In 2021, there is a real struggle for income. Advisors are contending with a delicate balancing act of sourcing income in a low-yield environment while avoiding taking on too much credit or duration risk.

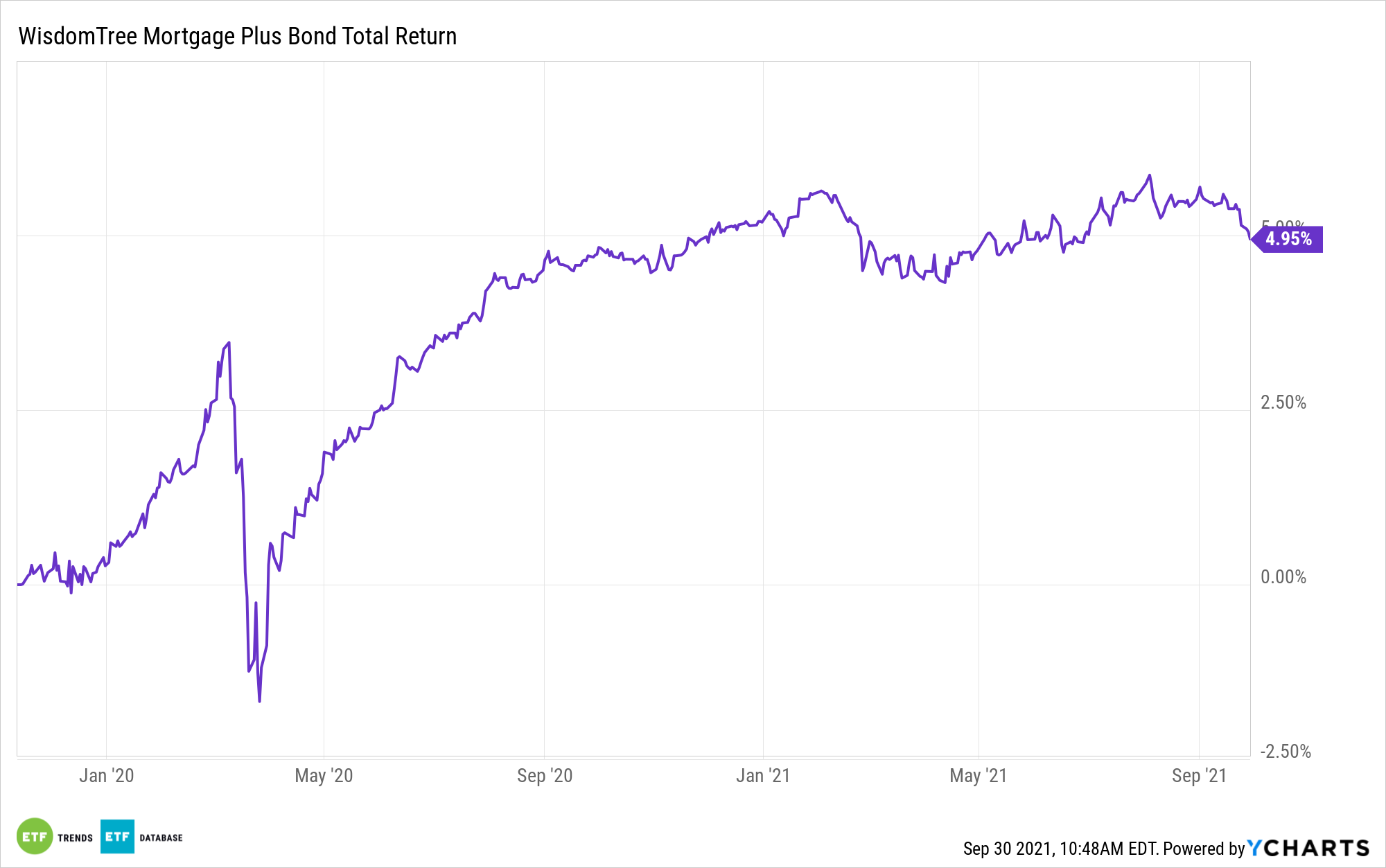

One way of striking that balance could be the WisdomTree Mortgage Plus Bond Fund (NYSEArca: MTGP). MTGP is an actively managed ETF primarily investing in agency residential and commercial mortgage-backed securities (MBS).

MBS qualify as securitized debt, which is the second-largest corner of the bond market after U.S. Treasuries. Within the securitized debt space, MBS are the most well-known assets. In other words, advisors can discuss MTGP with clients knowing that this a stable strategy with low credit risk because MBS are backed by the U.S. government.

“For MBS, one of the risks to be aware of is ‘prepayment risk,’ or receiving your principal back sooner if interest rates fall and mortgages are refinanced. The opposite side of this trade occurs when rates rise and is known as ‘extension risk.’ As a result, investors typically expect some incremental yield relative to a similar duration Treasury,” notes Kevin Flanagan, head of fixed income strategy at WisdomTree.

MTGP has a 30-day SEC yield of 1.23% and an effective duration of 3.49 years, according to issuer data. The ETF, which turns two years old in November, has more than 120 holdings. The bulk of the fund’s portfolio is dedicated to residential mortgage-backed securities (RMBS).

“MTGP provides exposure to the aforementioned agency RMBS and agency commercial MBS sectors, representing at least 80% of the core portfolio. As a result, the Fund has the ability to diversify toward other yield-enhancing sectors in the securitized debt market, up to 20% in total. The Fund is also designed to be at least 80% investment-grade,” adds Flanagan.

MTGP has some leverage to home prices because if prices rise too far too fast, buyers are priced out of the market, meaning that MBS demand falters. In other words, the Goldilocks scenario for this fund is strong demand in a buyers’ market.

However, MTGP has benefits. For example, it’s noticeably less vulnerable to rising rates than a corporate bond strategy.

“Another noteworthy aspect of MTGP is its makeup as compared to U.S. investment-grade corporate bonds. As of this writing, MTGP’s average yield to maturity is only 24 bps below the Bloomberg U.S. Corporate Index, but perhaps more importantly, effective duration stands at 3.49 years, or less than half of the corporate figure of 8.75 years,” notes Flanagan.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.