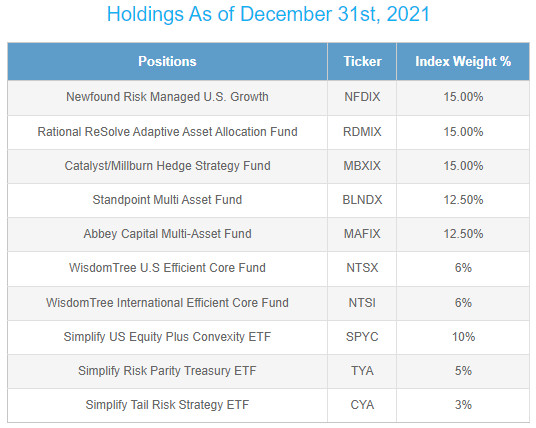

Nothing gets clicks like a negative headline, and a recent academic paper on ETF model portfolios provided an excellent opportunity for Bloomberg (among others) this week.

I’ll save you the click; the meat of the discussion goes something like this:

- Financial advisors love models, and they simplify portfolio management for good reason.

- ETF issuers put their own ETFs in their free model portfolios. This should surprise literally nobody.

- There’s an academic paper that says the ETFs in models aren’t great.

First, about the paper. I could spend a lot of ink poking holes at some of their conclusions and the way they used the data, but for the purposes of my thoughts here, let’s assume that they are 100% correct in two conclusions they make. The first is that model changes drive flows. This is pretty inarguable, and we’ve seen these effects for over a decade. When a major model provider decides it’s time to get into micro-cap toiletry companies, they pop. Their second point is that the funds inside models are somehow more expensive and perform worse than those not in models. There are huge apples/oranges problems in any analysis like this, which the study glosses over, but again, let’s just pretend they’re totally right.

Does this mean you should dump your model? Probably not. But should you be asking yourself what your model’s doing for you in the first place? Absolutely.

Why Use a Model

I’ve talked to many advisors who use model portfolios over the years — the majority, I’d suspect. Smaller advisors tend to lean more heavily on a house model, or perhaps one from a trusted third party like an issuer or an ETF strategist. Larger advisors are more likely to customize, perhaps starting with a house-view core and then augmenting to express their own opinions or to reflect the needs of their peculiar client base.

The “why” is pretty simple: It saves time. Time is the most critical resource any advisor has. I’d argue it’s the single most important resource any of us has to spend. So investment decisions have to balance three things. Yes, you need to receive a given unit of reward for a given unit of risk, whatever your investment ethos. But you also need to apply your time to improve that unit economy. An hour of work a month to do a little better for your clients? Easy. 1000 hours of work? Probably not. So a good model portfolio needs to maximize for two, often unrelated efficiencies: capital efficiency (return per unit of risk x # of dollars) and time efficiency (how much work it will take).

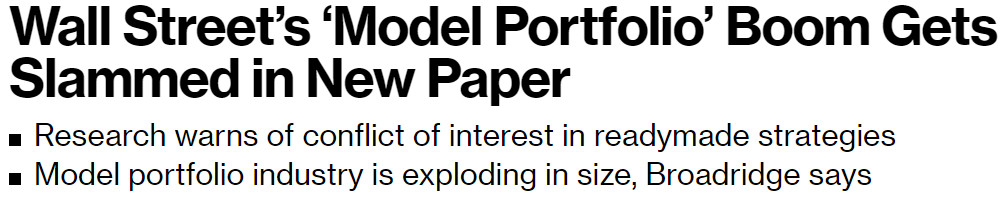

Historically, the assumption that model portfolio providers make is that the more boring you can make the portfolio, the better. At the extreme example, Rationalist Scion Rick Ferri publishes his free “Core-4” models, which are honestly probably as good as anyone else’s. And boy, are they boring. Here is the most interesting of his free models: It tracks the whole total economy!

With all kidding aside, this is a fine allocation for many investors. In fact, I’d argue that any allocation to anything more interesting than something akin to a “core 4” should have to pass a pretty straightforward test: Do I believe that this portfolio will get me more return for a given level of risk, for the dollars I have to allocate? If the answer’s no, stick tight.

