The FlexShares Real Assets Allocation Index Fund (ASET) is a compelling offering for investors seeking a packaged global real asset strategy.

Real assets have historically responded favorably in rising inflationary or expanding economic cycles, making them useful to investors looking to reduce the effect of inflation on their long-term returns, according to FlexShares.

Adding real asset classes such as commodities, real estate, agricultural land and oil to a portfolio may provide a combination of equity-like capital appreciation and bond-like yields, in addition to inflation hedging protection.

ASET provides comprehensive real asset exposure to real estate, infrastructure, and natural resources. ASET employs a “fund of funds” model to provide a broad, balanced exposure to real assets, while seeking to minimize volatility, according to FlexShares.

ASET tracks a custom index, the Northern Trust Real Assets Allocation Index, which is composed of three FlexShares ETFs, including the FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR), the FlexShares Global Quality Real Estate Index Fund (GQRE), and the FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA).

Looking through those portfolios, the top holdings in ASET include Prologis, Canadian National Railway, and Verizon.

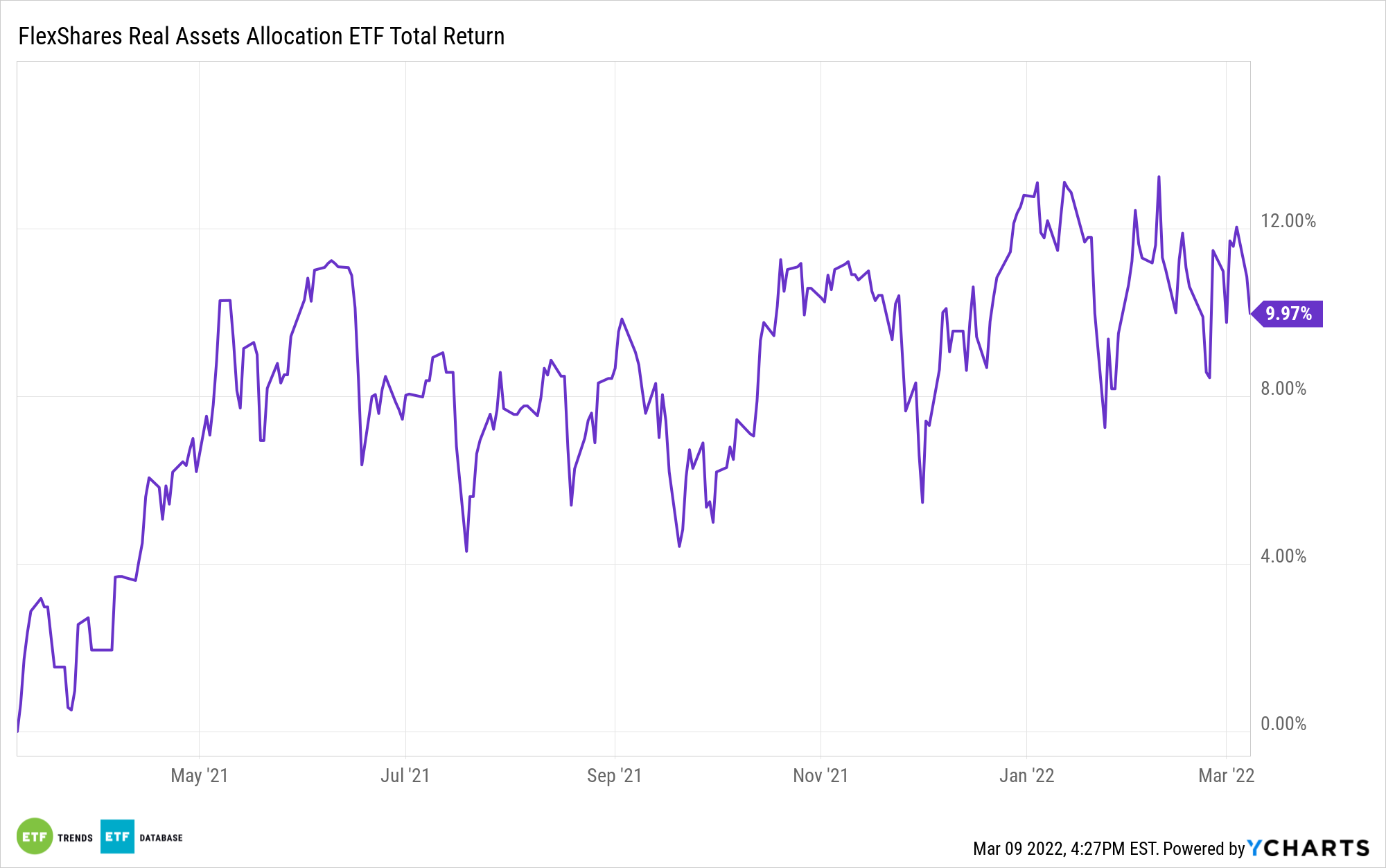

ASET’s returns are outpacing the FactSet Segment Average. ASET has returned -2.5% year-to-date, compared to the segment average of -7.65% during the same period, according to ETF Database.

Over a one-year period, ASET has returned 9.98% and the segment average has returned 1.68%, according to ETF Database.

ASET has an annual dividend yield of 1.94% and an expense ratio of 57 basis points. The fund has $49 million in assets under management.

For more news, information, and strategy, visit the Multi-Asset Channel.