A recent study done by State Street Global Advisors asked over 300 institutional investors their thoughts on ESG going forward and how they plan to proceed with ESG investing. The study found that in just two years, the primary reasoning for investing in ESG had changed amongst investors, a significant find and a good indicator of sentiment for the future.

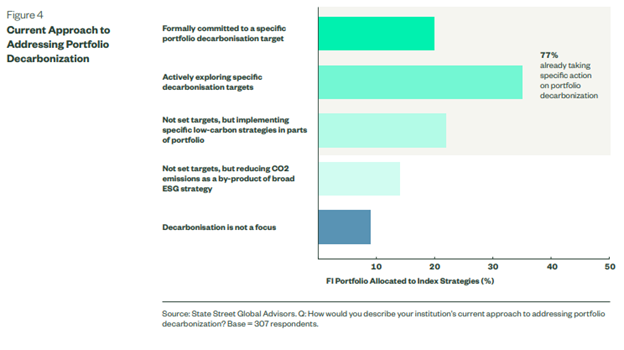

Currently, only 20% of the investors surveyed reported that they had committed specifically to decarbonization targets, but 61% of those in North America, 71% in Europe, and 70% in APAC have committed to introducing set targets within the next three years. It’s a recognition, particularly after the creation of the global carbon markets at the COP26 summit this month, that regulations and defined targets will be necessary for continued success.

What’s more, the study found that while only 20% have clearly defined decarbonization targets, over three-quarters of asset owners (77%) reported that they were taking “deliberate action” to reduce their portfolios’ carbon footprints.

Image source: State Street Global Advisors’ The World Targets Change Report

“Committing publicly to a number gives you an ambition to move towards. If you want to hit Paris alignment, that [net zero by 2050] is what it looks like. If one doesn’t have a target, you can still measure where you are, but it’s difficult to know where you’re getting to and how to plan,” said David Vickers, CIO of Brunel Pension Partnership, in the paper.

It’s growth, particularly over previous years, and the reason is simple and yet significant: 44% of investors are aligning their investment policies due to feeling responsible to help push economic change and work towards resolving the climate change crisis. This was the top motivating reason reported, followed by creating outperformance at 41% and mitigating investment risk at 36%.

State Street notes that this is a big change from previous ESG surveys in 2019 that had reported fiduciary duty as the top motivator, followed by regulatory landscape and investment risk. The motivation to help bring about real change as the top reason to invest in ESG and set targeted decarbonization goals could very well be a reflection of the acknowledgement of the massive systemic risk that climate change poses.

SPDR Offers Low Carbon Investing

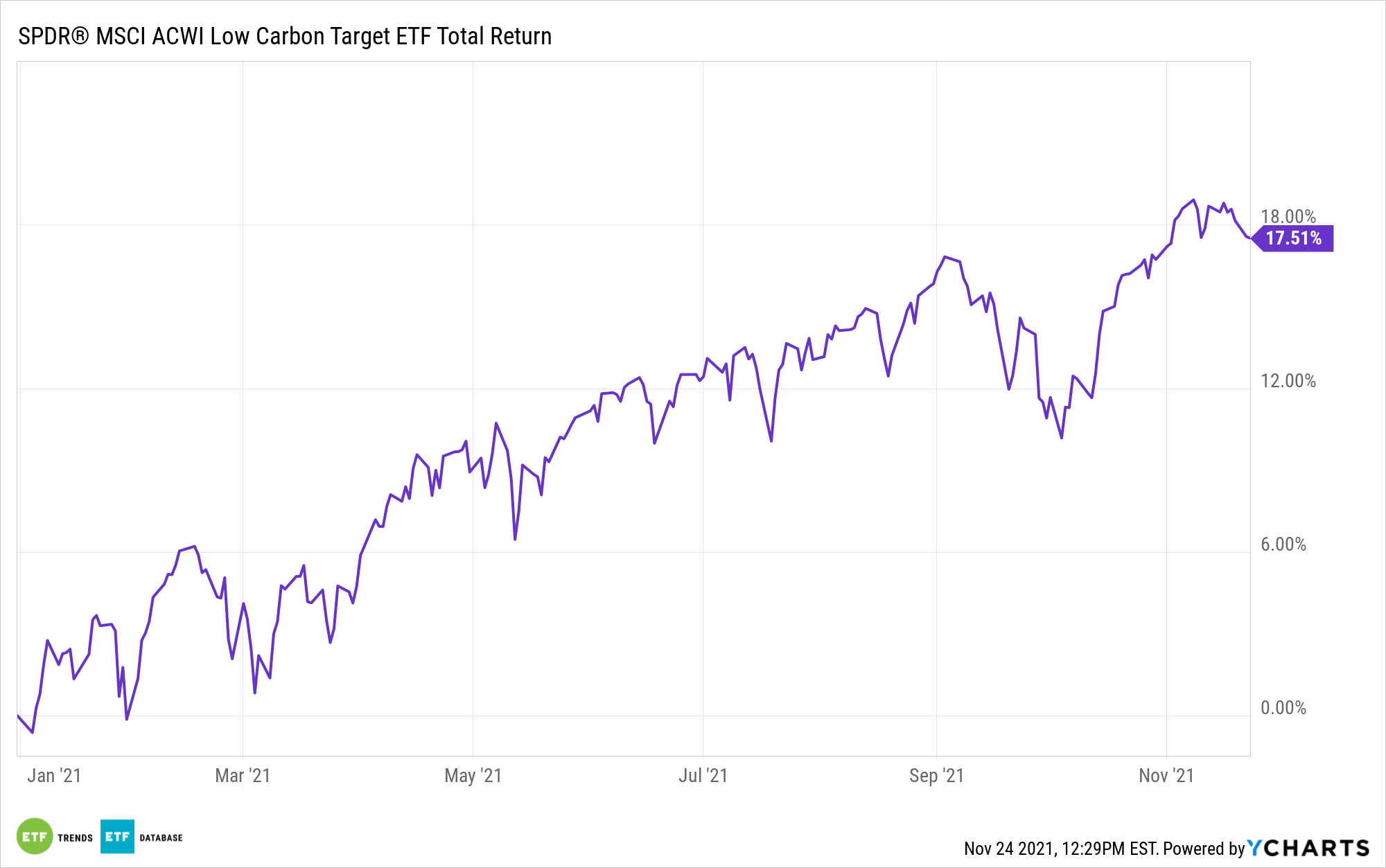

For investors looking to invest in reduced emissions, the SPDR MSCI ACWI Low Carbon Target ETF (LOWC) offers investors exposure to companies with low carbon emissions and fossil fuel reserves.

The fund tracks the MSCI ACWI Low Carbon Index. This index reweights securities in the MSCI All-Country World Index (ACWI) to favor lower carbon emissions and lower fossil fuel reserves.

The benchmark overweights companies with low carbon emissions relative to sales and companies with low potential carbon emissions, offering lower carbon exposure when compared to the broad market.

LOWC’s top five sector allocations include information technology at 23.03%, financials at 15.20%, consumer discretionary at 12.63%, healthcare at 11.35%, and industrials at 10.29%.

The ETF carries an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.