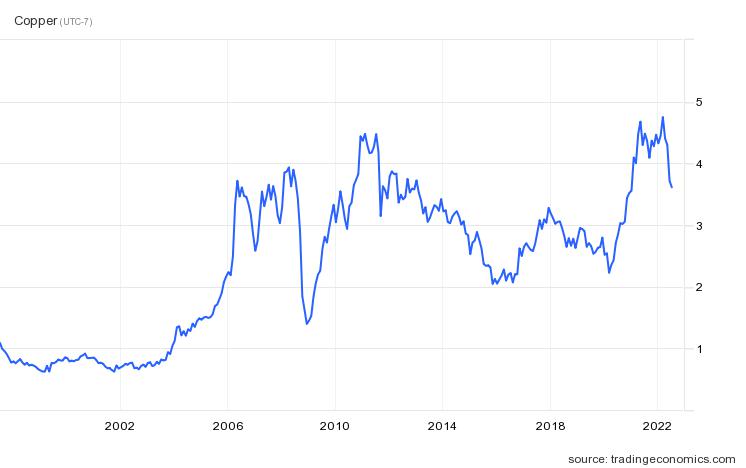

At the start of 2022, copper offered investors an ideal inflation hedge, given the rising prices of the industrial metal. Now, copper prices are heading back down to earth, putting exchange traded funds (ETFs) like the Global X Copper Miners ETF (COPX) on watch.

The fund could give patient investors an ideal entry point, given the way copper prices have been falling lately. The S&P GSCI Copper index is down about 17% for the year, but within a three-year time frame, the index is still up close to 37%.

COPX seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Copper Miners Total Return Index, which is designed to measure broad-based equity market performance of global companies involved in the copper mining industry.

Recession Fears Weighing on Copper

Recession fears have been weighing copper prices down, as have isolated headwinds like China’s COVID-19 resurgence. China is one of the largest producers of copper globally, and rising COVID cases forced factory activity to slow down.

Moving forward, however, recession fears continue to swirl in the capital markets.

“Market sentiment remains subdued as the same old worries about inflation and recession circulate,” Neil Wilson, an analyst at broker Markets.com, said. “Copper down hard, also nickel, as industrial metals are being offered as recession fears dominate.”

In terms of the copper industry specifically, some fund managers aren’t worried. Right now, it’s all about the potential storm brewing from a macroeconomic perspective.

“Right now fund managers are evidently in no mood to worry about copper’s micro dynamics. It’s the big picture that counts, and the big picture is one of darkening economic clouds on the horizon,” wrote Reuters columnist Andy Home.

Despite this, investors looking at copper from a long-term growth perspective can see that opportunities can exist. COPX will also give investors exposure to copper prices without having to invest in the actual commodity itself via a dynamic investment vehicle in the ETF.

For more news, information, and strategy, visit the Thematic Investing Channel.