October isn’t just spooky season, it’s also tax efficiency season. With rate increases a distinct possibility as the Biden administration kicks the tires on capital gains, advisors need to consider the tax efficiency of their clients’ portfolios.

In a T. Rowe Price white paper, Portfolio Construction Specialist Terry Davis and Portfolio Construction Analyst John Gray write, “One of the great benefits of the current U.S. tax code is its treatment of municipal bonds. Income received from municipal bonds is generally exempt from taxes at the federal level (and even at the state and local level too, if you live in the issuing state).”

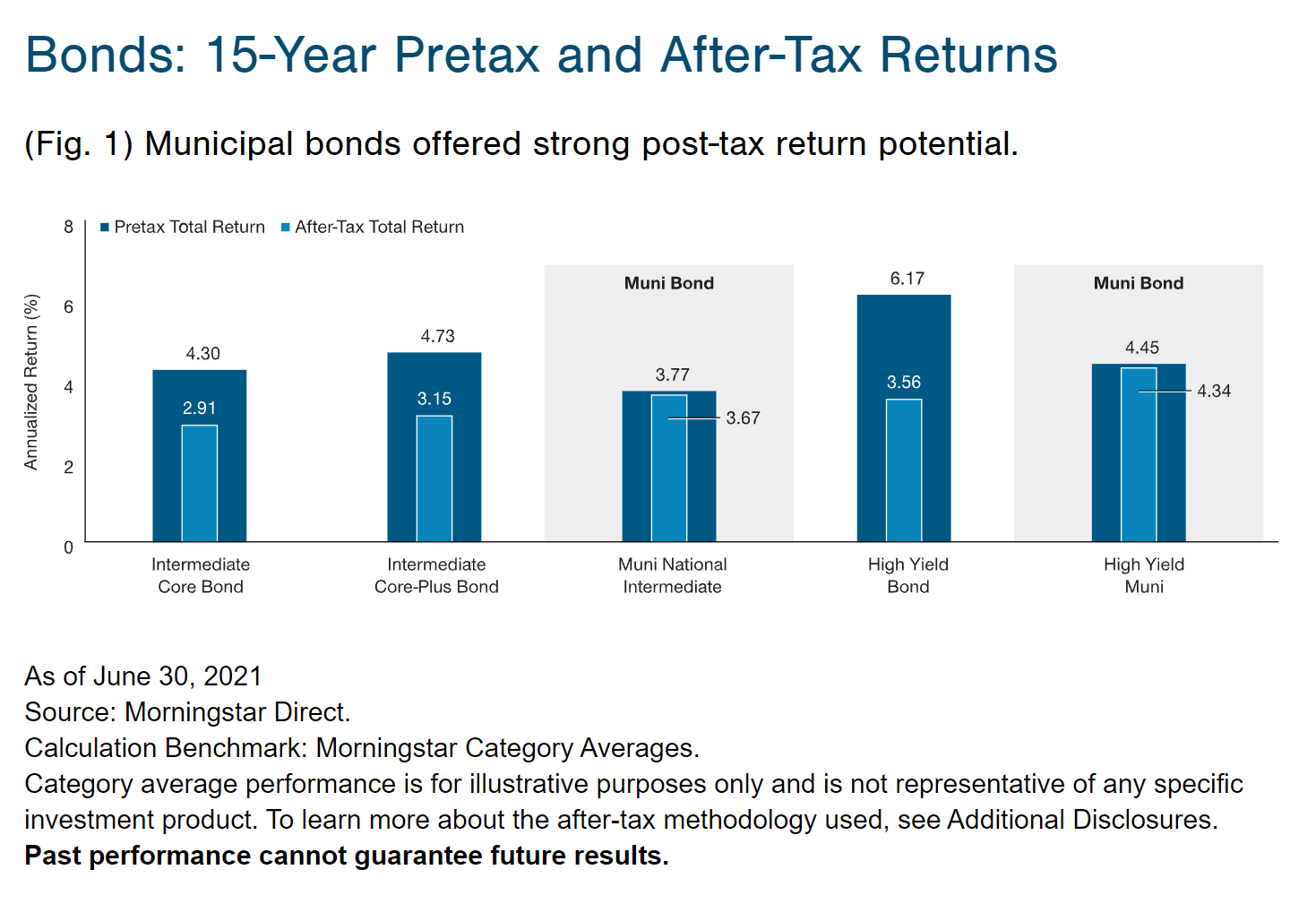

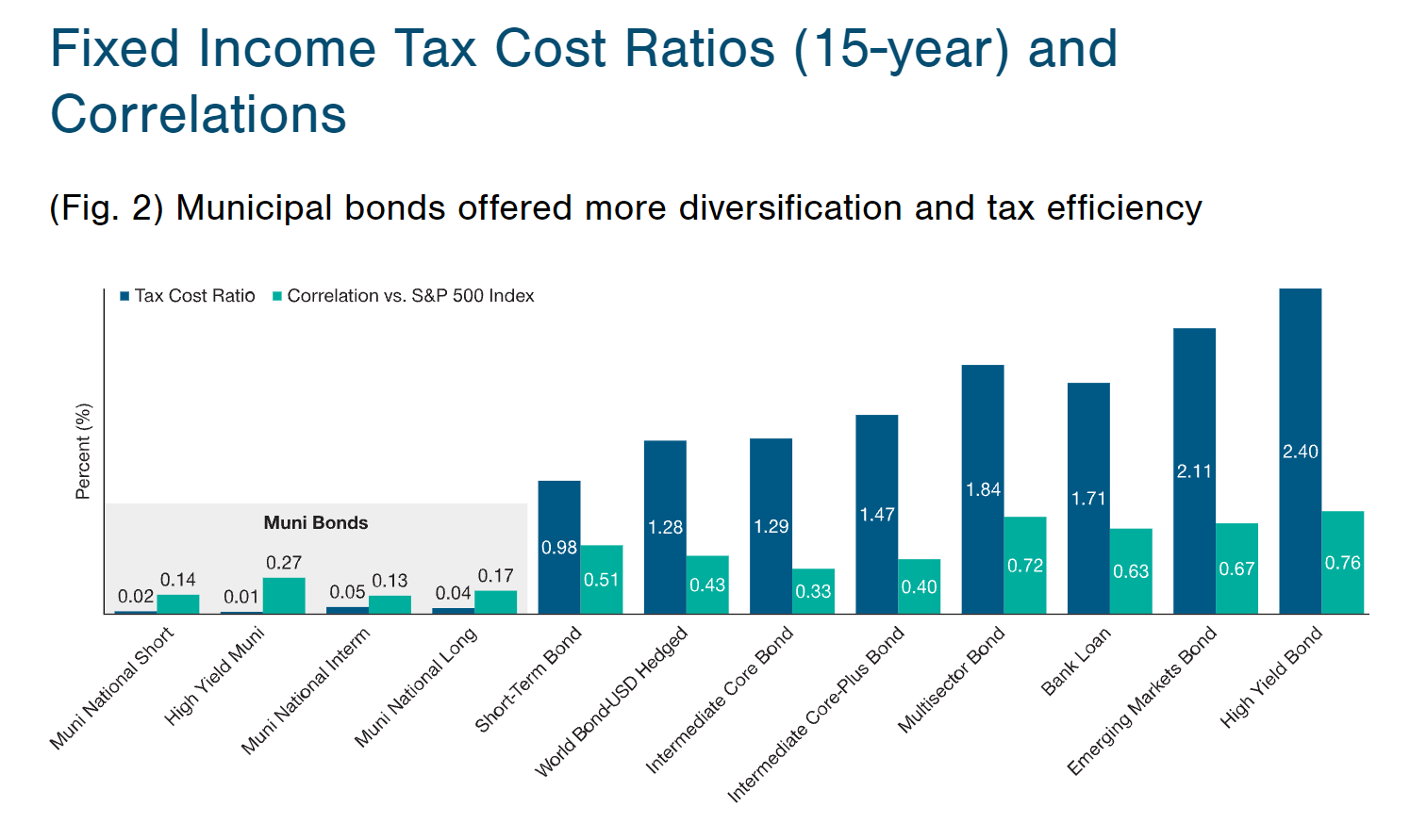

In most categories, taxable bonds come out ahead in pretax returns, but municipal bonds perform better after taxes. Certain taxable bond categories, such as high yield, are particularly inefficient. Municipal bonds also have the advantage of having low correlation to equities. Correlation measures the degree to which securities move in tandem, so a lower correlation indicates superior diversification.

In most categories, taxable bonds come out ahead in pretax returns, but municipal bonds perform better after taxes. Certain taxable bond categories, such as high yield, are particularly inefficient. Municipal bonds also have the advantage of having low correlation to equities. Correlation measures the degree to which securities move in tandem, so a lower correlation indicates superior diversification.

Finding Tax Efficiency In Equity

Finding tax efficiency in equities can be daunting compared to fixed income, but equity strategies can still find efficiency. Davis and Gray point out that, “When constructing the equity portion of a tax-efficient investment model, vehicles such as ETFs and SMAs are typically used.” The ETF wrapper tends to create fewer taxable events and only sell off holdings when they change up their index and rebalance. Davis and Gray go on to note that active mutual funds can also be a compelling option to add tax-efficient alpha to a portfolio.

Additionally, long-term capital gains through dividends is also an efficient model. Hence, a low turnover strategy that is dividend-orientated is a strong play that can blunt the impact of taxes on returns. T. Rowe Price has several ETFs that are both tax and cost-efficient. On the equities side, they have funds such as the T. Rowe Price Blue Chip Growth ETF (TCHP), the T. Rowe Price Growth Stock ETF (TGRW), and the T. Rowe Price Dividend Growth ETF (TDVG). They also have a number of Fixed Income ETFs, such as the T. Rowe Price QM US Bond ETF (TAGG).

For more news, information, and strategy, visit the Active ETF Channel.