The U.S. Federal Reserve has been circulating the narrative that inflation is transitory, but opposing views make the case for long-term inflation, which makes gold exposure a must.

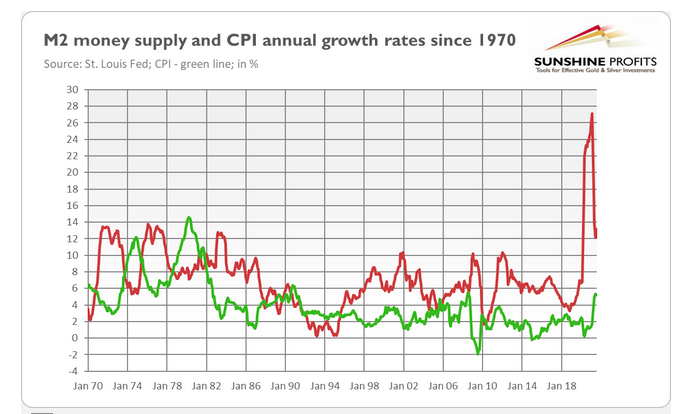

One thing to support the case for long-term inflation is the money supply, as noted by an Investing.com article. While the M2 money aggregate has retreated since the pandemic, it’s still relatively heightened.

“The pace of growth in the M2 money aggregate has slowed down since then, dropping to a still relatively high rate of 13%,” writes Sunshine Profits. “This is a rate that is almost double the pre-pandemic level (6.8% in February 2020) and the long-term average (7.1% for the 1960-2021 period ). So, actually, given the surge in the broad money supply and the monetary theory of inflation, rapidly rising prices shouldn’t be surprising at all.”

“Second, there is a lag between the money supply growth and the increase in inflation rates,” the article adds. “That’s why some analysts don’t believe in the quantity theory of money – there is no clear positive correlation between the two variables.”

Given those two factors, with respect to money supply, inflation looks like it’s here to stay for some time.

“Well, if the theory of inflation outlined above is correct, elevated inflation will stay with us for several more months,” Sunshine Profits says. “Therefore, it’s not transitory, as the central bank tells us. Instead, inflation should remain high for a while, i.e., as long as the money supply growth won’t slow down and go back below 10% on a sustained basis.”

Physical Gold Exposure With This ETF

Gold exposure doesn’t have to be a trying task with ETFs like the Sprott Physical Gold Trust (PHYS). PHYS gives investors easy access to gold exposure with the option to convert their ownership shares to physical gold.

PHYS invests and holds substantially all of its assets in physical gold bullion. PHYS seeks to provide a secure, convenient, and exchange-traded investment alternative for investors who want to hold physical gold without the inconvenience that is typical of a direct investment in physical gold bullion.

“The Trusts’ precious metals are fully allocated which provides the Trusts with direct beneficial ownership,” Sprott explains on its website. “Unlike other bullion funds, the Trusts do not have an unallocated account that is used to facilitate transfers of bullion between financial institutions that act as authorized participants. Without exception, all of the bullion owned by the Trusts is held in the Trusts’ allocated accounts in physical form.” For more news, information, and strategy, visit the Gold & Silver Investing Channel.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.