The S&P 500 Technology Index is higher by 20.5% year-to-date, an encouraging sign for investors pondering the fate of tech stocks into year-end.

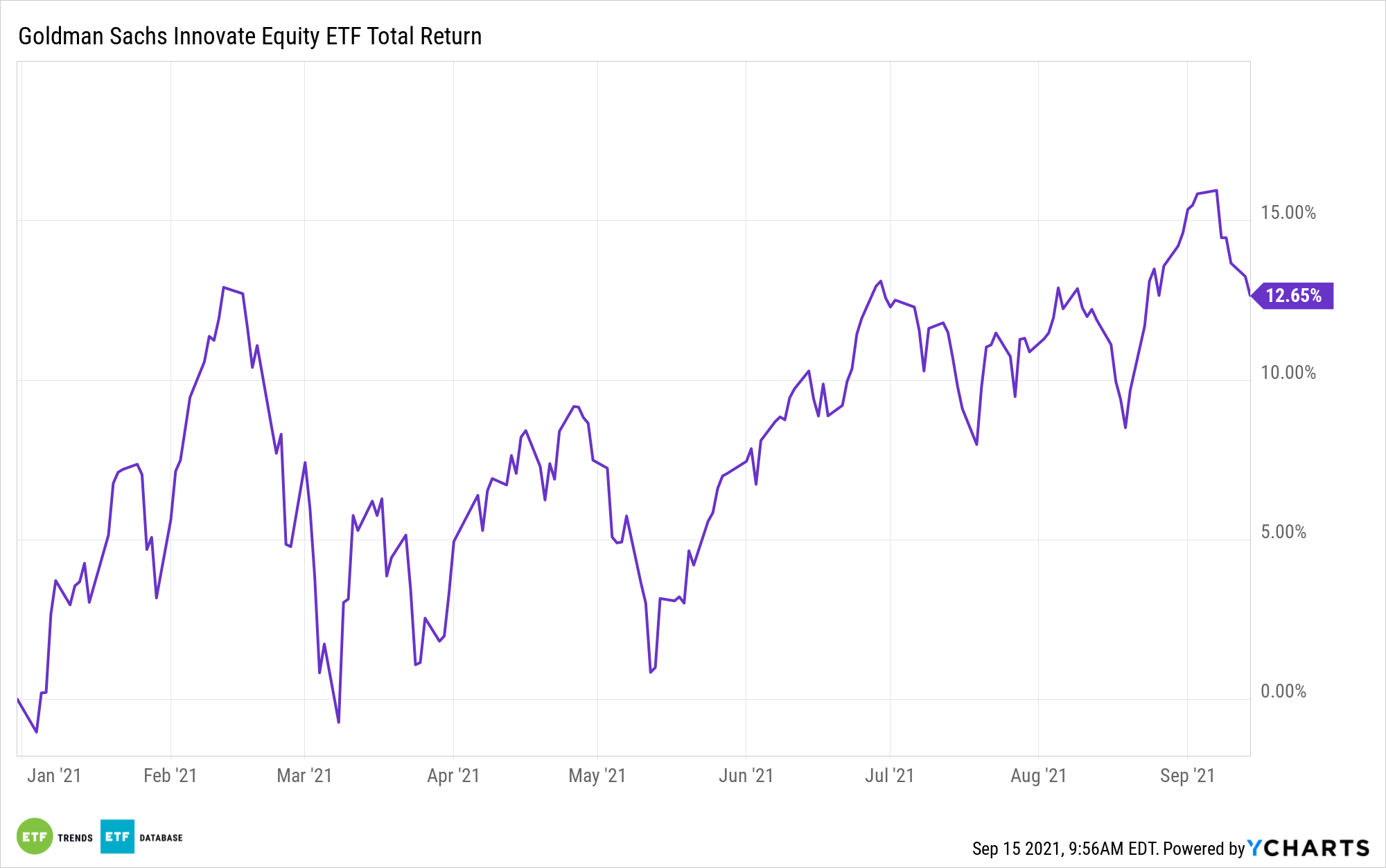

With the fourth quarter just a couple of weeks away, it’s a relevant consideration. For investors that want some technology exposure in disruptive growth form without going all in on the sector, the Goldman Sachs Innovate Equity ETF (GINN) is a credible idea to evaluate.

GINN tracks the Solactive Innovative Global Equity Index and allocates 33.4% of its weight to tech stocks, or 540 basis points more than the S&P 500 allocates to that sector. By way of its software holdings, GINN may have some momentum into year-end. In a note to clients on Monday, Goldman Sachs analysts spoke bullishly on software names.

“We enter the Fall incrementally more positive on the Software industry given an increasingly strong demand environment and improving fundamentals,” said the Goldman analysts. “We see a supportive set-up for software stocks in the near-term.”

Dow component Microsoft (NASDAQ:MSFT), GINN’s fifth-largest holding, is one of the software names that Goldman analysts are enthusiastic about.

Microsoft could potentially “double its $60 billion cloud business, which includes Office 365 and LinkedIn’s commercial arm. The company said it would raise prices for some Office365 subscriptions last month,” reports Lucy Handey for CNBC, citing the Goldman note.

Adobe (NASDAQ:ADBE) and cloud computing juggernaut Salesforce.com (NYSE:CRM), also a Dow component, are among the other software names Goldman likes. Both are members of GINN’s roster.

Salesforce’s “robust and strategically built product portfolio spanning sales, service, marketing, ecommerce, analytics, artificial intelligence, customer applications, integration and collaboration covers virtually all aspects of Digital Transformation,” according to Goldman.

Should the bullish views on software stocks prove accurate, GINN stands to benefit, but it has other avenues to generate upside in the fourth quarter. For example, it has ties to a possible rebound in consumer confidence via its fintech and consumer discretionary exposures.

Likewise, the disruptive growth corner of the healthcare sector, GINN’s second-largest sector weight, is scuffling this year, but many on Wall Street don’t think that this condition will last as valuation on normally pricey innovative healthcare names are starting to look attractive.

Additionally, some analysts are bullish on mega-cap internet stocks, which could be a boon for GINN and its 13.4% weight to the communication services sector. Alphabet (NASDAQ:GOOG) and Facebook (NASDAQ:FB) are two of GINN’s top three holdings.

For more news, information, and strategy, visit the Future ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.