By Leks Gerlak, CFA, CFP, Investment Strategist

“BITO has provided returns closely aligned with spot bitcoin[1]. Investor demand for BITO remains strong.” – Leks Gerlak, CFA, CFP, Investment Strategist, ProShares

ProShares launched the first U.S. bitcoin-linked ETF (BITO) on October 19, 2021. Attracting more than $1 billion in assets in its first two days of trading, BITO’s launch was among the most successful in the history of the ETF industry. Since launching 6 months ago, BITO has performed as designed, providing returns closely aligned with spot bitcoin. Investor demand for BITO has remained strong as well, even amid falling bitcoin prices. This persistent demand may arise from bitcoin’s historic resiliency, along with the convenience and regulated structure the ETF provides.

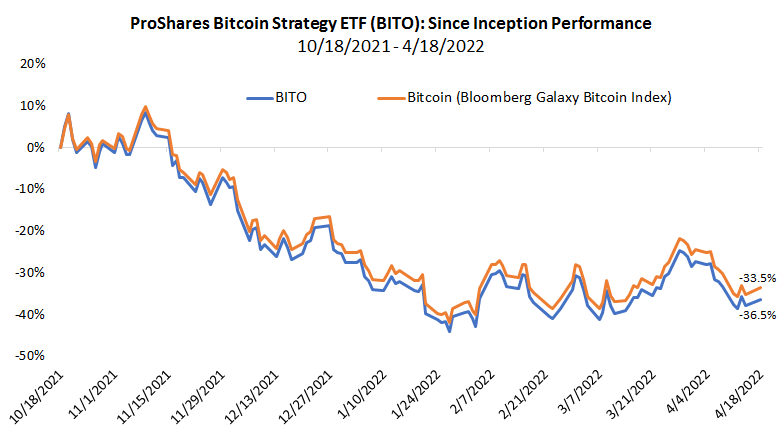

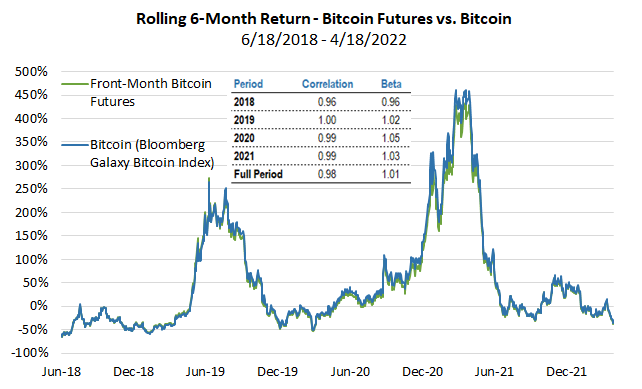

Since inception, BITO has returned -36.5% versus -33.5% for spot bitcoin.[2] Historically, bitcoin futures returns have exhibited, relative to spot bitcoin returns, a very high correlation and a beta of near one. [3] It is important to remember that there are costs – potentially significant – in obtaining spot bitcoin exposure, which are not reflected in the returns of a spot bitcoin price index.

Source: Bloomberg, BITO returns measured by NAV. The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Your brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see above. The spot bitcoin index performance does not reflect any costs associated with investing directly in bitcoin. Indexes are unmanaged and one cannot invest directly in any index.

Following the outsized activity of BITO’s first week, investors have added an additional $476 million to BITO and trading remains robust, with over $210 million in average daily volume and tight spreads.[4] In fact, BITO’s average daily trade volume placed it in the top 5% of most actively traded ETFs in the U.S.[5] Some surprise has been expressed at the continued demand amid falling bitcoin prices and volatility over the past few months. This demand potentially stems from bitcoin’s historic resiliency and features of BITO that make it a compelling option versus direct investment in bitcoin.

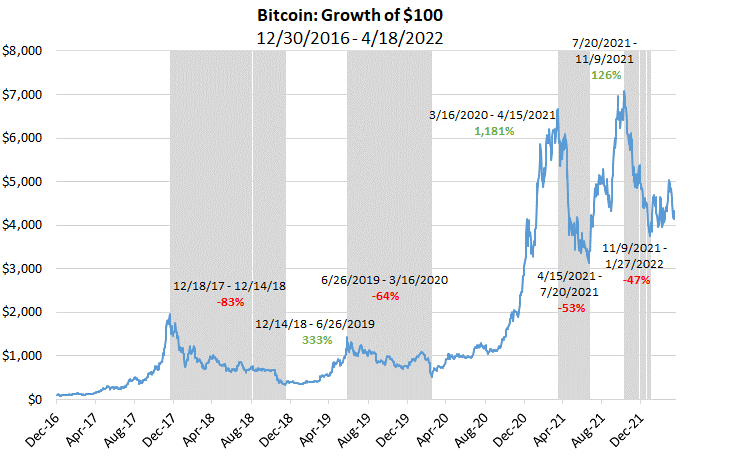

Historically, bitcoin has experienced a number of drawdowns, but they have often been followed by rebounds and new highs. Volatility is inherent to a digital asset like bitcoin, and gives it potential benefits as a portfolio diversification tool. While we can’t predict where prices go from here, bitcoin has exhibited resiliency.

