By Day Hagan Asset Management

SUMMARY

With corporate earnings coming out in abundance, a plethora of domestic and international narratives, and now, from a price perspective, a short-term overbought condition, we need to see if the market resets—consolidates or pulls back.

EVEN AN OLD DOG (ME) CAN LEARN A NEW TRICK

I’ve spent a good portion of the year discussing price volatility. Specifically, to expect and accept price movement in both directions by various asset classes, equity market indices (domestic and international), and macro sectors (XLE, XLU, etc.), along with capitalization size (large, mid, and small) and style (growth, value). Reflecting, I think we have experienced said price volatility, and the probability is that it will continue into year-end.

Over the weekend, I scanned a report written by Ed Mills and Chris Meekins with Raymond James & Associates that expanded my definition of volatility (thank you, gentlemen) when they used the phrase “policy volatility” (bolding by the author of this report):

Policy volatility tied to an accelerating pace of negotiations on a compromise reconciliation framework produced a market positive development this week with the likely removal of a corporate tax rate hike from consideration. Many revenue raising options remain on the table, including high income tax adjustments and minimum tax changes for corporations, but a shrinking top-line figure is reducing the scope of required revenue provisions.

Policy volatility. A great phrase and description given the current situations stemming from the “DC Beltway.”

GAME, SET, MATCH…

Consistent with the statement above (“produced a market positive development”), equity bulls retained possession of the ball last week, for the most part. This is evident by the NYSE (all issues) and S&P 500 Advance-Decline Lines (A/D Line) recording new intraweek highs, the Small Cap 600 A/D Line moved above a downtrend line (reach out for the charts) and the one-week performance statistics, through 10/22/21—Table 1.

…WELL, ALMOST

Within the context of the NDR Catastrophic Stop Loss Model remaining on a buy signal and the recent topside advance, shown below are a few short-term issues that may make equity market indices vulnerable to another period of volatility (downside probing) or lateral price action.

-

Overbought, defined by the percentage of stocks above 10-day MA and 20-day EMA—over 80%.

-

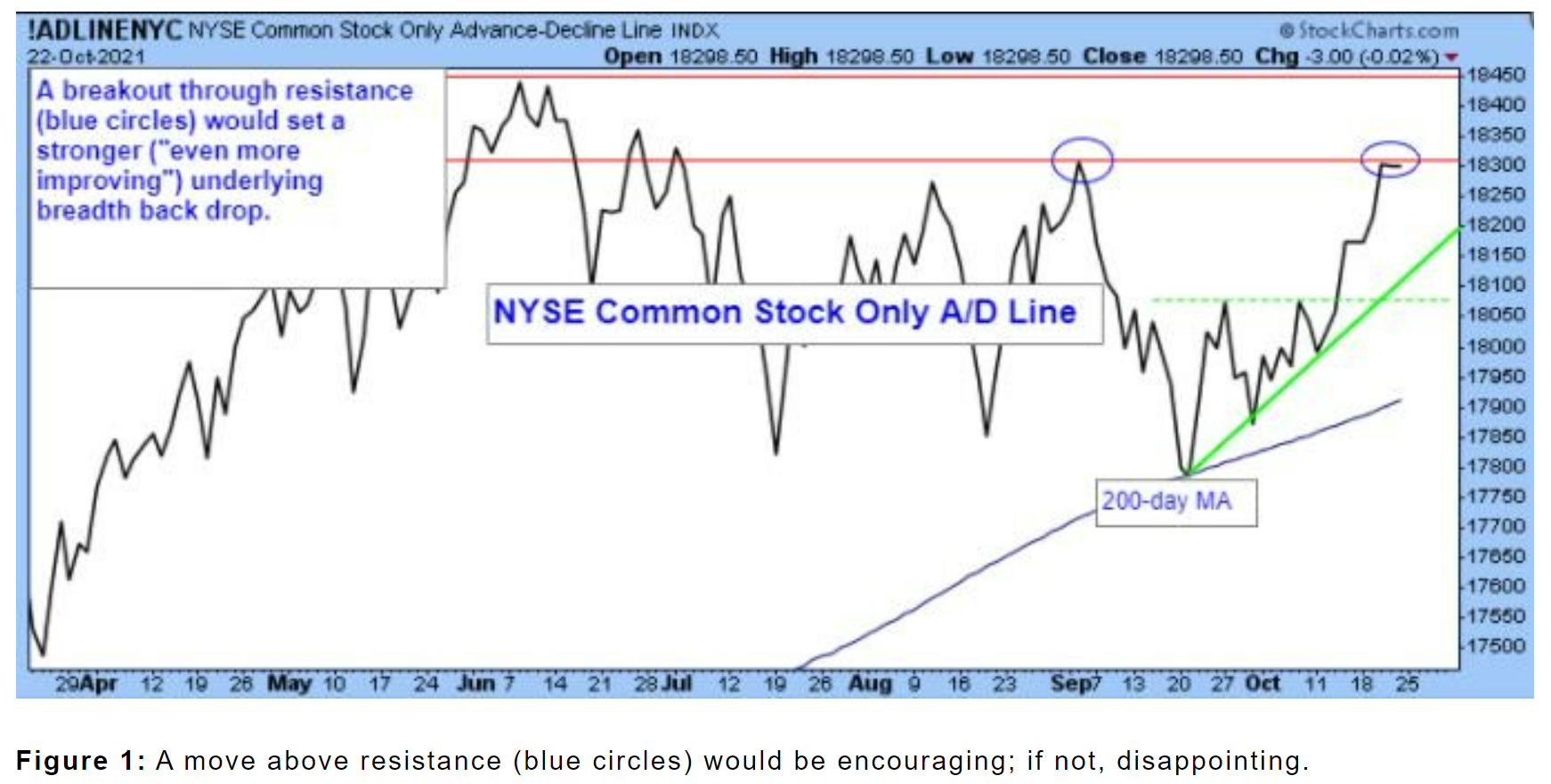

NYSE Common Stock Only A/D Line moved up to resistance and backed off. Figure 1.

