As has been widely noted over the past 18 months, the coronavirus pandemic has accelerated dramatic shifts in a myriad of sectors and industries.

One of the obvious members of that group is healthcare. While many limit that theme to vaccine development, broader healthcare innovation is taking off in notable fashion, putting the spotlight on an array of related investment opportunities, including the WisdomTree BioRevolution Fund (WDNA).

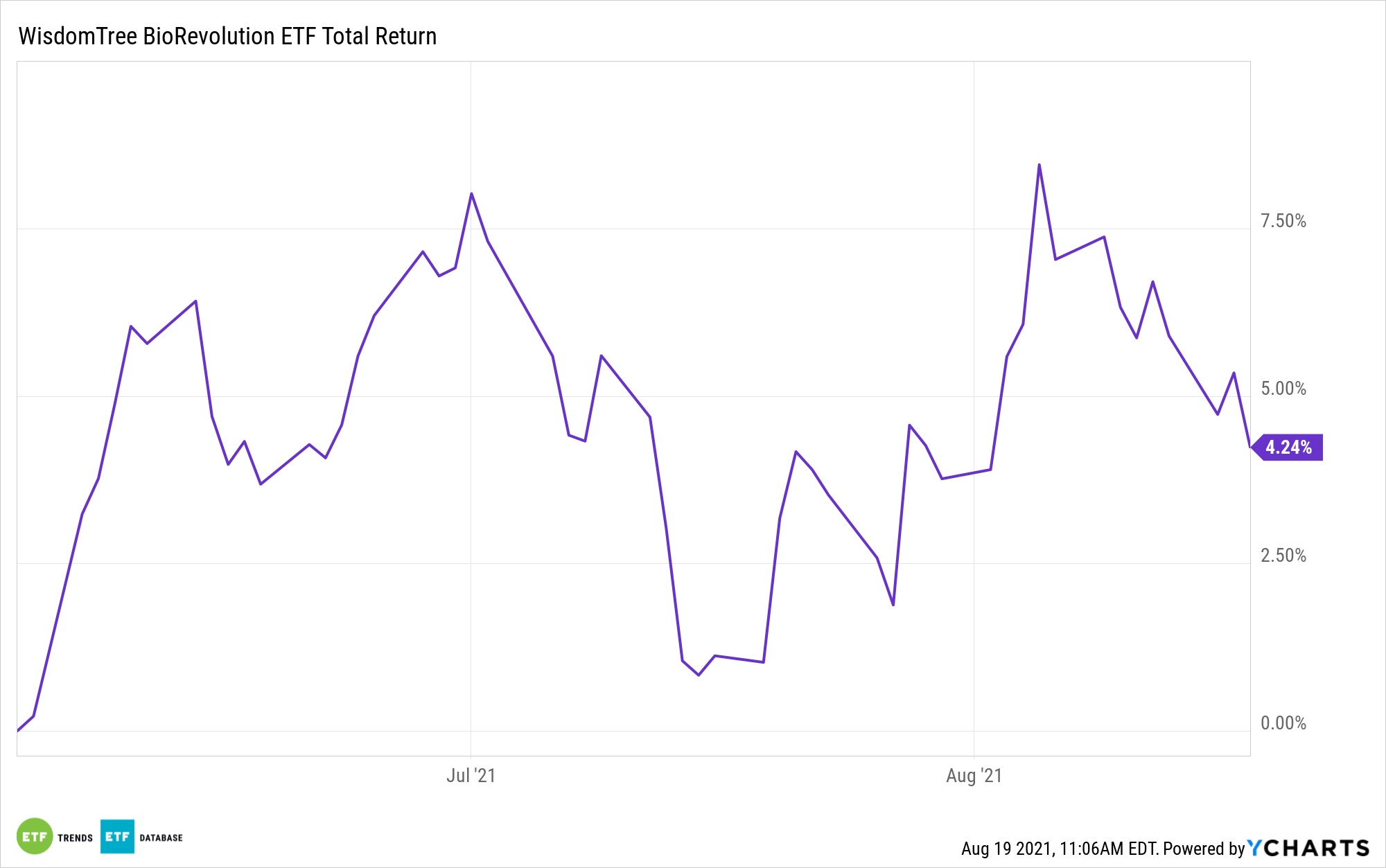

WDNA, which tracks the WisdomTree BioRevolution Index (WTDNA), debuted in June. While the vaccine factor is priced into an array of biotech and genomics companies, WDNA doesn’t lack for near- or long-term catalysts, underscoring the potency of investors taking a patient view of the healthcare innovation thesis.

“If any good at all is to come of the pandemic, it is already being seen in the rapid and innovative response of the healthcare and medical technology world to a profound and urgent need. Stretching far beyond the development of effective vaccines, this response offers enormous investment potential,” according to BNP Paribas research.

As its name implies, WDNA focuses on biotechnology and genomics stocks – two primary drivers of innovation in the healthcare arena. In fact, given the intersection of new-breed healthcare companies with disruptive technologies, healthcare is arguably one of the most tech-centric sectors outside of tech itself.

“Medical technology is characterised by constant innovation. In 2019, nearly 14 000 patent applications were filed with the European Patent Office (EPO) in the field of medical technology, more than in any other technical field. In Europe, there are more than 32 000 medical technology companies, employing some 730 000 people,” adds BNP Paribas.

WDNA has some ties to Europe’s healthcare innovation revolution, as nearly all of the ETF’s non-U.S. exposure, save for a small weight to Japan, centers around Europe.

There are nearly two dozen biotechnology and genomics ETFs on the market today, indicating rookie funds in this space, like WDNA, need to have avenues for separating themselves from older rivals.

“WDNA separates from the pack is its reach beyond the healthcare sector. Typically, investors view genomics and DNA sequencing equities as solely members of the healthcare sector. However, this disruptive segment has implications beyond healthcare and intersects with industries investors may not readily associate with genomics, including agriculture, chemicals and materials,” according to Nasdaq.

The fund also has a holdings-level diversification card as none of its components have weights exceeding 1.83% and its top 10 holdings combine for just 15.57%, confirming single-stock risk is minimal in the ETF.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.