Although not much is known definitively about the newest variant yet, the threat of Omicron is spreading at an exponential rate as more countries begin lockdowns or restrict travel. It’s reminiscent of the beginning of the COVID-19 pandemic, which saw the travel sector hit hard as the global economy came to a stand-still.

Investors at the time might remember the air travel industry ETF, the U.S. Global Jets ETF (JETS), and the astronomical amount of inflows that it experienced last year once the pandemic hit. It became one of the first big pandemic-related ETFs to experience a massive influx of investors buying the dip in anticipation of reopening and recovery, and between March of 2020 and the end of December, JETS took in an incredible almost $2.3 billion in inflows. Previously, the fund had played in the ballpark of $50 million or so.

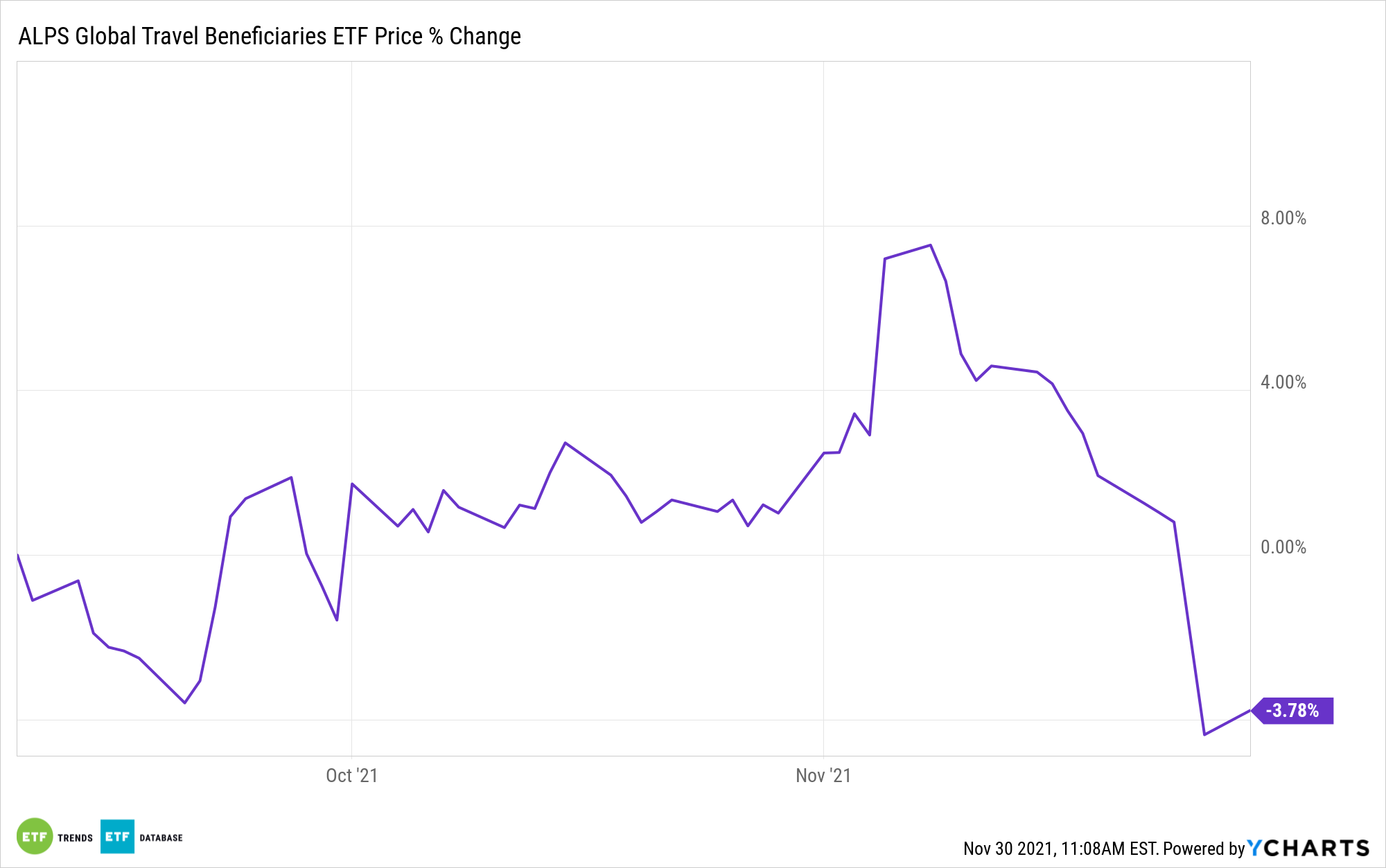

With more countries shuttering travel and closing access, and while Omicron remains new enough to carry a lot of uncertainty in its potential impact, the global travel industry is once again facing a major pullback. This time, there is a fairly new ETF, the ALPS Global Travel Beneficiaries ETF (JRNY), that is presenting investors with an opportunity to gain exposure to the travel sector at value pricing.

As of now, Omicron is showing potential indicators of being even more contagious and spreading more rapidly than the Delta variant, but South African doctors have reported that so far it seems to be more mild, with no hospitalizations yet. Vaccine maker Pfizer has already reported that it has begun the initial stages of developing a vaccine based on the newest variant and its plethora of mutations, and Moderna has reported that it will be able to tailor its booster to Omicron.

Recognition that current vaccines will most likely not be as efficient with this new variant and its more than 50 mutations has caused markets to pull back some for now, and the travel industry is experiencing a decline once more.

Buy the Dip With JRNY

For investors that are looking to capitalize on value-priced access to the global travel industry and wanting to capture the upward momentum once travel bans eventually lift, the ALPS Global Travel Beneficiaries ETF (JRNY) is an ETF to consider. It invests in companies involved within the global travel industry, from rental agencies to airlines and hotels, all of which are facing potentially steep pullbacks if travel restrictions and bans continue to increase, but should bounce back once restrictions lift.

JRNY seeks to track the S-Network Global Travel Index, which uses a rules-based methodology to identify companies involved in the global travel industry. These are broken down into four segments: airlines and airport services; hotels, casinos, and cruise lines; booking and rental agencies; and ancillary beneficiaries, which are comprised of companies that are not directly in the global travel industry but instead benefit from it. Ancillary beneficiaries can include technology companies providing the software for travel services, as well as retailers of luxury goods and personal products that are aligned with travel.

The index identifies companies that demonstrate strong growth characteristics within their segments and contains domestic and international companies. To be included, companies must trade on one of the major global exchanges and create significant revenue within one of the segments. The index is built from 20 securities within each segment and must have a minimum of one constituent from each geographic region, as well as a 65% max weight per region. These regions include the U.S. and Canada, Europe, Pacific (ex-Canada), and Emerging.

Some of the top holdings include Marriott International Inc (MAR) at 5.13%, Booking Holdings Inc (BKNG) at 4.38%, and Airbnb Inc. (ABNB) at 4.08%.

JRNY carries an expense ratio of 0.52%.

For more news, information, and strategy, visit the ETF Building Blocks Channel.