of recession. In the long term, investors will benefit from the robust economy supported by thoughtful fiscal policy choices. In the shorter term, there’s a case to be made that fixed income markets have fully priced in both expected rate hikes and inflation. This brings us back to the question of recession. Current economic forecasts and market valuations roughly expect an economic slowdown — somewhere in the grey area around a shallow recession. Whether investors will benefit depends on whether the market is under- or over-estimating the future, in particular, whether inflation subsides without excessive intervention.

We do not forecast the real estate market, but home prices have appreciated for many investors and the housing market affects the broader economy. We apply the institutional investment framework when building core portfolios for households, which means building portfolios to provide risk-optimized return across a range of market scenarios. Home prices make up a larger portion of many households’ wealth but housing prices are more volatile than normal. This means the overall volatility of household wealth has risen substantially which should be considered when investing in a core portfolio.

Looking further ahead, deglobalization is a continuing theme in economies around the world. Potential shortages of critical food and energy resources have enhanced already high concerns around global supply chains for ordinary economic production. Over time, this will incentivize individual economies to be more self-reliant and insulated from other markets. Economic deglobalization and decoupling have the potential to make international markets less correlated and international diversification more valuable to a portfolio.

Conclusion

This quarter’s commentary is, as is often the case, a story of opposing forces. In this instance, the aggressive stance taken by the Fed in its quest to lower inflation is at a crossroads with investor expectations of an impending recession, with both contributing to market uncertainty. While our focus on the Fed is largely because its plans for rate increases and bond tapering have been laid out, unexpected events may still have a significant impact on markets. While future phases of the COVID-19 pandemic, the Russian invasion, US political infighting and Chinese regulations will almost certainly affect markets throughout the rest of 2022, their impacts are unpredictable and whatever information we have is already priced in. If there is a lesson for the quarter, it is that after 10+ years of consistent economic growth, the current market reminds us that the best diversified portfolio is one that accounts for the inherent uncertainty in investing.

Research

We’re excited to announce Richard Michaud’s recent research on expected utility and the implications of social science on financial theory is under contract for publication by Palgrave Macmillan.

DISCLOSURES: Past performance does not guarantee future results. As market conditions fluctuate, the investment return and principal value of any investment will change. Diversification may not protect against market risk. There are risks involved with investing, including possible loss of principal.