Dividends have become a popular investment choice in 2022 for advisors and investors seeking income opportunities and performance potential in a volatile market that has seen major indexes dip into bear territory on more than one occasion.

As advisors and investors pivot some of their allocations, the habit of looking to large-cap due to the previous decade where large-cap growth was the easy choice for many can be a difficult one to break, but it’s worth examining small- and mid-cap dividend allocations.

“Many investors rarely think of dividends when it comes to mid- and small caps. This can be a costly oversight,” wrote Matt Wagner, CFA and associate director, research, at WisdomTree, in a recent blog post.

Investors who allocated to all of the Russell 200 Index dividend-payers using a market cap-weighted approach in the last 12 months, ending in May, would have outperformed the broader Russell 2000 by 13.5%. A similar market cap-weighted investment into the Russell Midcap Index dividend-payers would have yielded a 9.3% outperformance over the Russell Midcap during the same period.

“Dividends have provided safety amid the volatility in U.S. equities this year. While many investors may ignore dividends outside of large caps, the relative performance of mid- and small-cap dividend payers and non-payers over the past 12 months suggests this can be a mistake,” Wagner wrote.

Both the indexes for the WisdomTree U.S. Midcap Dividend Fund (DON) and the WisdomTree U.S. SmallCap Dividend Fund (DES) are significantly underweight to traditional growth sectors (information technology and healthcare) and instead are overweight to the sectors that typically yield higher dividends — real estate, financials, materials, and utilities.

Image source: WisdomTree Blog

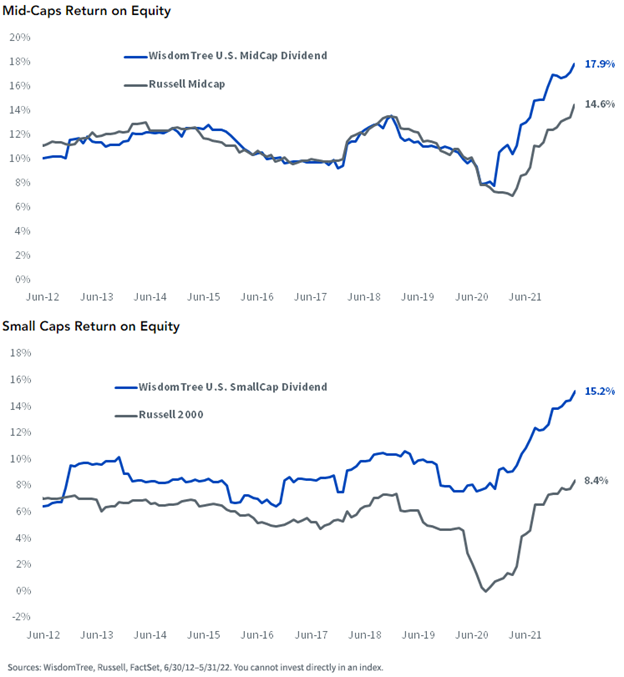

What’s more, the WisdomTree U.S. Midcap and SmallCap Dividend Indexes have exhibited a growing profitability gap from the broad, market cap-weighted Russell Indexes. This becomes increasingly more notable in an environment where companies have begun to report negative earnings, a trend that is likely to continue in a challenging environment of rising rates and quantitative tightening by the Fed.

The Russell 2000 Index was comprised of 22.9% of companies that reported negative earnings as of May 31, 2022, while the Russell Midcap Index had 9.4% of negative earnings companies. Conversely, the WisdomTree Dividend indexes carried less than 3.5% weight in companies with negative earnings over the same period.

“We anticipate the leadership of companies with strong cash flows and dividend payouts will be sustained during a rising interest rate environment that punishes non-dividend-paying story stocks. The opportunity cost of not having current cash flows is a headwind to non-payers,” Wagner wrote.

Small- and Mid-Cap Dividend Investment With WisdomTree

The WisdomTree U.S. Midcap Dividend Fund (DON) seeks to track the WisdomTree U.S. MidCap Dividend Index, an index comprised of the top 75% of dividend-paying companies by market cap that make up the WisdomTree U.S. Dividend Index after the 300 largest companies have been removed. The index is fundamentally weighted based on dividend projections for the next year, and DON carries an expense ratio of 0.38%.

The WisdomTree U.S. SmallCap Dividend Fund (DES) seeks to track the WisdomTree U.S. SmallCap Dividend Index, an index comprised of the bottom 25% of dividend-paying companies by market cap that make up the WisdomTree U.S. Dividend Index after the 300 largest companies have been removed. The index is fundamentally weighted based on dividend projections for the next year, and DES carries an expense ratio of 0.38%.

For more news, information, and strategy, visit the Modern Alpha Channel.