The trillion-dollar infrastructure package should pave the way for more charging stations, giving exchange traded funds (ETFs) that focus on electric vehicles (EVs) a push.

One clear path to EV exposure is the Global X Autonomous & Electric Vehicles ETF (DRIV), which is up 24% year-to-date heading towards the end of 2021. Top holdings in DRIV include a household name in the EV sector, Tesla, which comprises about 4.58% (as of December 2), so there’s not too much concentration risk in the popular electric automaker.

Overall, DRIV seeks to invest in companies involved in the development of autonomous vehicle technology, EVs, and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

While the pace has picked up for automakers to put more EVs on the road, they will need the chargers to match. This is where the infrastructure package comes into play, providing the funding necessary to build out the charging stations.

“President Joe Biden’s $1 trillion infrastructure package, which was recently passed by Congress, includes $7.5 billion toward a nationwide network of 500,000 EV charging stations by 2030,” an ABC News report notes.

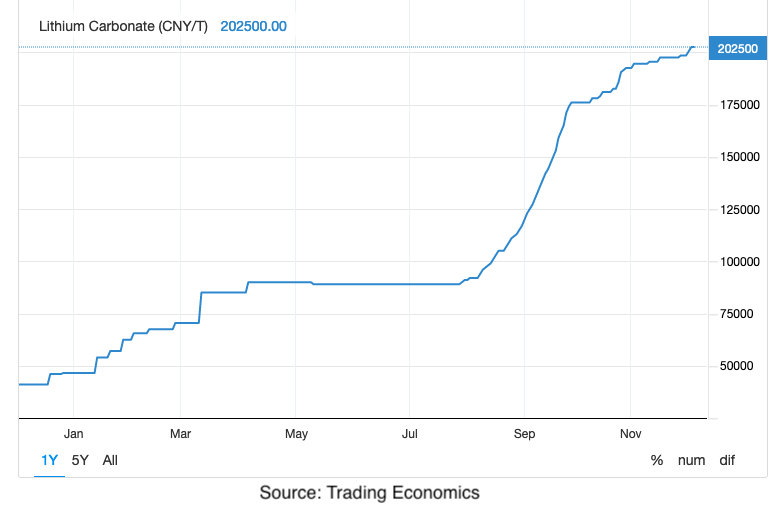

Playing Strength From Rising Lithium Prices

While DRIV is the more direct choice for playing the EV explosion, a backdoor play could be to bet on lithium prices going higher as a result of increased demand. Enter the Global X Lithium & Battery Tech ETF (LIT).

The fund seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry. The top holding is Albemarle (comprising 11% of the fund as of December 2), which operates in the specialty chemicals industry that includes lithium.

“Albemarle is the industry leader in lithium and lithium derivatives, one of the highest growth markets in the specialty chemicals industry,” the company website says. “Our unique natural resource position, derivatization capabilities and technology leadership gives us a sustainable competitive advantage.”

When juxtaposed, both funds have been trending higher in 2021, but DRIV appears to exhibit more stability from an eyeball test for both line charts. LIT is the more obvious choice this year in terms of extracting gains, but it’s also an alternative for hedging inflation given the rise in lithium prices.

For more news, information, and strategy, visit the Thematic Investing Channel.