How consumers pay for goods was changing long before the coronavirus pandemic, but the global health crisis has accelerated the growth of fintech.

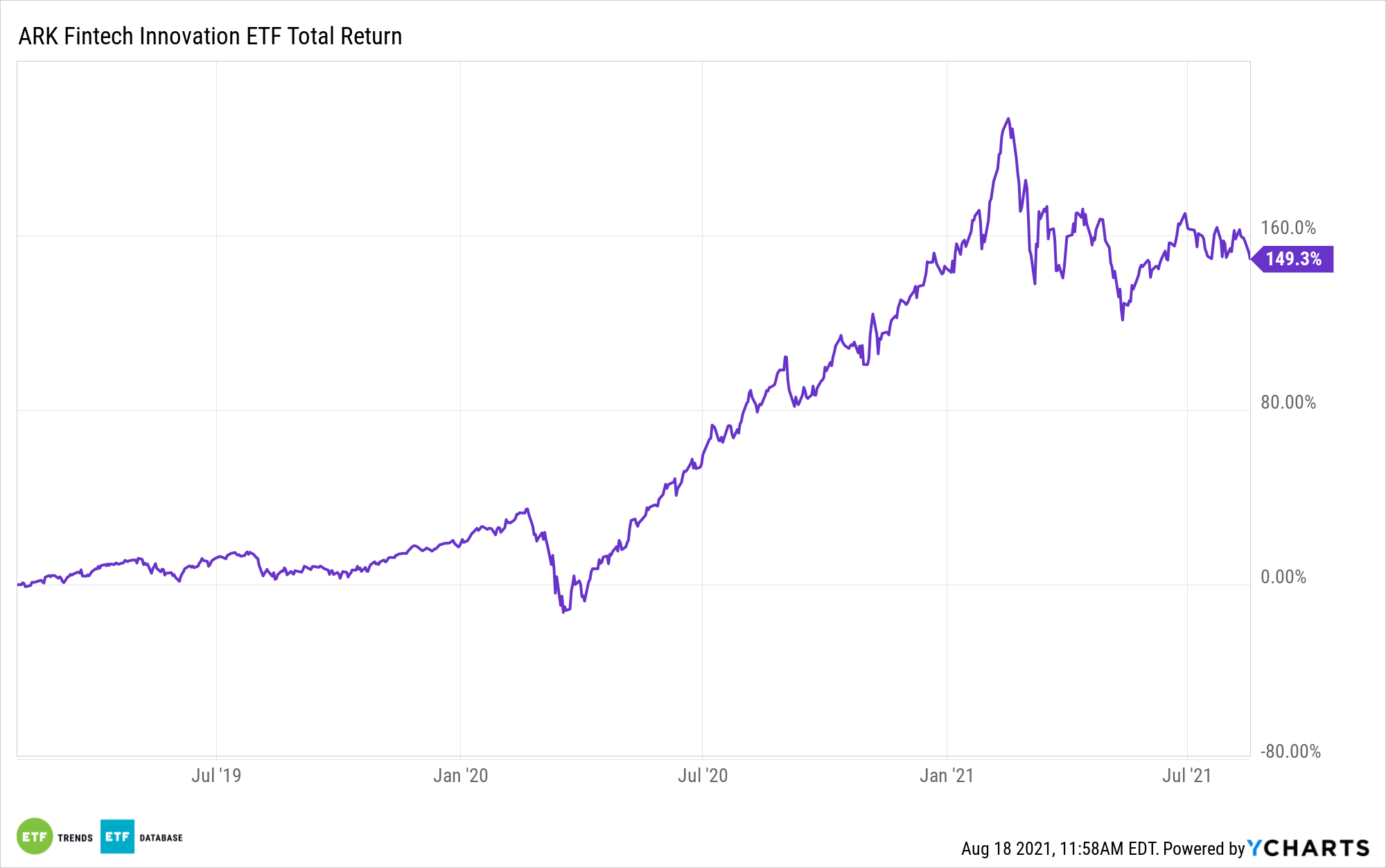

That’s one reason why the ARK Fintech Innovation ETF (NYSEARCA: ARKF) is up almost 41% over the past 12 months. Obviously, that’s past performance and is not guaranteed to repeat, but what isn’t up for debate is ARKF’s status as an exchange traded fund at the forefront of a payments revolution – one that’s shaping up to be durable and sustainable.

“The power dynamics in the payments industry are changing as businesses and consumers shift dollars from cash and checks to digital payment methods. Cards dominate the in-store retail channel, but mobile wallets like Apple Pay are seeing a rapid uptick in usage and paving the way for the future of payments,” according to Insider Intelligence.

Apple (NASDAQ: AAPL) isn’t one of ARKF’s holdings, but the fund is actively managed, so that could change and ARKF does have a small allocation to Alphabet (NASDAQ: GOOG), the purveyor of the Google Pay digital payments platform.

Additionally, digital wallets are increasingly prominent parts of the peer-to-peer payments landscape. ARKF taps into that trend in earnest by way of a combined 16% weight to Square (NYSE: SQ) and PayPal (NASDAQ: PYPL), the companies behind the popular Cash App and Venmo digital wallets.

The use of digital wallets has increased exponentially against the backdrop of the coronavirus pandemic. Yet the long-term thesis for this fintech segment is also sturdy.

“The digitization of payments isn’t just contained to retail, though, with real time mobile P2P payments, digital remittances, and digital business payments continuing to blossom as change spreads through the ecosystem. Mobile proximity payment volume accelerated to $131.36 billion,” adds Insider Intelligence.

Predictably, online shopping is fertile territory for some ARKF holdings too.

“At the same time, e-commerce will chip away at brick-and-mortar retail as smartphones attract a rising share of digital shopping. Digital peer-to-peer (P2P) apps are supplanting cash in the day-to-day lives of users across generations as they become more appealing and useful than ever,” continues Insider Intelligence.

ARKF holdings levered to that theme include Shopify (NYSE: SHOP), Facebook (NASDAQ: FB), and Amazon (NASDAQ: AMZN), among others. That trio combines for about 10% of the ARK fund’s weight.

The $4 billion ARKF usually holds 35 to 55 stocks and charges 0.75% per year.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.