All indexes tracked by passive exchange traded funds rebalance at some point during the year, some more frequently than others.

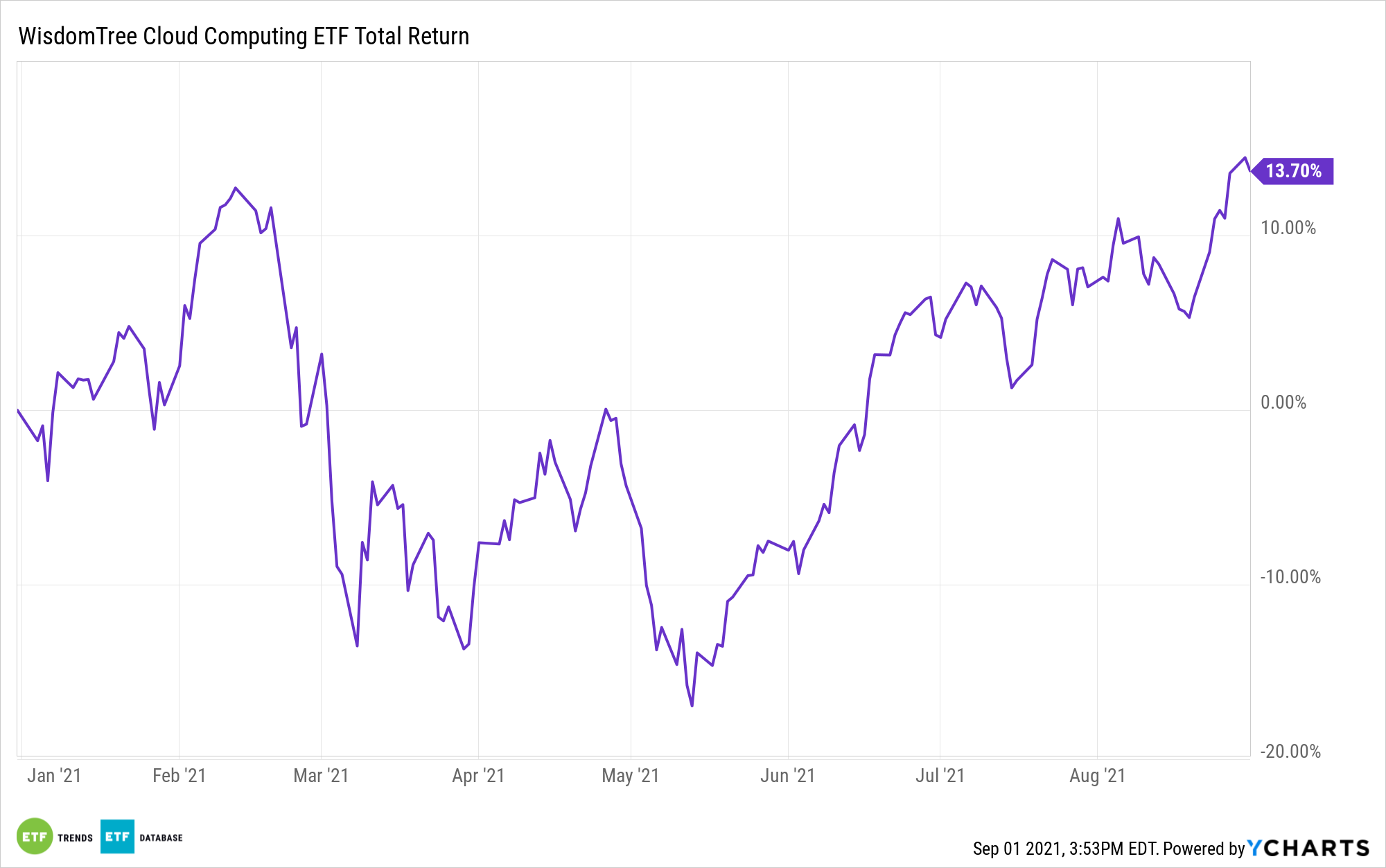

Usually, a rebalancing isn’t big news nor is it noteworthy to investors. There are, however, instances when the opposite is true. Take the example of the popular WisdomTree Cloud Computing Fund (WCLD). WCLD tracks the BVP Nasdaq Emerging Cloud Index, which recently underwent its semi-annual review and rebalance.

This is an example of a notable rebalance because WCLD’s newly configured lineup provides more exposure to two prominent cloud computing themes: initial public offerings (IPOs) and mergers and acquisitions activity. New additions to WCLD are UiPath, Inc., C3.ai, Inc., and Qualtrics International.

“The most recent IPO addition from April 2021 was UiPath, a company focused on automating business processes across various departments of an enterprise,” says WisdomTree analyst Kara Marciscano. “More specifically, UiPath’s software platform uses artificial intelligence (AI) to perform tasks like logging into applications, extracting information from documents, moving folders, filling in forms and updating information fields and databases.”

C3.ai is another example of recent cloud IPO, having gone public only last December. That new WCLD component is also another example of the cloud intersecting with other disruptive technologies because the company provides software that enables companies to develop and scale AI applications.

“C3.ai offers customers the ability to build customized enterprise AI applications, as well as families of turnkey AI applications that target various industry verticals, like financial services, manufacturing, utilities, oil and gas, and aerospace and defense,” according to Marciscano.

Regarding mergers and acquisitions, those are the primary reasons behind WCLD’s recent deletions because the removed companies were acquired. In other words, WCLD is showing some tendency to be a hotbed of consolidation activity, and that’s a positive for investors. Indeed, that’s been the case since the $1.37 billion ETF debuted two years ago.

“Similar to February 2021, all of the drops from WCLD are pending acquisition targets. It is especially reassuring that the removals are not because of failures to meet growth requirements, but instead because these businesses are attractive takeover candidates. This brings the tally to 16 companies held within WCLD that have been acquired or are pending acquisitions at premium deal multiples,” adds Marciscano.

Bottom line: Cloud computing is a rapidly evolving industry, and WCLD is ideally positioned to capitalize on that evolution, perhaps more so than rival cloud ETFs.

“The private and public cloud markets are fast-moving, and WCLD’s semi-annual rebalance allows the Fund to refresh its constituents and weights for the latest developments,” concludes Marciscano.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.