The energy sector is the best-performing group in the S&P 500 this year, and that’s benefiting a plethora of exchange traded funds.

As its name implies, the VanEck Vectors Natural Resources ETF (HAP) isn’t a dedicated energy ETF, but the fund devotes 23.1% of its weight to energy equities, making energy its second-largest sector exposure and providing more than adequate leverage to recovery in that sector.

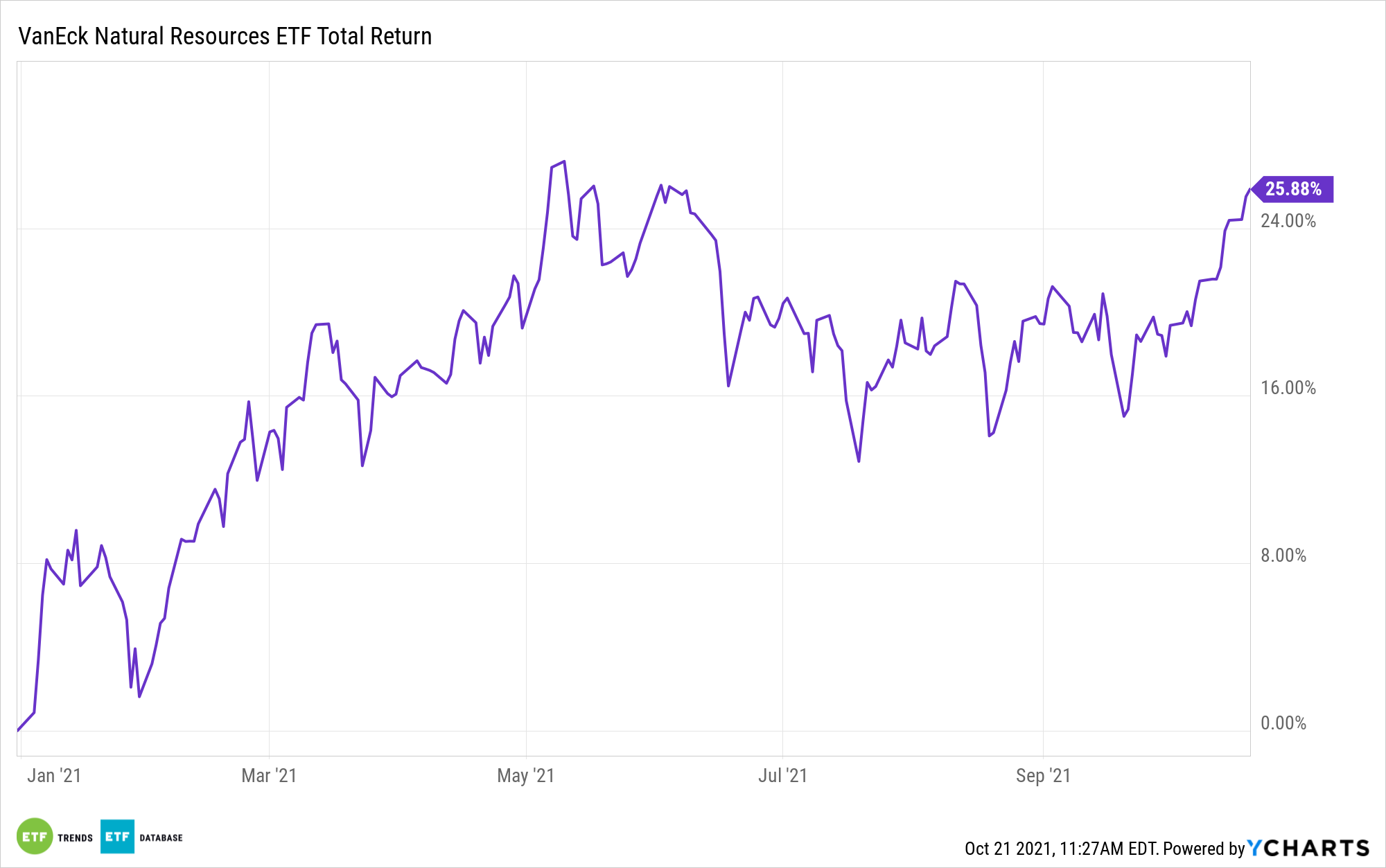

That large energy weight is providing material benefit to HAP investors this year, as evidenced by the fund being higher by nearly 26% and flirting with all-time highs. Despite HAP’s impressive 2021 run and that of the broader energy sector, the group isn’t overvalued. Actually, some analysts make the case that the energy patch remains undervalued.

“Energy stocks have skyrocketed this year. The Morningstar U.S. Energy Index has jumped more than 58% for the year to date, with 15% growth in the past month alone. In our 2021 Outlook, we highlighted that energy was the most undervalued sector by far at that time. And yet we still see the sector as undervalued,” says Morningstar analyst Dave Sekera.

One of the reasons that traditional energy stocks, broadly speaking, are undervalued is sentiment. As in, some investors are flocking to renewable energy equities while others are favoring environmental, social, and governance (ESG) investing — a style that usually doesn’t favor fossil fuels producers.

“There remains a lot of negative sentiment surrounding investing in oil companies, as many investors are hesitant to invest in a commodity where the long-term trend in demand is lower,” adds Sekera. “Other investors with specific environmental, social, and governance investment guidelines are unwilling to invest in firms that directly contribute to carbon dioxide emissions.”

Among the energy names Morningstar says are undervalued are familiar fare, including Chevron (NYSE:CVX) and Exxon Mobil (NYSE:XOM), the two largest domestic oil companies. That duo combines for 4.66% of HAP’s weight, according to VanEck data.

Several other HAP holdings check the undervalued box as well. Those include BP (NYSE:BP), Occidental Petroleum (NYSE:OXY), and Pioneer Resources (NYSE:PXD). Overall, there’s valuation opportunity in the energy patch, and HAP is an idea for investors to consider, particularly for those that don’t want a dedicated energy ETF.

“In a market that we consider to be broadly trading on the high side of our fair value range , the energy sector is one of the few areas we continue to view as undervalued. While the undervaluation has declined as the stocks have ramped higher over the past few weeks, we continue to see more 4- and 5-star stocks in this sector than any other,” concludes Sekera.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.