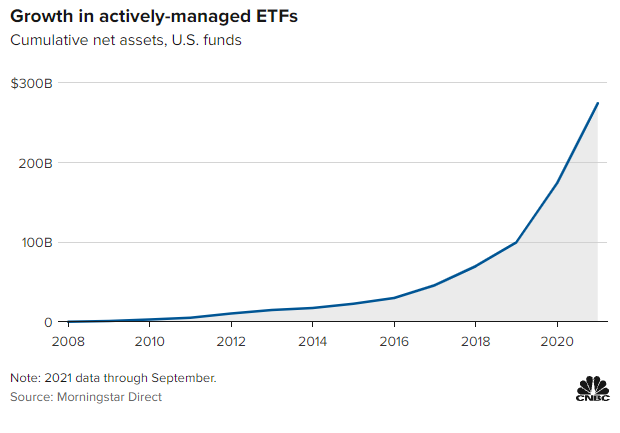

Investors continue to lean into actively managed ETFs as markets wobble and uncertainty about forward-looking growth persists. Actively managed ETFs within the U.S. brought in nearly $275 billion in net assets in the month of September, making up roughly 4% of the ETF market, according to Morningstar numbers reported by CNBC.

The popularity of the ETF vehicle has continued to make headway as record investments into ETFs have poured in over the course of the year. Many investors appreciate the tax efficiency that ETFs can offer, and active management within the space has provided the responsiveness to changing market conditions that allows for targeted investments in response to market movements.

Image source: CNBC’s How to know if actively managed exchange-traded funds are right for your portfolio

Last year, actively managed ETFs in the U.S. had only brought in $140 billion in assets over the same time period. Asset management firms are increasingly stepping into the ETF arena, either converting existing mutual funds into ETFs or creating ETFs that follow similar investment strategies used within their mutual funds.

“Over the past year, we have pivoted a good bit of our client model portfolio holdings from mutual funds to ETFs to reduce investment expenses and help to lower taxes in non-retirement accounts,” said Jon Ulin, managing principal of Ulin and Co. Wealth Management.

Active ETFs can hold a lot of appeal for investors who are looking for a more targeted approach than passive investing may yield, particularly when trying to beat benchmarks.

“Managers have the flexibility to use their processes, knowledge, research and tools to find who they believe will be the best-performing companies in a particular sector,” said CFP Ashley Folkes, a financial advisor and director of marketing and growth strategies at Bridgeworth Wealth Management.

What’s more, active managers are able to respond immediately should market conditions turn unfavorable, creating lower risk profiles for their clients while working to provide less volatility than the market might experience. At a time when markets are continuing to experience wobble, active management can be more of a refuge for investors than passive strategy investing.

Active management firm T. Rowe Price believes in the difference and benefits to active investing and active management. The firm currently offers eight actively managed ETFs for investors that are looking to invest in an environment of record IPOs that benefits stock pickers. The firm brings a bevy of experience and research to its products, with portfolio managers averaging over 20 years in investing each, as well as over 400 investment professionals dedicated to researching companies within ETFs.

For more news, information, and strategy, visit the Active ETF Channel.