Women have been disproportionately affected by the COVID-19 pandemic, with high numbers of unemployment being seen in front-facing jobs such as retail, healthcare, and food services, whether salaried or hourly. However, a new report from McKinsey and Co. and LeanIn.org, 2021 Women in the Workplace, found that amongst white collar women, the number of senior level jobs held by women actually increased during the pandemic.

The report is the biggest study on women in corporate America and was based on information from 423 companies with 12 million employees collectively. 65,000 of those employees were surveyed this year.

In an interview with the Wall Street Journal, Rachel Thomas, Lean In’s co-founder and CEO, explained that while women were in more positions of leadership, their experiences have become increasingly worse as they feel the toll being taken. “The reality is, a lot of us, we can’t leave our jobs. There’s more movement now, but mostly the movement we’re seeing, it isn’t leaving the workforce—it’s people moving companies,” she explained.

Thomas believes that employees are increasingly pushing back on their employers to provide more and to create a better culture that is more supportive, and they are more willing to walk away and find employment elsewhere if they believe they will have that support with a new company. Amidst all the hardships wrought by the pandemic, women in particular are really questioning if their work is worthy work, and if they hold careers that are meaningful and have room for growth.

Lareina Yee, senior partner at McKinsey and former chief diversity and inclusion officer for the firm, put it succinctly: “Women’s ambition levels haven’t faltered, but they’re working harder and more and they are largely unrecognized for that,” Yee said. “If you imagine yourself in the shoes of a female executive, you’re thinking, ‘I’m working more, I’m unrecognized, I have no recovery time. Is this the best ROI of my time?’”

A concerning potential path forward is the question of how employers will handle continued working from home versus in-office work. The survey found that 90% of respondents of any gender wanted at least one day working from home weekly; women responded that they wanted three days of remote work.

“I do think we need to be really thoughtful about: Are we inadvertently creating two classes of employees? So employees that are in the office get more access to senior leaders,” Thomas said. “And then we’ve got another group of employees—who are disproportionately women—who don’t have that access.”

Not only does the report look at the percentages of women in upper levels of leadership, it also takes a hard focus on the experiences of women of color, LGBTQ+ women, women with disabilities, and other areas of diversity within the corporate workplace. Largely, it found that little to no progress has been made on representation for women of color.

“When you have almost 80% of white employees saying they see themselves as an ally, far less than half are confronting discrimination when they see it. Far less than a quarter are advocating for new opportunities for women of color or mentoring and sponsoring women of color. So we see this pretty big gap right now between intent and action when it comes to women of color,” said Thomas.