Maybe the Answer Is Yes?

One of the huge challenges any investor faces is simply portfolio size. Whether you have a $10,000 account or a $10,000,000 account, that’s the money you have to put to work. So making every dollar work for you is critical. This efficiency discussion is hardly new. In 1996, Cliff Asness of AQR published a short and pithy piece in the Journal of Portfolio Management called “Why Not 100% Equity?” In it, he shows that for most investors, neither a full allocation to the risky asset (equity) nor a traditional balanced portfolio (60/40) gets the math right:

“I argue that two steps necessary in creating a portfolio must be examined separately. Step one is constructing the feasible set of efficient portfolios (portfolios that are investable and have the most expected return per unit of risk). Step two is choosing which of these portfolios to own (i.e., what risk-return trade-off maximizes utility). A long-term investment in 60/40 may or may not get step two wrong (i.e., not take enough risk). An investment in 100% equities almost certainly gets step one wrong (it is not an efficient portfolio).”

Asness’ relatively simple solution is familiar to anyone who’s done any digging into risk-parity: You just lever up the 60/40 portfolio until you’ve reached your personal risk/reward tolerance target. Twenty-two years later, Jeremy Schwarz and the team at WisdomTree launched a fund doing precisely that — leveraging a 60/40 portfolio up to 90/60 — in the form of the WisdomTree 90/60 U.S. Balanced Fund (NTSX), now called the U.S. Efficient Core fund, which (with apologies) sat around, largely ignored, until last year.

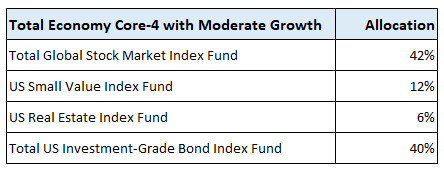

Over the last six months, things started to get interesting. First, on the fund’s third anniversary in August, it had absolutely crushed the S&P 500: 73.46% vs. 63.66% over three years. That caught some attention. But perhaps more importantly, a few folks in the ecosystem figured out what was lying on the table. ReSolve Asset Management and Newfound Research authored a paper in the fall on “Return Stacking” — the idea of using the capital efficiency baked into products like NTSX to add additional, hopefully uncorrelated units of risk/return to a portfolio. They then went on to launch an actual index you can track on what this diversified, leveraged, “return stacked” portfolio might look like:

If that looks wildly different than the “SPY+AGG” you are used to seeing, that’s kind of the point. The idea here is to use the capital efficiency inherent in several of the included funds to fund allocations into uncorrelated alternatives. It’s honestly one of the more interesting actual portfolio concepts I’ve seen kicked around in years. (That sound you hear is a much younger Cliff Asness signing across the gulf of 25 years).

I’m still not sure I’m 100% on board, but that’s why I called a bit of an audible and asked WisdomTree, Newfound, and ReSolve to show up on Friday the 28th of January to go deeper down the rabbit hole. I hope you’ll join us!

Too Good to Be True?

Going into next week’s webinar, it’s worth taking a read of WisdomTree’s latest update to their work on capital efficiency: When do Capital-Efficient Strategies Disappoint? In it, they go through the scenarios where leveraging up the 60/40 can be problematic. In a few years (2018, 1980), this kind of approach underperformed, both being just in equities or being in a boring 60/40 fund. But the vast majority of the time, capital efficiency has worked for people here. Still, implementation remains a bit of a mystery — while the core idea here is pretty straightforward, actually managing it is… less obvious to me. I suspect this is where Newfound’s new Model Portfolios will come in.

I’m not expecting a free lunch from this new focus on capital efficiency. But it’s possible that there might be a bit of an antiemetic for markets which, to be honest, have been pretty nauseating lately.

[Editors Note: Dave Nadig will host WisdomTree’s Jeremy Schwarz, ReSolve’s Rod Gordillo, and Newfound’s Corey Hoffstein on January 28th at 2:00 PM, register here!]

For more news, information, and strategy, visit the Modern Alpha Channel.