When it comes to inflation-fighting assets, equities are part of the equation, but when investors get tactical, this effort often centers around hard assets, such as energy companies, hard assets producers, and real estate investment trusts (REITs).

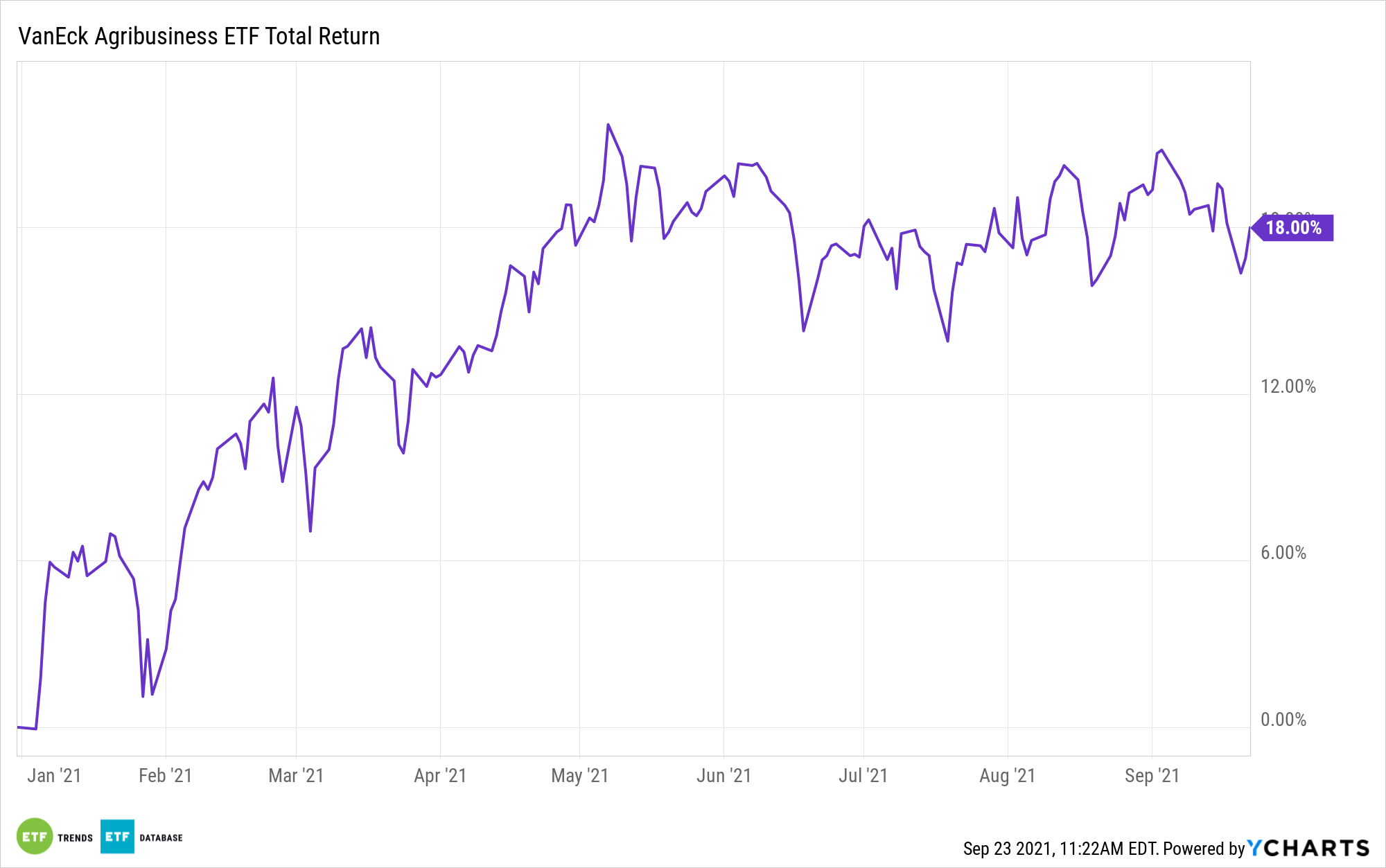

They might want to consider an equity-based approach to agriculture with the VanEck Vectors Agribusiness ETF (MOO) — the premier exchange traded fund in this category. Up about 18% year-to-date, MOO tracks the MVIS Global Agribusiness Index.

MOO’s index “is intended to track the overall performance of companies involved in: (i) agri-chemicals, animal health and fertilizers, seeds and traits, from farm/irrigation equipment and farm machinery, aquaculture and fishing, livestock, cultivation and plantations (including grain, oil palms, sugar cane, tobacco leafs, grapevines, etc.), and trading of agricultural products,” according to VanEck.

The $1.1 billion ETF holds 54 stocks, which is actually a fairly expansive lineup for a concept as nuanced as agribusiness equities. Nuanced or not, agribusiness stocks and agricultural commodities are highly relevant in today’s inflationary environment.

While the “core” Consumer Price Index’s (CPI) monthly reading out that investors hear so much about excludes food and energy prices due to the volatility associated with those prices, there’s no avoiding the fact that food prices are soaring around the world and hit the highest levels in a decade in June. That’s the very definition of inflation.

“Higher prices of agricultural commodities can also boost prices of nondurable goods such as bread and hamburgers. However, the commodity price index with the largest agricultural commodity weighting (CRB) also has the smallest correlation with changes in nondurable goods,” according to the Federal Reserve Bank of St. Louis.

The Fed research also notes that there are noticeable correlations between energy-intensive commodities prices, which includes agricultural commodities and services prices, meaning that when prices of the former increase, the latter often follow suit.

That’s impactful for investors considering MOO because the ETF mandates that its member firms derive at least half their sales from agribusiness pursuits.

Adding to the ETF’s allure is that it offers a surprising level of depth. It features exposure to agriculture machinery manufacturers and fertilizer producers, confirming deep reach into the farm ecosystem. Additionally, MOO, in quiet fashion, touches on another booming theme: animal healthcare. Several of its holdings operate in that universe, and it’s arguably an underappreciated, overlooked element in the MOO investment thesis.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.