Although roughly 60% of the S&P 500 has delivered earnings updates for the June quarter, there are still some marquee reports coming this week.

That’s particularly true for investors in the VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO), as a broad swath of the exchange traded fund’s video game publisher holdings step into the earnings confessional this week.

Activision Blizzard (NASDAQ: ATVI) and Electronic Arts (NASDAQ: EA) are among the big-name video game software companies reporting results this week. That duo combines for nearly 10% of ESPO’s roster, according to issuer data.

With Activision, EPSO’s seventh-largest holding, “expect a steady-as-she-goes quarter when Activision (ATVI) reports its second-quarter results after the closing bell Tuesday. No huge launches, and the steady drumbeat of profit from Call of Duty and other franchises will likely drive its estimated earnings of 75 cents on an adjusted bases, and bookings of $1.9 billion,” reports Max Cherney for Barron’s.

Electronic Arts, ESPO’s ninth-largest component, reports earnings on Wednesday. Analysts expect earnings per share of 62 cents on bookings of $1.3 billion.

Reaction to EA’s report may not center around its June quarter results as much as it does on the company’s outlook for the back half of the year. EA is slated to release Battlefield 2042 and FIFA 22 in October.

With the new hardware cycle having taken place late last year, ESPO and rival funds could find much-needed catalysts from software releases, particularly those that are new installments of popular franchises.

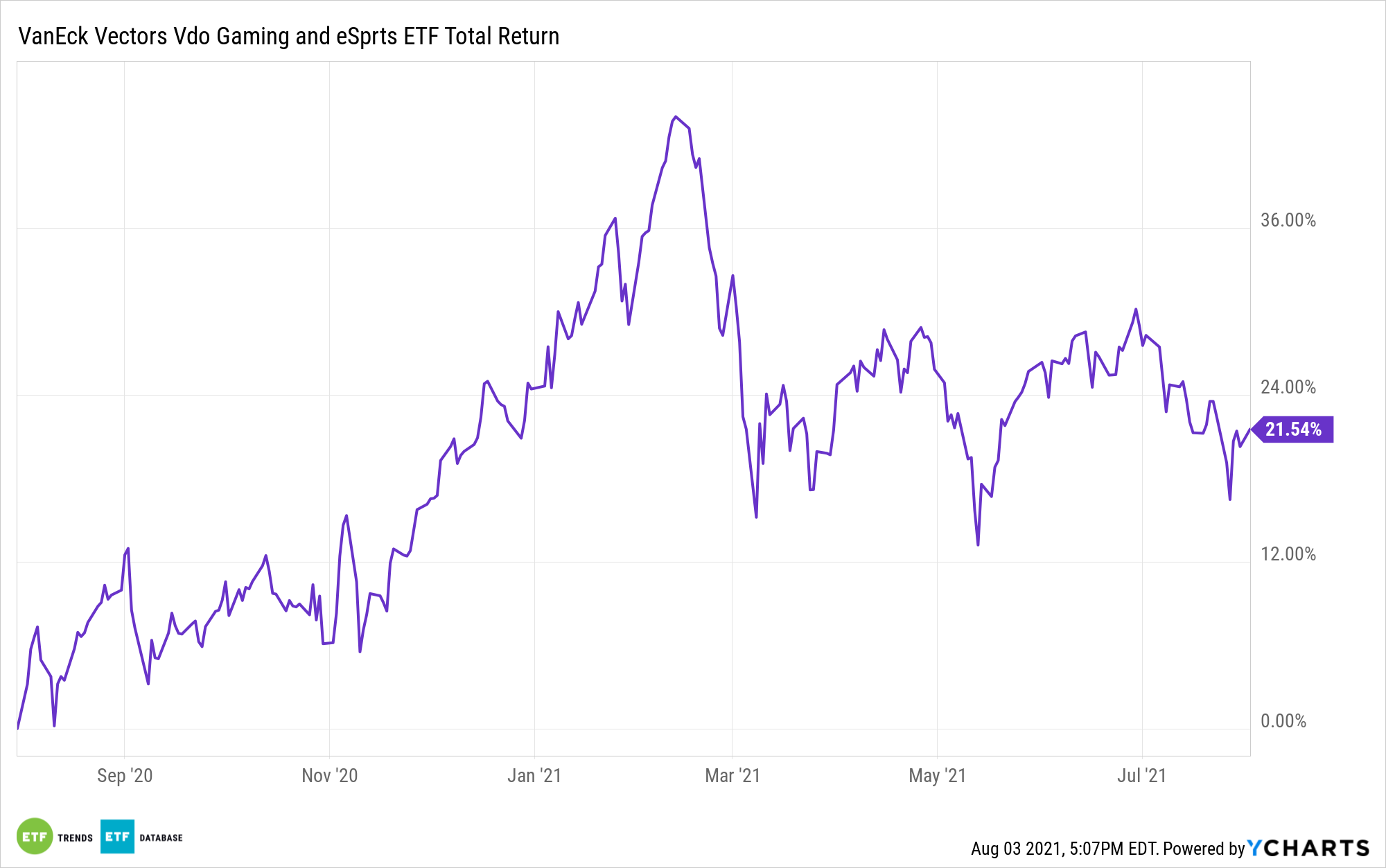

That could prove pivotal for ESPO’s publisher holdings because after video game equities surged last year because of coronavirus-induced stay-at-home directives, some analysts and investors fretted the group was due for a pullback this year.

“We currently see ‘return to normalcy’ risks and valuation risks for video game companies, but we believe supportive long-term trends are still in place around consumer demand for interactive digital entertainment, cord-cutting and demographics,” according to VanEck.

On that note, while many politicians say they are loathe to revisit the shutdown model of 2020, the delta variant of the coronavirus may be a drag on the reopening trade and could prompt folks to revisit some of last year’s beloved stay-at-home entertainment options, including streaming and video games.

For more news and information, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.