Downward pressure continues to push yields lower, which is forcing fixed income investors to seek other sources of yield and making the Russell 2000 Covered Call ETF (RYLD) a prime option.

Small cap exposure can give investors the growth component they are seeking as markets continue to rebound from the pandemic. Additionally, a buy-write strategy using covered calls offers income potential too.

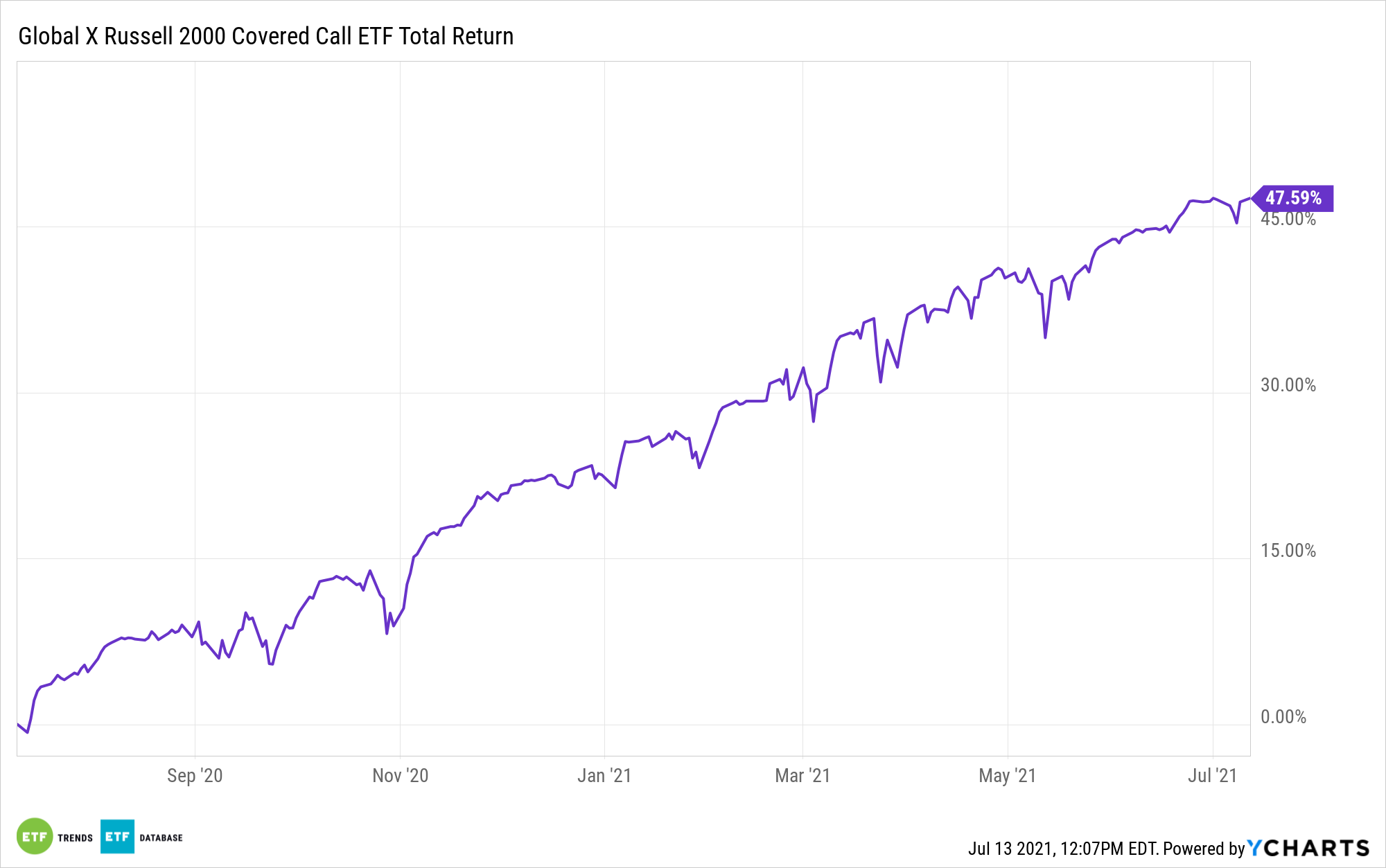

RYLD seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cboe Russell 2000 BuyWrite Index. The Global X Russell 2000 Covered Call ETF (RYLD) follows a covered call or buy-write strategy, in which the fund buys exposure to the stocks in the Russell 2000 Index and writes or sells corresponding call options on the same index.

“The Russell 2000 index tracks the 2,000 smallest public companies by market cap in its parent Russell 3000 stock index,” a Forbes article explained. “The remaining 1,000 companies are grouped in the Russell 1000 large-cap stock index.”

RYLD gives investors:

- High Income Potential: RYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility.

- Monthly Distributions: The fund makes distributions on a monthly basis.

- Efficient Options Execution: The ETF writes call options on the Russell 2000 Index, saving investors the time and potential expense of doing so individually.

Higher Risk, Higher Reward

The potential for higher income doesn’t come without its fair share of risks. The Russell 2000, in particular, can be sensitive to large market movements—big or small.

“Because it tracks the performance of small-cap stocks, the Russell 2000 serves as a very different benchmark than other major indexes, like the S&P 500 or the Dow Jones Industrial Average (DJIA), which focus on much larger companies,” the Forbes article explained. “That heavy focus on small-cap companies means the Russell 2000 may show more volatility than these indices because smaller companies have more limited financial resources than big companies and are less equipped to weather negative changes in the overall economy than their larger counterparts.”

“However, with that greater potential for risk comes built-in greater potential to grow exponentially,” the article added further. “It’s easier, after all, to double your value when your stock is worth $10 than when it is worth $100.”

For more news and information, visit the Thematic Investing Channel.