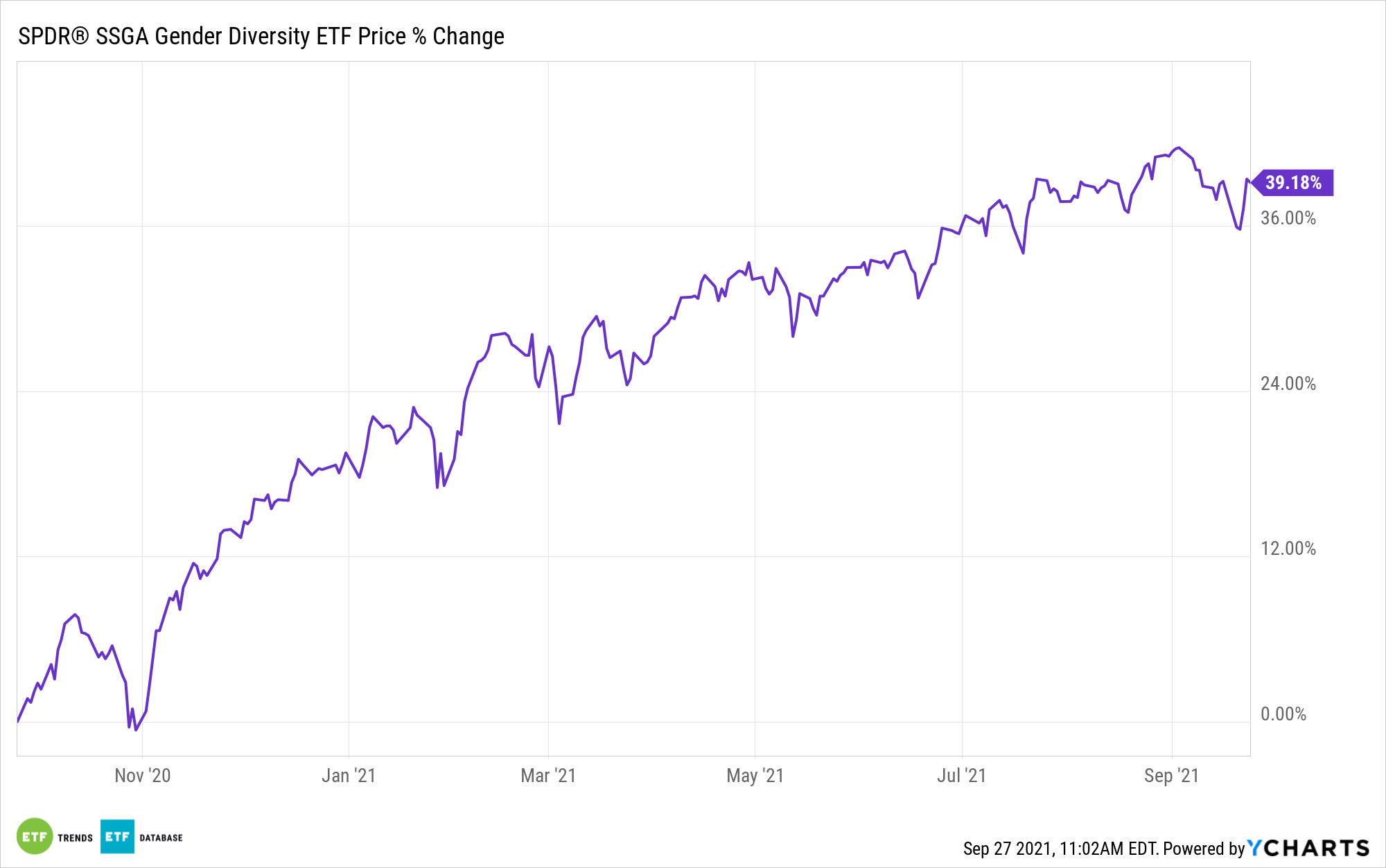

SPDR Invests in Gender Equity

State Street Global Advisors recognizes the importance of investing in a future that is more female by supporting companies that are practicing gender equity today. The SPDR SSGA Gender Diversity Index ETF (SHE) offers data-driven exposure to companies with the highest diversity amongst leadership positions within their industries.

SHE follows the SSGA Gender Diversity Index, an index that tracks large-cap U.S. companies exhibiting gender diversity within their senior leadership.

The benchmark pulls from the top 1,000 U.S. stocks by market capitalization, utilizing three different gender diversity screens to narrow down its selection universe.

These metrics include the ratio of female executives and female board of director members to all executives and all board of director members; the ratio of female executives versus all executives; and the ratio of female executives (excluding those on the board of directors) compared to the number of executives in total (again, excluding board members).

For the purposes of the index, “executives” are defined as any position in a company at the rank of Vice President or higher, or any position of Managing Director and above in a financial sector company.

According to their free-float market cap, the top-ranking 10% of companies within each sector are selected and weighted proportionally. Each stock has a maximum weight cap of 5%.

The top three sectors in SHE include information technology (33.42% of its portfolio), healthcare (12.11%), and consumer discretionary (11.97%).

Currently, the fund’s top three holdings include salesforce.com inc. at 5.18%, Walt Disney Company at 4.88% weight, and Visa at 4.79% weight.

SHE carries an expense ratio of 0.20%.

For more news, information, and strategy, visit the ESG Channel.