The carbon emissions market is growing as more participants buy and sell their excess carbon emissions allowances, creating a potential opportunity for traders to get in the middle of those transactions through a thematic exchange traded fund strategy.

Big carbon emitters like steel producers receive emission allowances and can acquire more to stay under tougher emissions guidelines. Meanwhile, companies that fall below those carbon emission limits can sell their excess carbon emissions allowances on the open market.

This new market for carbon emissions has created an opportunity for traders seeking to profit from moves in the price of carbon and sometimes even bet on the direction of prices, the Wall Street Journal reports.

According to data provider Refinitiv Holdings Ltd, the world’s carbon markets, which cover Europe and smaller markets in places like California and New Zealand, expanded 23% last year to €238 billion, or $281 billion.

While this nascent market remains small compared to some of the world’s more developed multi-trillion dollar markets, industry experts argue that there is growth potential. Wood Mackenzie, an energy consulting firm, calculated that global carbon market could grow to $22 trillion by 2050.

Initial signs of growth are already showing. For example, the European Union revealed plans to expand its market. China has even started its own limited trading system based on carbon trading. The Biden administration also likes putting a price on carbon, but the U.S. remains far behind other economies in coming up with a standardized plan.

Looking ahead, the value of the carbon market is projected to exceed the oil market’s value by 2030, or even as soon as 2025 if more immediate action is taken and regulations are enacted, according to former oil trader Hannah Hauman, who leads Trafigura’s carbon desk.

However, some warn that the market is hard to price due to the loose standards since there are no clearly defined rules on cross-border trading.

“The problem is defining what are high-quality carbon credits,” Chris Leeds, head of carbon-markets development at Standard Chartered PLC, told the WSJ.

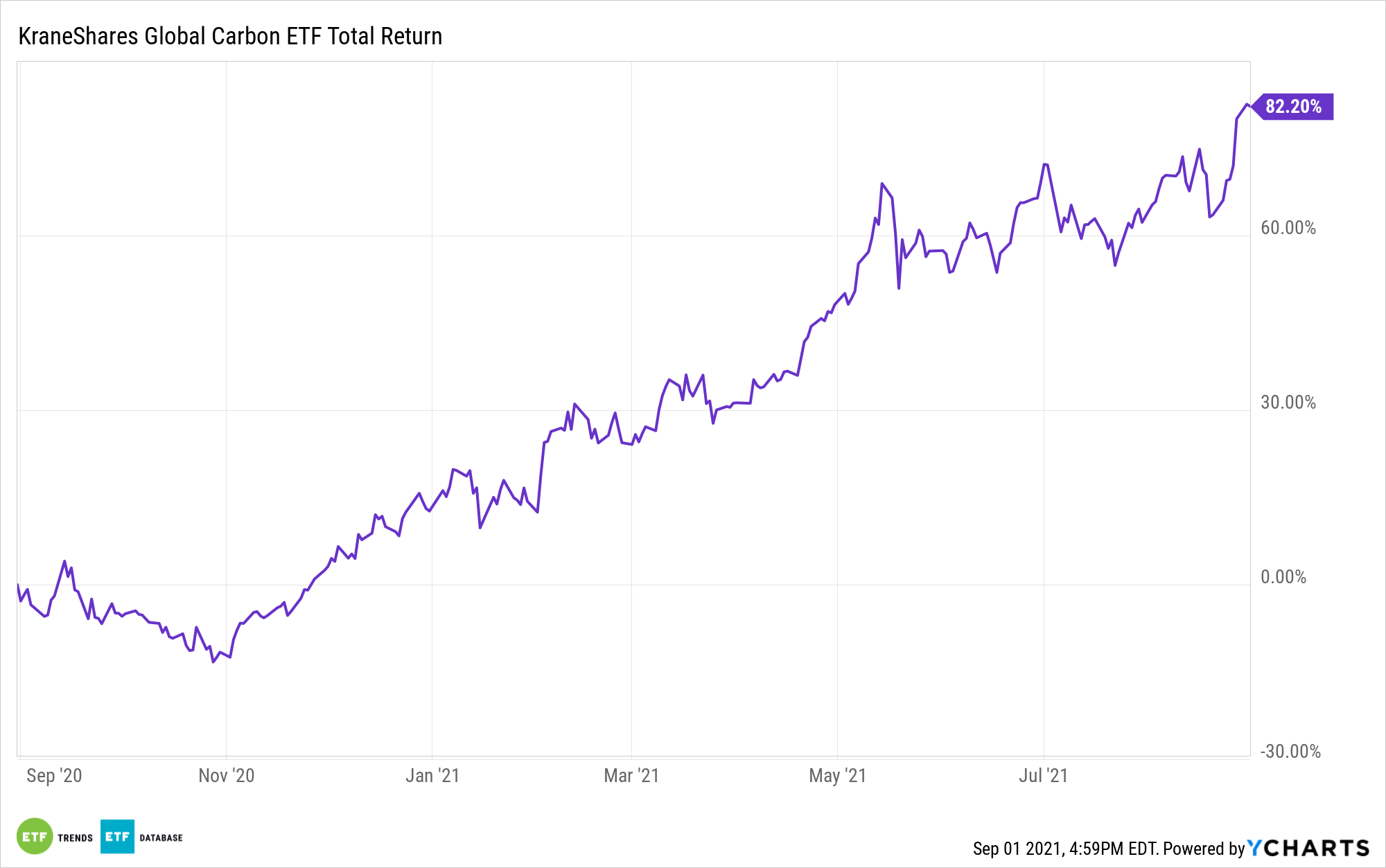

As a way to gain exposure to this growing opportunity, the KraneShares Global Carbon ETF (KRBN) can help investors access the carbon allowances futures market.

KRBN tries to reflect the performance of the IHS Markit’s Global Carbon Index, which offers broad coverage of cap-and-trade carbon allowances by tracking the most-traded carbon credit futures contracts. The index introduces a measure for hedging risk and going long for carbon prices while supporting responsible investing. Currently, the index covers the major European and North American cap-and-trade programs: European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gas Initiative (RGGI).

For more news, information, and strategy, visit ETF Trends.