Advisors are on the receiving end of an ever increasing number of requests from their clients interested in ESG (Environmental, Social, and Governance) and Socially Responsible Investing (SRI). ESG and SRI investing can no longer be considered a fad, it is here to stay. However, the ESG investment landscape can be confusing, and it may not be obvious where to begin or how to provide reliable investment solutions to clients. By blending a tactical, global multi-asset approach alongside ESG-focused investing, Advisors and their clients can meet their investment objectives and invest for the greater good.

In the past, it wasn’t easy to invest in a manner that could generate returns and provide a positive impact on the environment and society. For one thing, attempting to create a portfolio of individual stocks of companies that could be considered ESG-focused took an enormous amount of work and capital. In addition, the performance of more ESG-focused investments didn’t seem to keep up with the overall market. However, over time, the market for ESG-fo-cused Exchange Traded Funds (ETFs) has shown steady growth and deep maturity, helping to bring ESG investing into the mainstream. While an ETF may seem like a blunt object to gain a specific ESG focus, ETFs typically embody improvements in many if not all ESG categories when compared against their parent non-ESG index.

ESG Investing Methodology

At 3EDGE, we have derived a methodol-ogy to evaluate and select ESG ETFs for use in our tactical ESG suite of offerings. 3EDGE ESG solutions provide the same time-tested, tactical approach as other 3EDGE investment solutions — actively adjusting client portfolios between risk-on and risk-off, depending on our mar-ket outlook. We also monitor the ESG scores of the ETFs that we use in our strategies to enable investing in compa-nies that are socially responsible, inclu-sive, and focused on sustainability. The 3EDGE ESG Strategy and the ESG Ag-gressive Strategy allow investors to put their capital to work in a way consistent with their values and with the confidence that they are working with a firm that is a recognized leader in creating tactical, multi-asset portfolios.

The 3EDGE Approach to Sustainable, Impact Investing

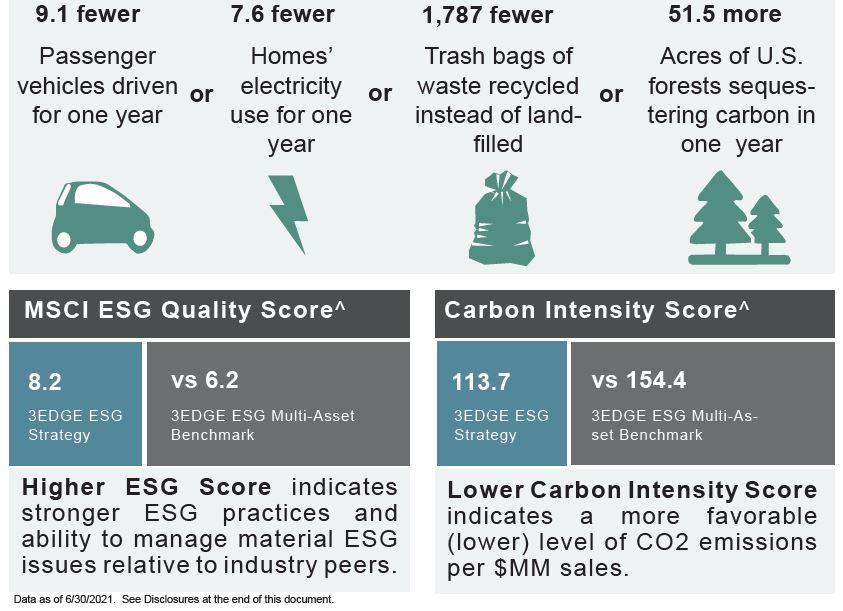

3EDGE’s ESG strategies seek to generate both an attractive risk-adjusted re-turn as well as a positive, long-term impact on society, the environment, and the behavior of businesses. The 3EDGE ESG strategies also place an added emphasis on reducing the world’s carbon footprint by investing in ETFs with lower weighted average carbon intensity measured in tons of carbon dioxide produced per million dollars in sales.

