By Kevin Nicholson, CFA, Global Fixed Income Co-CIO, Co-Head of Investment Committee

SUMMARY

- We believe the Fed is still on investors’ side; monetary policy historically takes a year to 18 months to impact the economy.

- We believe the trend is still investors’ friend globally, and particularly in the US.

- Investor sentiment is neither too optimistic nor pessimistic – a positive for markets in our view.

Our ‘Three Rules’ Give a Green Light

Looking through the rearview mirror, our ‘Three Tactical Rules’ – Don’t Fight the Fed, Don’t Fight the Trend, and Beware the Crowd at Extremes – steered us to favor stocks over bonds throughout 2021. As we are about to enter 2022, we review the Three Rules one last time this year to help with portfolio tactical positioning as inflation climbs, the Omicron variant spreads, and the safety net of ‘Quantitative Easing’ (QE) winds down. Have these rules downshifted, downgrading the positive signals of the past year? The answer is no; they are currently sending a clear positive message, in our view. Hindsight is 20/20, but our forward-looking Three Rules are giving us a green light, indicating few roadblocks or rocks to ding the windshield as we enter 2022.

Don’t Fight the Fed: Global Central Banks Remain on Investors’ Side, in Our View

Since the onset of the pandemic, the Federal Reserve has been supporting the economy and financial markets by increasing its balance sheet by $4.4 trillion in bond purchases, a process known as QE. The Fed grew its balance sheet to help meet its dual mandate of full employment and price stability with an average inflation target of 2%. The Fed is getting closer to fulfilling both targets after stabilizing a labor market that lost 22.3 million jobs in March and April of 2020. As of November 30th, the unemployment rate in the US sat at 4.2%, down from 14.8% in April of 2020.

When it comes to price stability, the Fed’s average inflation target of 2% is also on its way to being met. The Fed had struggled to get inflation up to 2% over the last ten years, but now they are dealing with the opposite problem: inflation – currently trending at 6.8% year-over-year – has been assisted by excess capital in the economy due to its QE purchases and government transfer payments. The increased inflation has led the Fed to tap the brakes on its $120 billion monthly purchases of Treasuries and mortgages. Now the Fed is opting to look through its side-view mirror, as it slows its bond purchases in the first quarter, “closer than once appeared”. While tapering bond purchases makes the Fed less accommodative, it is not restrictive for 2022 because monetary stimulus historically takes a year to 18 months to impact the economy. Thus, the Fed’s accommodative policies from the pandemic should continue to boost economic activity and earnings through next year. In conclusion, we are of the opinion that the Fed is still on the investor’s side until interest rate hikes begin to negatively impact economic growth.

