China tech giants Alibaba Holding Ltd. (BABA) and Tencent Holding Ltd. are looking at individual concessions that would allow consumers to utilize the services in tandem, reports the Wall Street Journal.

Recent crackdowns by China’s State Administration for Market Regulation saw Alibaba fined $2.8 billion for exclusionary practices, amid a greater targeting of tech giants by Beijing.

Alibaba and Tencent are looking at slowly making their services available to one another’s users. Current restrictions prevent customers from actions such as paying for an item on Alibaba’s platform utilizing Tencent’s payment system.

The rivalry has also has created deep divisions within China’s consumer internet sector, as companies large and small align with one camp or the other.

Alibaba’s side includes financial affiliate Ant Group Co., as well as firms owned by Alibaba, such as Ele.me, a food delivery service. Firms on the Tencent side include investee companies such as JD.com, Pinduoduo Inc, and Meituan. As a result, China has begun to crack down on antitrust violations.

Currently, Alibaba is rumored to be looking at changes that would allow Tencent’s WeChat Pay on the Alibaba e-commerce platform Taobao and Tmall, while Tencent may be considering changes that would allow Alibaba e-commerce listings to be shared easier on the WeChat messaging app, as well as allowing some Alibaba services to be accessible via mini-programs (light apps embedded within the WeChat central app).

KWEB: Bridging Both Worlds

In this vein, the entire online industry in China stands to grow and change, making way for more platforms and creating great margins for profit.

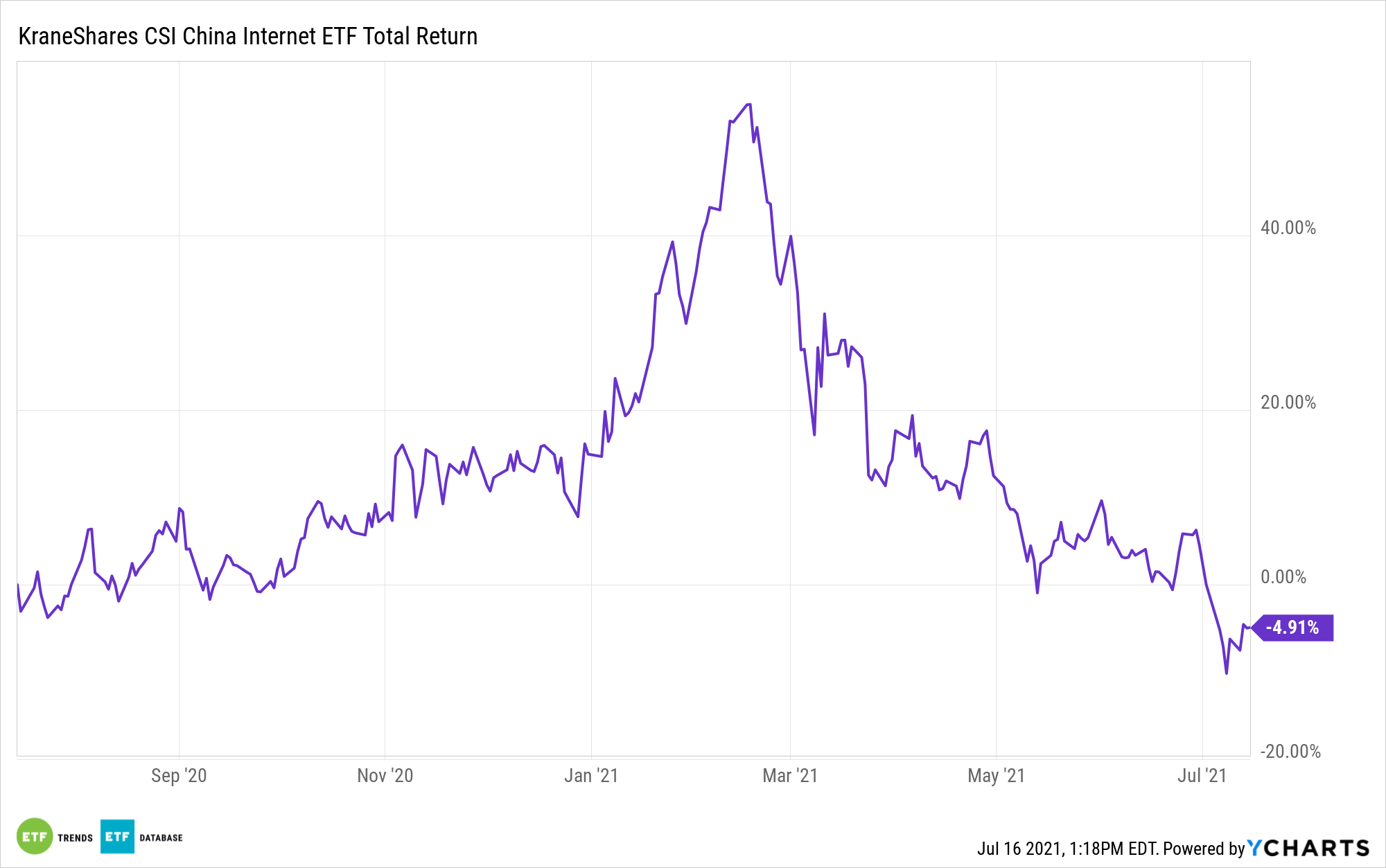

The KraneShares CSI China Internet ETF (KWEB) tracks the CSI Overseas China Internet Index and measures the performance of publicly-traded companies outside of mainland China that operate within China’s internet and internet-related sectors. This includes companies that develop and market internet software and services, provide retail or commercial services via the internet, develop and market mobile software, and manufacture entertainment and educational software for home use.

KWEB provides exposure to the Chinese internet equivalents of Google, Facebook, Amazon, eBay, and the like, all companies that benefit from a growing user base within China, as well as a growing middle class.

China has reported that there are nearly 1 billion internet users in the country as of the end of 2020, according to CNBC.

KWEB’s top 3 holdings include Tencent Holdings Ltd at 10.21%, Alibaba Group at 9.17%, and Meituan at 7.8%.

The ETF has an operating expense of 0.73%.

For more news, information, and strategy, visit the China Insights Channel.