Single-country opportunities can inject a healthy dose of diversification into a portfolio. Two funds to consider in today’s markets include the Global X FTSE Nordic Region ETF (GXF) and the Global X MSCI Argentina ETF (ARGT).

Both funds were strong performers in the second quarter.

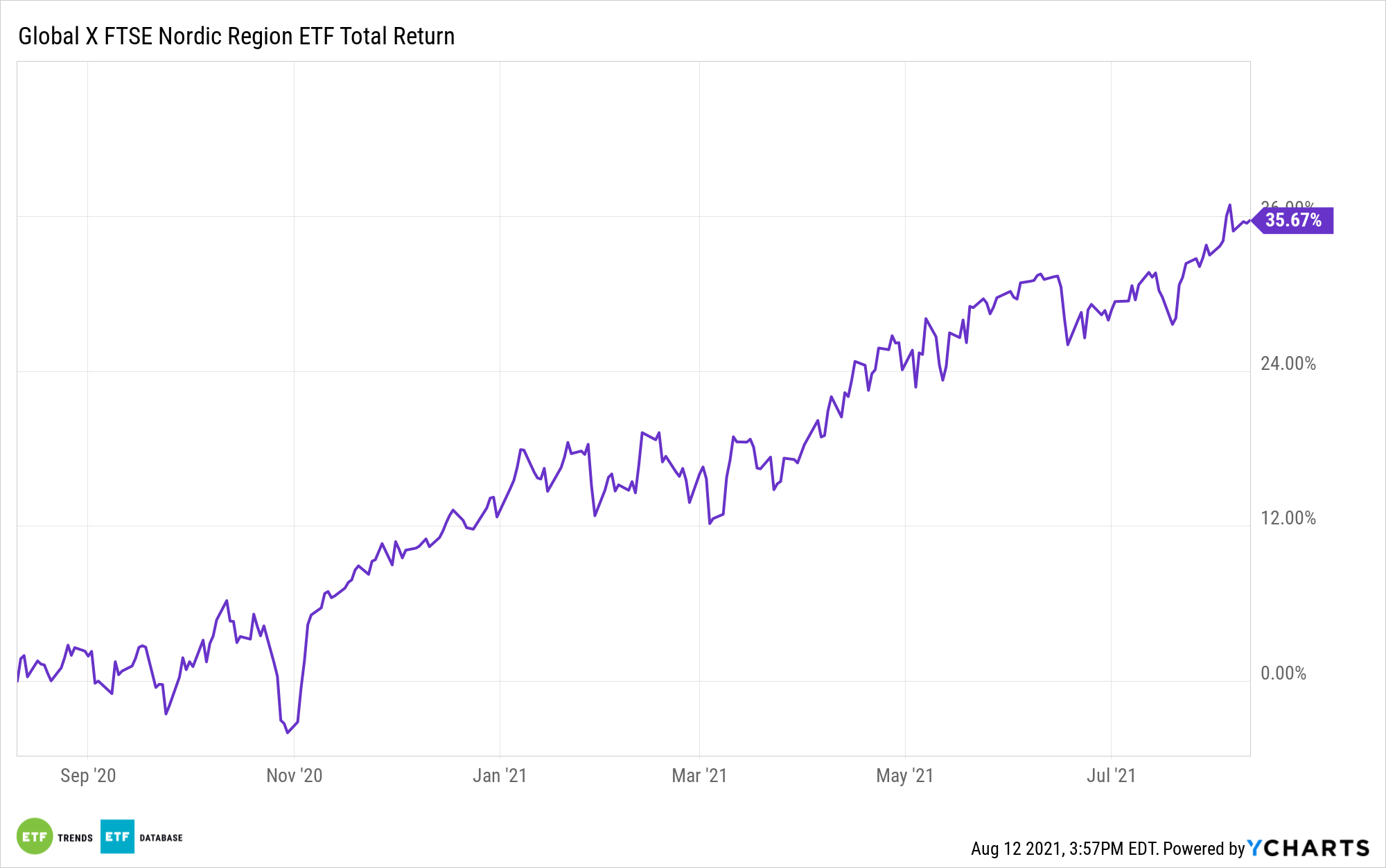

“The Global X FTSE Nordic Region ETF (GXF) was the top performer in Q2, with returns of 9.01%,” a Global X report noted. “These returns were supported by a stronger than expected macroeconomic recovery in the Nordic region. 2021 GDP growth estimates for Sweden, Denmark and Norway were all revised upwards in Q2.”

“Overall, attitudes toward the economy in the Nordic region have become much more optimistic compared to 2020; 86% of people in Sweden and 69% of people in the Netherlands believe their country’s economic situation is good in 2021, compared to 29% in the US, 26% in France, 44% in the UK and 60% in Germany,” the report added.

GXF seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the FTSE Nordic 30 Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) based on the securities in the underlying index.

Don’t Cry for This ETF, Argentina

Argentina was the second-best performer for Global X’s geographic ETFs. ARGT responded to the upside as investors returned to emerging market opportunities after shying away from them at the height of the pandemic in 2020.

“The second top performer of Q2 was the Global X MSCI Argentina ETF (ARGT), which posted gains of 7.73%,” the Global X report said. “After three years of recession, including a precipitous decline of -9.96% in 2020, Argentina is expected to achieve a growth rate of 5.84% in 2021.3 This can partly be attributed to rising agricultural commodity prices, which Argentina should benefit from because it is the largest exporter of soy products.”

ARGT seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Argentina 25/50 Index. The underlying index is designed to represent the performance of the broad Argentina equity universe, while including a minimum number of constituents.

For more news and information, visit the Thematic Investing Channel.