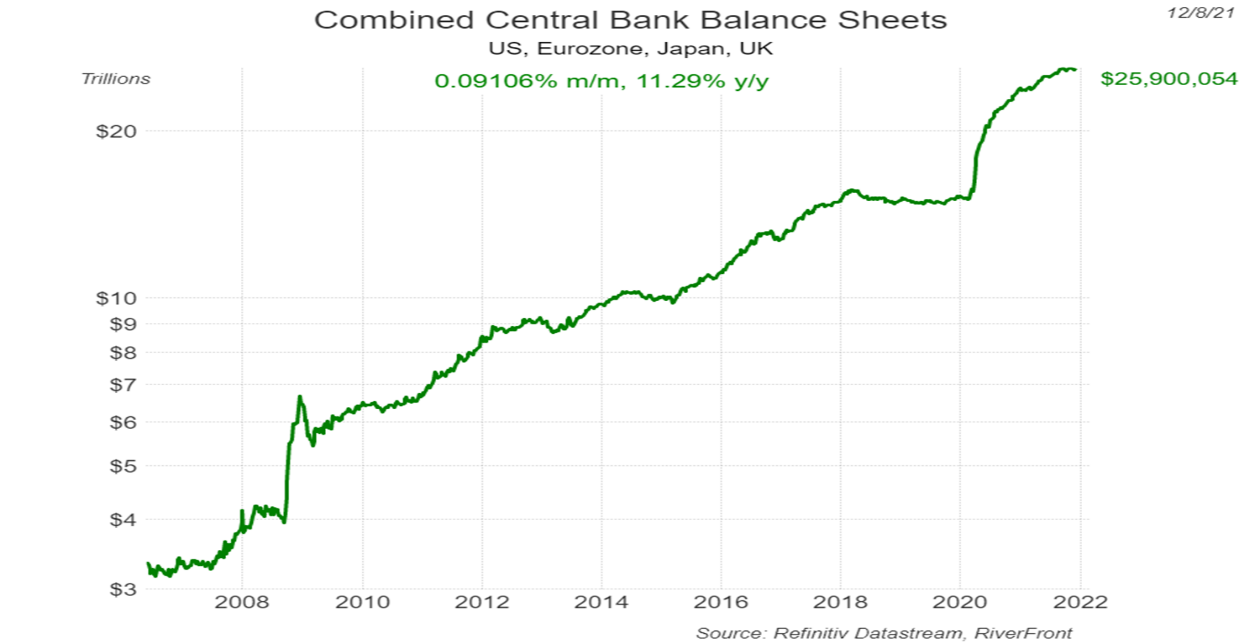

Internationally, the central banks of Europe, Japan, and the UK also remain accommodative as they continue to use various QE purchasing programs to maintain stability in their economies as the Omicron variant has some calling for lockdowns. The chart below shows that the major central banks’ balance sheets have not contracted, despite pulling back stimulus in some instances. Central banks remain on the investor’s side, in our view, despite varying degrees of stimulus depending on each country’s view of how to best combat the pandemic.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

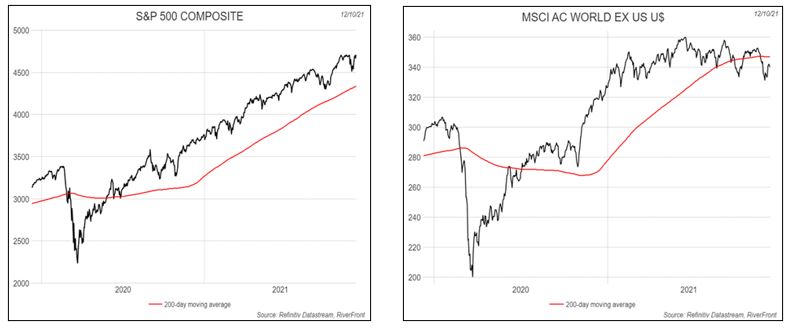

Don’t Fight the Trend: US Trend Still Strong, International Trend Mixed

The S&P 500’s trend as measured by the 200-day moving average has been positive all year, making the call for our portfolios to have a larger allocation to domestic equities easier. However, we recently had been concerned that the trend was rising too rapidly – making it difficult to sustain – and thus concluded investors should proceed with caution. As we near the end of the year, the trend is rising currently at an annualized rate of 24%, down from the 35% annualized rate experienced in our September 20th update. We believe that the pace of the trend in the US is starting to slow towards a more sustainable rate, and our models suggest the trend remains investors’ friend (see chart, left). Internationally, the trend of the MSCI All Country World-Ex US Index is flat, and the index level is currently below its 200-day moving average, suggesting to us that it is not time to add to international equities. (See chart, right). Despite the disparity between the domestic and international trends, we believe that the trend is still the investor’s friend globally because neither has turned negative.

Past performance is no guarantee of future results. Shown for illustrative purposes. Not indicative of RiverFront portfolio performance.

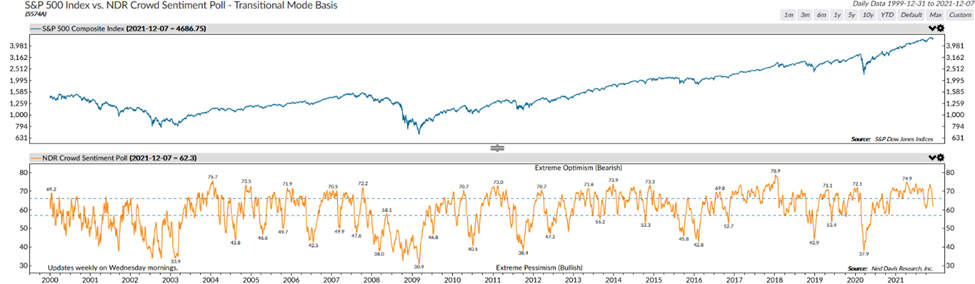

Beware of the Crowd at Extremes: Crowd Now Neutral…A Potential Positive for Investors

For most of the year, Crowd sentiment has been very optimistic due to the trifecta of strong earnings, supportive Fed policy, and government transfer payments. The combination of slowing monetary and fiscal policy, along with rising inflation and Omicron worries, has caused the Crowd’s euphoria to wane and turn neutral. In the context of the rule of ‘Beware the Crowd at Extremes’, a Crowd that is less optimistic is a market positive, in our view.

