There’s been a spate of encouraging dividend news in recent weeks. Globally, payouts are expected to increase this year following a rough 2020.

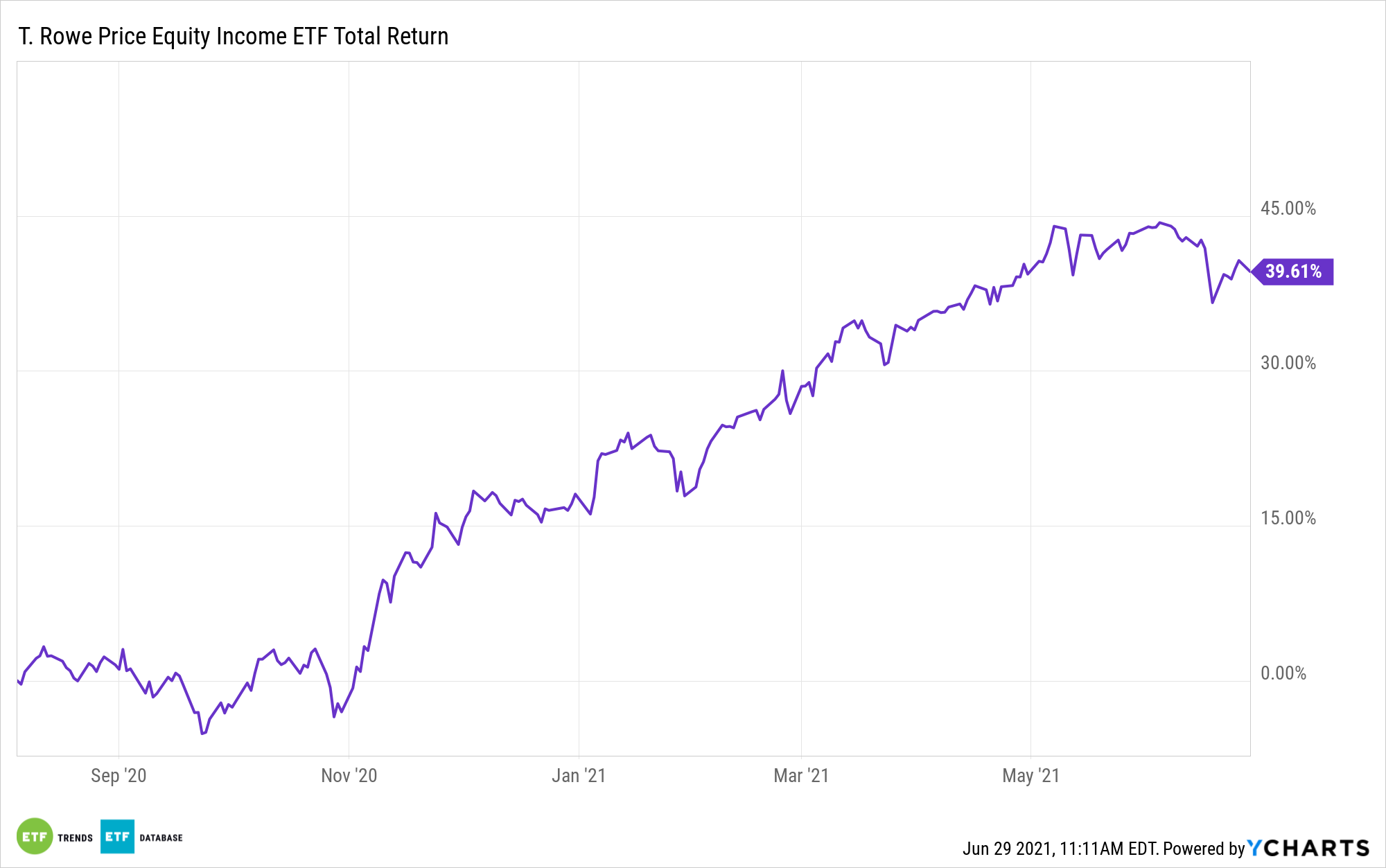

The U.S. will be part of that growth. In fact, some recent forecasts suggest markets may underestimating the extent to which domestic payouts will grow this year and in 2022. Add all that up and it’s a good time to be a dividend investor with active strategies like the T. Rowe Price Equity Income ETF (TEQI).

TEQI, a semi-transparent exchange traded fund, blends two themes beloved among investors looking to dial back equity risk: dividend growth and value stocks. The actively managed fund’s roster is typically comprised of companies with strong histories of payout growth and those that are undervalued. Additionally, TEQI is a relevant near-term idea.

“John Linehan, lead portfolio manager of the $19 billion T. Rowe Price Equity Income fund, spends a lot of time thinking about dividend stocks. But with the S&P 500 index having returned about 40% over the past year, he is concerned that many investors aren’t paying enough attention,” reports Lawrence Strauss for Barron’s.

That fund is the mutual fund equivalent of TEQI.

Active management is part of the allure with TEQI. Since it’s not constrained by an index, it can underweight sectors that are chock-full of high dividend stocks that may be vulnerable to dividend cuts or suspensions down the road. Conversely, the fund’s managers can overweight groups with rosy payout growth prospects.

For example, TEQI allocates 23.36% of its weight to financial services stocks, as compared to 11.92% for the benchmark. That’s something for investors to consider because, last week, the Federal Reserve said all major banks that participated passed the annual stress test, meaning higher dividends from banks could arrive as soon as next month.

“Top holdings in his (Linehan) fund (ticker: PRFDX) recently included banking giant Wells Fargo (WFC), which cut its dividend last year; insurer MetLife (MET), and utility Southern Co. (SO). Over the past year, the fund has returned about 45%, placing it in the top 30% of Morningstar’s large-cap value category. The fund yields about 2.4%,” according to Barron’s.

TEQI (the ETF version) devotes about 21% of its combined weight to healthcare and tech stocks. Those have been and are expected to continue being reliable sources of S&P 500 dividend growth.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.