In constructing the ESG portfolios, the 3EDGE investment committee ana-lyzes ESG-focused index ETFs utilizing rankings established by third-party data providers such as MSCI. Increased and improved data from individual companies and better research and analytics capabilities now provide more robust, quantitative, objective, and financially relevant information on ESG issues important to investors. An ETF’s ESG score represents a balance among the aggregate of each company’s environmental, social, and gover-nance scores. The 3EDGE ESG strategies seek ETFs with the highest over-all ESG score combined with the lowest/smallest carbon footprint measured as the weighted average tons of carbon dioxide emitted by each company per million dollars of sales.

A hypothetical investment of $500,000^ in the 3EDGE ESG Strat-egy represents an approximate annual decrease of 42 tons of car-bon dioxide equivalents compared to the 3EDGE ESG Multi-Asset Benchmark representing a 27% decrease. This decrease is roughly equivalent to:

The 3EDGE ESG strategies provide investors access to tactically managed, broadly diversified portfolios of ESG-focused ETFs that seek attractive risk-ad-justed returns over full market cycles while also having a meaningful positive impact on Environmental, Social and Governance issues. A clear advantage of the 3EDGE tactical approach to ESG investing is that it provides Advisors and their clients with a transparent, simple and straightforward solution to a rapidly growing area of client interest. That is a potential win-win for Advisors and their clients as ESG investing continues to gain traction among individual investors.

About 3EDGE

3EDGE Asset Management, LP, is a multi-asset investment management firm serving institutional investors, the advisor marketplace and private clients. 3EDGE strategies act as tactical diversifiers, seeking to generate consistent, long-term investment returns, regardless of market conditions, while seeking to manage downside risks.

The primary investment vehicles utilized in portfolio construction are index Exchange Traded Funds (ETFs). The investment research process is driven by the firm’s proprietary global capital markets model. The model is tested over the widest variety of economic and market conditions and translates de-cades of research and investment experience into a system of causal rules and algorithms to describe global capital market behavior. 3EDGE offers a full suite of solutions, each with a target rate of return and risk parameters, to seek to meet investors’ different objectives. Of course, investing involves risks and the potential loss of your investment. There is no guarantee that any target return will be achieved.

Contact 3EDGE Phone: 844.903.3343

Website: 3edgeam.com

DISCLOSURES:

^The MSCI ESG Rating measures the resiliency of portfolios to long-term ESG risks and opportunities. The most highly rated portfolios consist of issuers with leading or improving management of key ESG risks. The ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC), and are a direct mapping of ESG Quality Scores. The MSCI ESG Quality Score measures the ability of underlying holdings to manage key medium- to long-term risks and opportunities arising from environmental, social and governance factors. A portfolio’s Weighted Average Carbon Intensity is achieved by calculating the carbon intensity (Greenhouse Gas Emissions / $M Sales) for each portfolio company and calculating the weighted average by portfolio weight. Source: ETFdb.com and ETF.com. Strategy Rating, Carbon Dioxide emission equiv-alents table, MSCI ESG Quality score and Carbon Intensity score are calculated for the Strategy holdings as of 6/30/2021. For more on MSCI ESG Ratings https://www.msci.com/our-solutions/esg-investing/esg-ratings. Hypothetical portfolio equiv-alent emissions reduction figures were estimated using the Environmental Protection Agency (EPA) Greenhouse Gas Equiv-alency Calculator (https://www.epa.gov/energy/green¬house-gas-equivalencies-calculator). The 3EDGE ESG Multi-Asset benchmark is 45% Financial Times Stock Exchange World Government Bond Index WGBI/ 45% Morgan Stanley Capital International All Country World Index MSCI ACWI TR / 10% Bloomberg Commodity Total Return Index BCOMTR.

This paper is provided to current and prospective clients of the 3EDGE ESG Strategies for informational purposes only. It does not constitute an offer to buy or sell any security. The information provided is not intended to provide personal invest-ment advice and does not consider the investment objectives and financial resources of the recipient. Investments in secu-rities, including common stock, fixed income, commodities, ETNs and ETFs involve the risk of loss that investors should be prepared to bear. Past performance is not indicative of future results.