Copyright 2021 Ned Davis Research, Inc. Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/.

Conclusion:

The combination of the Three Tactical Rules still indicates a pro-risk portfolio positioning in the US as we enter 2022. The Fed and global central banks remain accommodative, the trend is positive and at a more sustainable level in the US, and the Crowd is neither too optimistic nor pessimistic. Therefore, we do not feel the need to look through the rearview mirror when our three rules give us a ‘green light’. Rather, we can focus on looking forward through the windshield, with our balanced portfolios continuing to have equity allocations that exceed their composite benchmark allocations.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. Opinions expressed are current as of the date shown and are subject to change. Past performance is not indicative of future results and diversification does not ensure a profit or protect against loss. All investments carry some level of risk, including loss of principal. An investment cannot be made directly in an index.

Information or data shown or used in this material was received from sources believed to be reliable, but accuracy is not guaranteed.

This report does not provide recipients with information or advice that is sufficient on which to base an investment decision. This report does not take into account the specific investment objectives, financial situation or need of any particular client and may not be suitable for all types of investors. Recipients should consider the contents of this report as a single factor in making an investment decision. Additional fundamental and other analyses would be required to make an investment decision about any individual security identified in this report.

Chartered Financial Analyst is a professional designation given by the CFA Institute (formerly AIMR) that measures the competence and integrity of financial analysts. Candidates are required to pass three levels of exams covering areas such as accounting, economics, ethics, money management and security analysis. Four years of investment/financial career experience are required before one can become a CFA charterholder. Enrollees in the program must hold a bachelor’s degree.

Standard & Poor’s (S&P) 500 Index TR USD (Large Cap) measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market.

MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 developed markets (DM) countries (excluding the US) and 26 emerging markets (EM) countries.

The 200-day moving average is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

In a rising interest rate environment, the value of fixed-income securities generally declines.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. Also, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Foreign investments, especially investments in emerging markets, can be riskier and more volatile than investments in the U.S. and are considered speculative and subject to heightened risks in addition to the general risks of investing in non-U.S. securities. Also, inflation and rapid fluctuations in inflation rates have had, and may continue to have, negative effects on the economies and securities markets of certain emerging market countries.

Mortgage-backed securities are subject to prepayment and extension risk; as such, they react differently to changes in interest rates than other bonds. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage backed securities.

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing.

Don’t Fight the Fed – ‘Supportive’ means the Fed’s monetary policy regarding inflation and employment is in what we believe based on our analysis to be the investors’ best interest; ‘Against’ means the Fed’s monetary policy, in our view, is going against the investors’ best interest; ‘Neutral’ means the Fed’s monetary policy is neither supportive nor against the investors’ best interest in our view. Don’t Fight the Trend – Terms correlate to the 200-day moving average as it relates to the equity indexes: ‘Positive’ means that the trend is rising, ‘Flat’ means the trend is flat, ‘Negative’ means the trend is falling. Beware the Crowd at Extremes – Terms correlate to the NDR Crowd Sentiment Poll and its measurement of Extreme Optimism (Bearish), Neutral, or Extreme Pessimism (Bullish).

RiverFront Investment Group, LLC (“RiverFront”), is a registered investment adviser with the Securities and Exchange Commission. Registration as an investment adviser does not imply any level of skill or expertise. Any discussion of specific securities is provided for informational purposes only and should not be deemed as investment advice or a recommendation to buy or sell any individual security mentioned. RiverFront is affiliated with Robert W. Baird & Co. Incorporated (“Baird”), member FINRA/SIPC, from its minority ownership interest in RiverFront. RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated, a registered broker/dealer and investment adviser.

To review other risks and more information about RiverFront, please visit the website at www.riverfrontig.com and the Form ADV, Part 2A. Copyright ©2021 RiverFront Investment Group. All Rights Reserved. ID 1956288