Cybersecurity is in the spotlight, and that could be a plus for stocks and exchange traded funds, including the First Trust Nasdaq Cybersecurity ETF (CIBR).

However, investors should be careful of merely paying attention to CIBR because large-scale cyber attacks are in the news. While those headlines are relevant over the near-term, the cybersecurity investment thesis is supported by compelling long-term trends. Much of that is supported by governments realizing that they need to move rapidly to eliminate cybersecurity vulnerabilities.

“In response to several high-profile data breaches, governments and regulators around the world are implementing new laws concerning data privacy and cybersecurity,” notes First Trust. “One of the most important and far-reaching is the European Union’s General Data Protection Regulation, or GDPR, which unified privacy laws across EU countries and applies to any company that collects the personal data of EU citizens.”

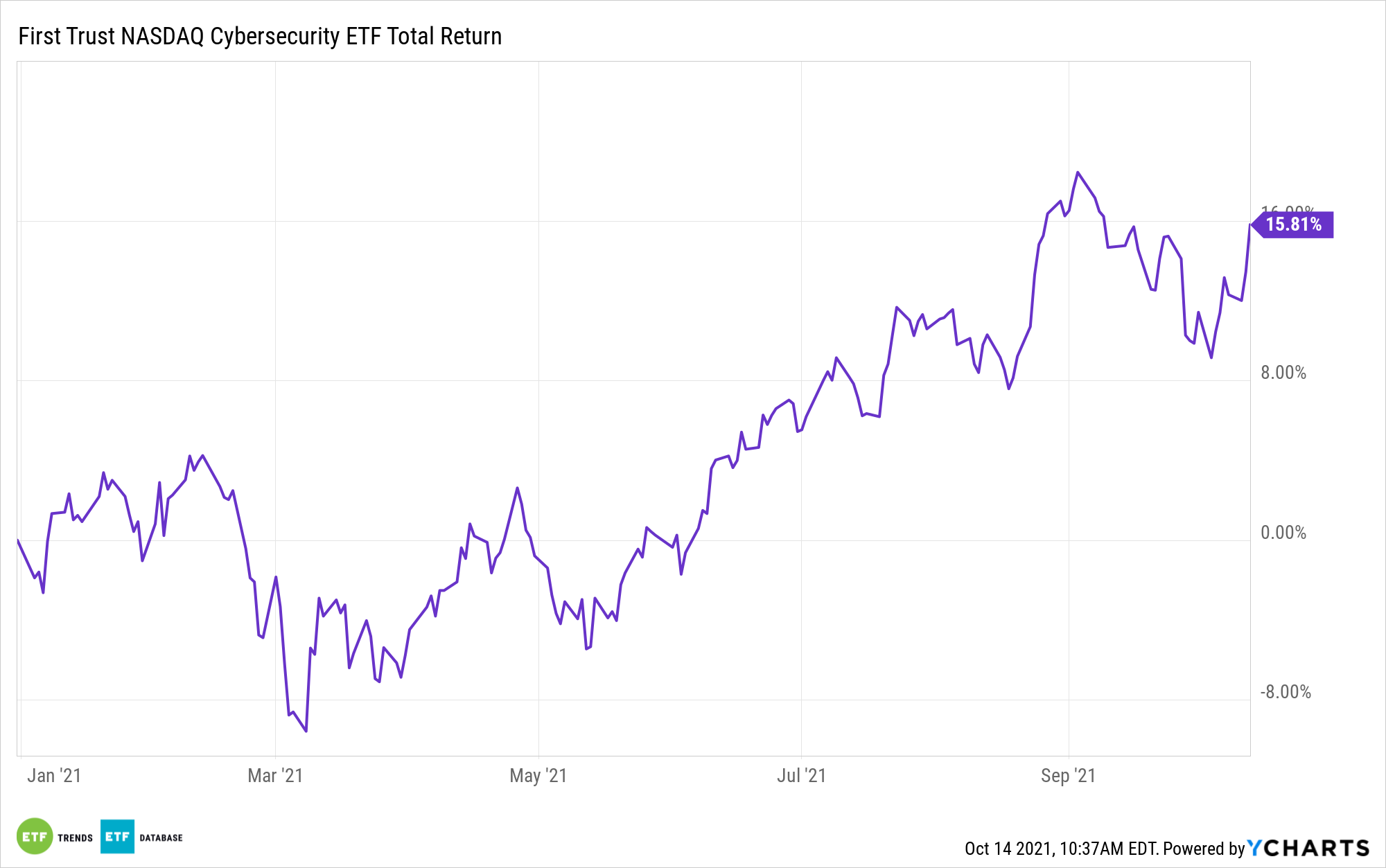

In other words, some level of forward thinking and patience is required to be involved with CIBR. Trading the fund around near-term headlines is fine for active traders, but investors exhibiting patience with CIBR could be rewarded for exercising that virtue.

For its part, CIBR has long since proved that it has staying power. The fund, which is more than six years old, follows the Nasdaq CTA Cybersecurity Index and has nearly $5 billion in assets under management.

CIBR is relevant for another reason. Obviously, the First Trust ETF provides dedicated cybersecurity exposure — something broad market benchmarks and even old guard technology ETFs are often light on. In other words, investors that want basket exposure to cybersecurity stocks would be wise to do it with a fund like CIBR, not a traditional tech ETF. Then, there is the attractive long-term opportunity set available to investors in this industry.

“Faced with the threat of cyberattacks and stringent new data privacy laws, organizations around the world have little choice but to increase their cybersecurity defenses, in our opinion,” adds First Trust. “Estimates are that worldwide cybersecurity spending will more than double from 2019 levels by 2024, rising to over $300 billion. Moreover, given the growing sophistication and persistence of cybercriminals, we expect cybersecurity spending to be less susceptible to cyclical slowdowns than other forms of technology spending.”

Perhaps it’s not surprising that investors have added $1.28 billion in new capital to CIBR this year.

For more news, information, and strategy, visit the Nasdaq Portfolio Solutions Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.