The Consumer Price Index came in higher than anticipated at 8.5% for March, and while stock markets in the U.S. initially rallied in the hopes that it might be the peak, many economists believe that inflation could remain substantial through the end of the year.

The increases to consumer prices have happened at a rate not seen since stagflation in the 1970s and ‘80s, and while core inflation rose slower at 6.5%, it is still the highest since August 1982, reports CNBC. Wages fell further behind costs, with real average hourly earnings dropping 0.8% for March, which could continue to add to mounting inflationary pressures.

“Overall, this report is encouraging, at the margin, though it is far too soon to be sure that the next few core prints will be as low; much depends on the path of used vehicle prices, which is very hard to forecast with confidence,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

As the U.S. faces six more interest rate increases, investors are searching for income opportunities in areas beyond fixed income, and an increasingly popular choice has been in dividend-paying companies. While volatility continues both in U.S. markets and abroad, investing in profit-making companies can be a feasible option to weather the storm of uncertainty.

For investors looking beyond U.S. markets for allocation, the WisdomTree Dynamic Currency Hedged International Equity Fund (DDWM) could be an excellent option, as it offers exposure to dividend-paying companies in the developed, international markets ex-U.S. and Canada, while hedging for currency exposure.

The Benefits of Currency Hedging

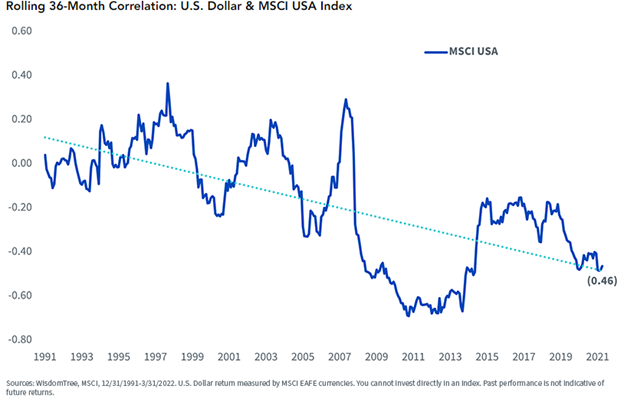

Currency hedging is becoming increasingly important amidst volatility as various countries begin to enact diverging fiscal policies. Jeremy Schwarz, CFA and Global CIO of WisdomTree, believes that the U.S. dollar offers one of the best diversifiers and hedges for portfolios with its -0.46 correlation to the S&P 500 over the previous 36 months.

Image source: WisdomTree blog

“While I am arguing you should bet less on currencies by adopting a strategic currency hedged framework, I also believe currency hedged strategies offer the more interesting diversifying property for the current Fed cycle and the negative correlation the dollar brings,” Schwarz writes in a WisdomTree blog.

DDWM seeks to track the WisdomTree Dynamic Currency Hedged International Equity Index, an index that is dividend-weighted and comprised of companies incorporated in Europe, Japan, Australia, Hong Kong, Israel, or Singapore. Companies that pay larger dividends are weighted heavier with sector and country representation capped at 25% (except real estate, with a 15% cap).

The index hedges for currency fluctuations, ranging anywhere from 0%-100%, and updates the hedge ratios monthly. Hedge ratios are determined by three quantitative signals that are all equally weighted for consideration: momentum, interest rate differentials, and value. By hedging the currency, it seeks to limit losses driven by depreciation of foreign currencies compared to the U.S. dollar and also capture gains when foreign currencies appreciate compared to the U.S. dollar.

DDWM carries an expense ratio of 0.40% and can be used to replace or complement active or passive strategies in international, developed, all-cap allocations.

For more news, information, and strategy, visit the Modern Alpha Channel.