-

Small Cap absolute and relative performance is troubling, despite an improvement in the Small Cap A/D Line (getting better but not bullish) and current favorable seasonal period for Small Caps.

-

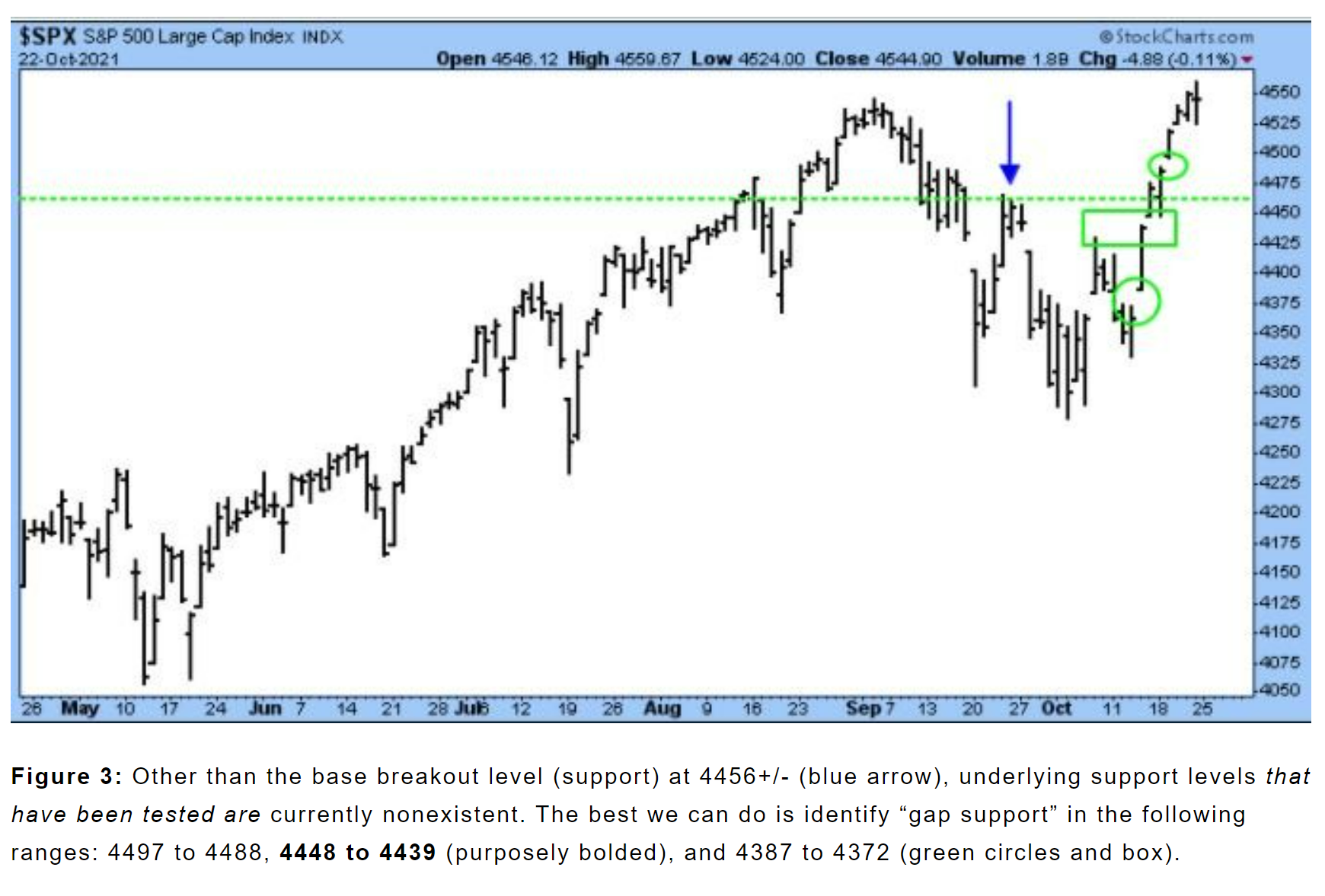

Other than at the top end of the SPX’s recent breakouts, no tested support levels exist. Figure 3.

Day Hagan Asset Management appreciates being part of your business, either through our research efforts or investment strategies. Please let us know how we can further support you.

Art Huprich, CMT®

Chief Market Technician

Day Hagan Asset Management—Written 10.24.2021. Chart and table source: Stockcharts.com unless otherwise noted.

PDF Copy of this Article: Day Hagan Tech Talk: Volatility of a Different Type, October 25, 2021 (pdf)

For more news, information, and strategy, visit the ETF Strategist Channel.

Disclosure: The data and analysis contained herein are provided “as is” and without warranty of any kind, either express or implied. Day Hagan Asset Management (DHAM), any of its affiliates or employees, or any third-party data provider, shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Day Hagan Asset Management literature or marketing materials. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before investing. DHAM accounts that DHAM or its affiliated companies manage, or their respective shareholders, directors, officers, and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. The securities mentioned in this document may not be eligible for sale in some states or countries, nor be suitable for all types of investors; their value and income they produce may fluctuate and/or be adversely affected by exchange rates, interest rates, or other factors.

Investment advisory services offered through Donald L. Hagan, LLC, a SEC-registered investment advisory firm. Accounts held at Raymond James and Associates, Inc. (member NYSE, SIPC) and Charles Schwab & Co., Inc. (member FINRA, SIPC). Day Hagan Asset Management is a dba of Donald L. Hagan, LLC.