Stocks bounced up and down on Tuesday after the S&P 500 slid into a bear market. Most investors expect the Fed to raise rates by three-quarters of a percentage following its upcoming policy meeting Wednesday.

“This is one of the days where the market is going to have to take a wait-and-see attitude and certainly that’s what seems to be happening in the major indices,” Art Hogan, chief market strategist at National Securities, told CNBC before adding: “We’re really stuck in middle ground here.”

The S&P 500 dropped 3.9% on Monday amid investor fears that major central banks will have to be more aggressive than expected to fight inflation. Data released last week on U.S. consumer prices revealed that inflation reached its highest level in more than 40 years, adding fuel to those concerns.

The S&P has gone down 9.6% so far in June. The index is down 22% from its recent early January peak.

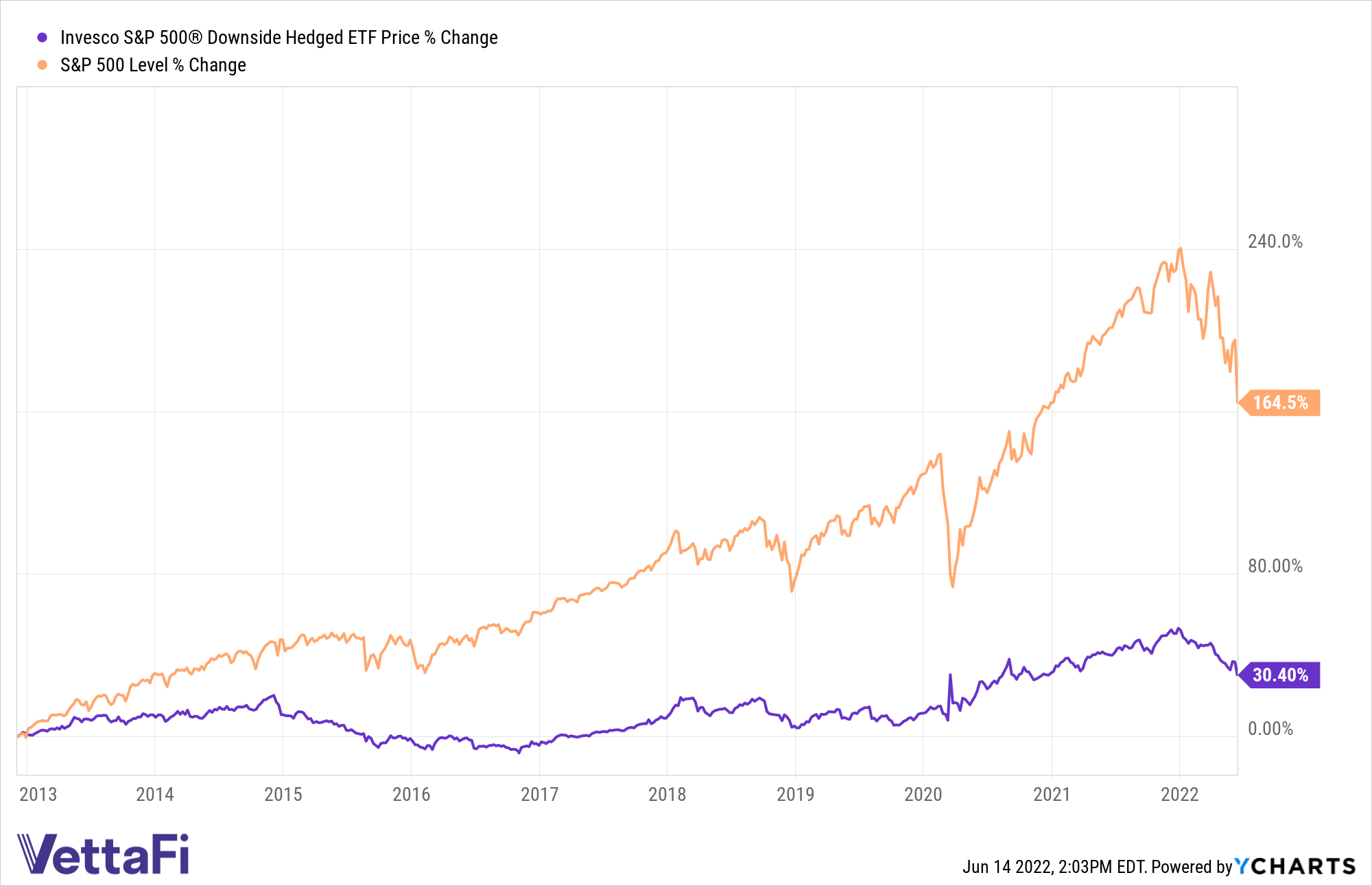

Amid continued volatility, Investors seeking dynamic exposure to markets while limiting their downside exposure may want to consider the Invesco S&P 500® Downside Hedged ETF (PHDG). The actively managed fund seeks to achieve positive total returns in rising or falling markets that are not directly correlated to broad equity or fixed income market returns. PHDG seeks to achieve its investment objective by using a quantitative, rules-based strategy that seeks to obtain returns that exceed the S&P 500 Dynamic VEQTOR Index.

The index provides investors with broad equity market exposure with an implied volatility hedge by dynamically allocating between equity, volatility, and cash. The index allows investors to receive exposure to the equity and volatility of the S&P 500 Index in a dynamic framework.

Since its inception in December 2012, PHDG has outperformed the S&P 500 by more than 134 percentage points.

PHDG has an expense ratio of 0.40%

For more news, information, and strategy, visit the Innovative ETFs Channel.