At first, Ryan Krueger doesn’t come off as particularly revolutionary. The co-founder and CEO of Houston, TX-based Freedom Day Solutions is so unfailingly polite that you almost don’t notice when he says things like, “the retirement planning business needs to be turned upside down.”

But that’s exactly what the strategy underpinning his firm’s new fund, the Freedom Day Dividend ETF (MBOX), attempts to do.

Traditional concepts of retirement planning focus on preparing clients for a certain age, after which they begin to withdraw from some nest egg of savings, usually at or around a 4% withdrawal rate.

Krueger’s actively managed, dividend growth strategy, however, concentrates on helping investors reach their own personal “Freedom Day”—that is, the day when their cash flow exceeds their outflow. In other words: the day when the dividend checks coming into your mailbox bring you more money than the bills you’re paying out. That “mailbox math” strategy is what has been packaged into MBOX.

Freedom Day isn’t about a specific age or asset level, says Krueger, nor is it connected to the FIRE movement (financial independence, early retirement). It’s about income generation, pure and simple.

“Freedom Day is our mathematical version of something better than retirement,” he says. “It’s the day when you finally know for certain that ‘enough is enough.’”

Lara Crigger, managing editor at ETF Trends, had a chance to sit down with Krueger to discuss the Freedom Day strategy.

Crigger: You argue that the current model of retirement planning isn’t working any more. Why not? What’s changed?

Krueger: In the last 40 years, everyone has been roughly 60/40, and we’ve gotten this amazing tailwind from the total return of the bond side of that allocation. As a result, a 4% [withdrawal rate]was never really challenged. Of course it works, right? But if those tailwinds disappear, what happens then? The math no longer works out.

Once, there was this notion that you could have $1 million and live off the interest; or that you needed some set amount–$2 million, $4 million, $5 million—and just withdraw 4%. But if you’re starting with a 1.5% risk-free rate of return, then what happens to you if the stock market doesn’t go up every decade?

This ETF is a result of us being asked to solve a problem, not launch a product. Personally, I don’t think there’s any need for any more ETF products. But that problem of “how am I going to generate growth of income?” That’s all I’ve [focused on]for the past few decades. So the idea of sharing it with more people is thrilling.

Crigger: What is the concept of a “Freedom Day”? And how is it different than a retirement age?

Krueger: In one sentence: Freedom Day isn’t about what asset level to retire at, but about what income number. Frankly, I don’t think retirement should be an age thing, anyway. Why not retire at 50—or if you really love what you’re doing, why not 80 or 90?

Freedom Day is our mathematical version of something better than retirement. It’s the day when your cash flow exceeds your inflows; when you finally know for certain enough is enough.

But it all comes back to income. Advisors’ biggest challenge right now is figuring out how to generate increasing income flows for their clients. As a result, investors are reaching for yield, and taking risks they might not realize are there, all to try to catch up and get that 4-5% income stream.

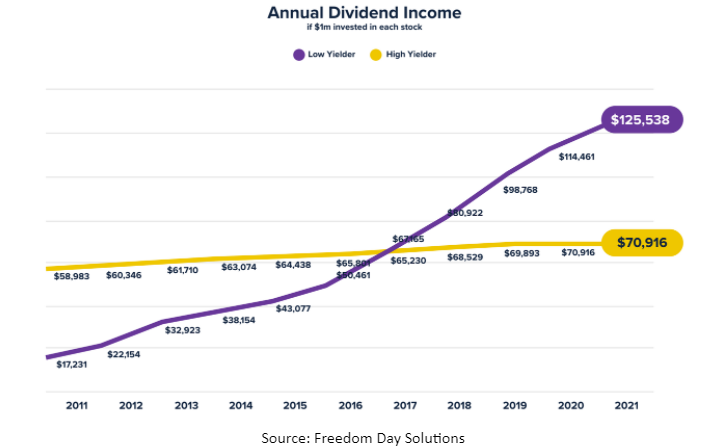

But if you dig your well before you’re thirsty, if you build a rising income stream, you can have a dividend yield of 2% now and, even with only moderate growth, generate 5% or 6% in less than ten years.

Crigger: It’s the perennial push-and-pull of dividend investing, right? Should I opt for those high, juicy yields; or should I go with the strategies that provide sustained growth over time? Everyone has their own opinion. How should advisors think about this choice for their clients?

Krueger: I’d say you need to think about your dividend yield, versus the current dividend yield. Part of this is just patience and time. Over time, a 2% yield that moves to a 5% yield is simply better for me than a 4% yield that doesn’t move.

Should you look for growth or income? We say it’s both. It’s growth of income that matters.

Plus, a dividend isn’t about when you bought or sold; it’s not about speculating. It’s real, tangible evidence of what’s going on at a company. And it’s clear in the data that companies that are growing their dividends have a competitive advantage versus ones that don’t.

Crigger: How so?

Krueger: [Dividend growth] is the single best clue for improvement within a business. After analyzing every investment factor for the past 25 years, the most telling clue of a company that can stand the test of time is that direction of its dividend.

So I look for the smaller dividend that’s growing, versus a big dividend yield that everyone can already see. When you unravel those big yields, you might find more red flags [than you’d expect]. Those big yields may be hiding other issues.

Crigger: What sets MBOX apart from all the other dividend growth active strategies out there?

Krueger: It seems like our biggest difference is the size of the moat we look for. The moat is an advantage that’s often discussed around big dividend-paying stocks. It’s easy to see; it’s easy to quantify. But the uncrowded trader in me says that attracts competition. It attracts investors who will price those as very easy-to-see advantages.

So we don’t look for the advantage—but the direction of the advantage. A small margin or return on invested capital that’s accelerating is more interesting to me than a giant margin or a giant ROIC.

I also happen to be a big believer in sell disciplines. Things don’t last forever. That’s the beauty of active management, in our opinion. When things change, you can sell them. When there are mistakes, we move on. So that’s why we re-score them every single month. We let the math do the talking; we don’t fall in love with any of our positions.

Crigger: Your strategy has a very mathematical basis to it: “We let the math do the talking,” etc. But that’s not necessarily what many active managers do. Active management is about making calls—and sometimes that’s math-driven, but sometimes it’s a qualitative process as well, or even about gut instinct.

Krueger: Absolutely, but the beauty of math is also that’s all about humility. Math should have nothing to do with what we think will happen, but about having a profound respect for what is happening.

Math changes. And when inputs change, I believe, so should the output. So we set strict buy and sell disciplines that leave no room for our opinion. We’ve had the same sell disciplines for 25 years. It doesn’t make for a fun article, but as I’ve often told folks: swap all the best ideas you have for one set of sell disciplines, and then you’ve got a chance of outperforming.

I think it gets to the heart of human nature. You could have a room full of investors with great ideas, but there are very few investors, amateurs or experts alike, who have a set of strict sell disciplines.

Crigger: You’re this family-owned and operated advisory in Houston. You’re very much outside the traditional Wall Street circles. Now you’ve launched an ETF. How did that decision come about?

Krueger: The nudge came from a couple advisors we worked with. We had an SMA program for our whole careers. But the only reason we did this was because advisors were complimenting our process and saying, “why don’t you do that in an ETF, so we can tap into it?” That really moved me. That got me excited.

Crigger: It’s not an easy thing to launch an ETF, though.

Krueger: It isn’t. It’s heck on wheels to get there. It’s expensive. It’s painful. But I think, mathematically, it’s a better solution than anything we could find out there.

For more news, information, and strategy, visit the Dividend Channel.