Source: Bloomberg. Bitcoin returns measured using Bloomberg Galaxy Bitcoin Index. The performance quoted represents past performance and does not guarantee future results. The spot bitcoin index performance does not reflect any costs associated with investing directly in bitcoin. Indexes are unmanaged and one cannot invest directly in any index.

The persistent and growing interest in BITO may indicate that investors are considering it for a range of portfolio applications, even in the midst of challenging markets. Certain features of BITO have addressed, for the first time, the needs of many investors and may further explain the ongoing appeal.

Source: Bloomberg, 12/18/2017 – 4/18/2022. 6-month rolling returns start 6/18/2018. Front-month bitcoin futures returns assumes front-month contract exposure is rolled to the next expiring contract one day prior to expiration. Bitcoin returns measured using Bloomberg Galaxy Bitcoin Index. The performance quoted represents past performance and does not guarantee future results. The spot bitcoin index performance does not reflect any costs associated with investing directly in bitcoin. Indexes are unmanaged and one cannot invest directly in any index.

- Bitcoin futures have exhibited, relative to spot bitcoin, correlation and beta near 1.

- Convenience / familiarity of using a brokerage account. BITO offers investors an opportunity to gain exposure to bitcoin returns conveniently, through a brokerage account. The fund can be bought and sold like a stock and eliminates the need for an account at a cryptocurrency exchange and for a crypto wallet – mitigating the need to worry about custody of bitcoin.

- Regulation. BITO invests in bitcoin futures contracts that are highly regulated and the ETF is a 40-Act fund with a fiduciary board looking after investors’ interest.

As the digital asset space continues to evolve, BITO provides a familiar way to gain exposure to bitcoin returns – with the liquidity and transparency of an ETF. The fund offers investors a convenient way to incorporate a rapidly growing digital asset into portfolios, and robust investor interest and demand may continue as we enter the second half of BITO’s first year.

[1] Bitcoin returns measured using Bloomberg Galaxy Bitcoin Index.

[2] Source: Bloomberg, as of 4/18/2022. BITO returns based on NAV. Bitcoin returns measured using Bloomberg Galaxy Bitcoin Index.

[3] Based on front- and second-month bitcoin futures contracts, which are the contracts that BITO has primarily invested in since launching.

[4] Source: ProShares, 10/25/2021 – 4/18/2022

[5] Source: Bloomberg, 10/25/2021 – 4/18/2022

Important Information

The performance quoted represents past performance and does not guarantee future results.

There is no guarantee any ProShares ETF will achieve its investment objective. This ETF may not be suitable for all investors.

Investing involves risk, including the possible loss of principal. Bitcoin and bitcoin futures are a relatively new asset class and the market for bitcoin is subject to rapid changes and uncertainty. Bitcoin and bitcoin futures are subject to unique and substantial risks, including significant price volatility and lack of liquidity. The value of an investment in the ETF could decline significantly and without warning, including to zero. You should be prepared to lose your entire investment.

This ETF is actively managed and invests in bitcoin futures contracts. The ETF does not invest directly in or hold bitcoin. The price and performance of bitcoin futures should be expected to differ from the current “spot” price of bitcoin. These differences could be significant. Bitcoin futures are subject to margin requirements, collateral requirements and other limits that may prevent the ETF from achieving its objective. Margin requirements for futures and costs associated with rolling (buying and selling) futures may have a negative impact on the fund’s performance and its ability to achieve its investment objective.

Bitcoin is largely unregulated and bitcoin investments may be more susceptible to fraud and manipulation than more regulated investments. Bitcoin and bitcoin futures are subject to rapid price swings, including as a result of actions and statements by influencers and the media.

This ETF is non-diversified and concentrates its investments. Non-diversified and narrowly focused investments typically exhibit higher volatility.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in the ETF’s summary and full prospectuses. Read them carefully before investing.

Shares of any ETF are generally bought and sold at market price (not NAV) and are not individually redeemed from the fund. Your brokerage commissions will reduce returns.

“Spot” price refers to the price of bitcoin that can be purchased immediately.

ProShares are distributed by SEI Investments Distribution Co. (“SIDCO”), which is not affiliated with the funds’ advisor or sponsor. SIDCO is located at 1 Freedom Valley Drive, Oaks, PA 19456.