By Rob Williams, Director of Research, Sage Advisory

The Fed’s announcement last week that would pull rate hikes forward by six months was somewhat of a surprise for investors. The good news is that it doesn’t really change our thesis, which calls for rates to modestly increase over the medium term; the bad news is that we’re still in an environment where yield can be difficult to come by. Given this backdrop, we believe the best course of action remains to out-yield passive indices by overweighting spread sectors, stay short duration to minimize negative price returns from rising rates, and utilize sector selection to generate additional upside.

Consider the following.

Yields Stalled in 2Q

After a sustained rise in the first quarter, yields have drifted down and stayed in a narrow range in the second quarter. Rangebound conditions could continue near-term as the flood of liquidity in the markets due to Fed policy needs to find a home; and with T-bills yielding nothing, this means safety buyers like banks will be buying longer Treasuries.

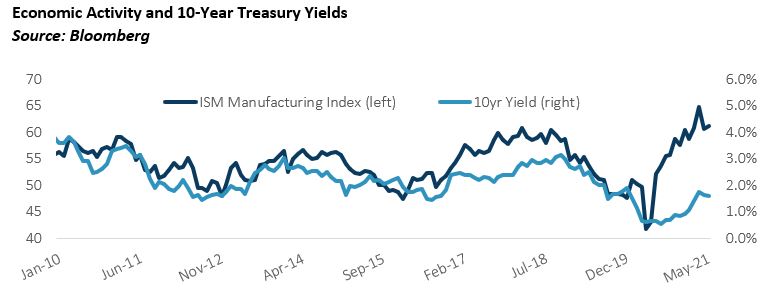

Activity Suggests Higher Yields, but Watch the Fed

A longer-term view on rates suggests an upward bias to yields given the spiking activity level. QE, however, continues to keep yields artificially low, and an increase in yields will depend on when the Fed begins unwinding its policies. Our outlook is for contained rates over the next couple months but increasing pressure in the fall as the Fed continues to message tapering plans.

The Reach for Yield Continues

Demand for yield in low-yield environment coupled with a positive fundamental outlook is a recipe for tight credit spreads. Given the level of valuations, a reach for yield makes us cautious, but a strong fundamental backdrop historically has kept spreads tight for long periods of time, even tighter than current levels. This is good news for bond investors, as the key to outperforming static bond indices will be reaching into spread sectors for excess yield.

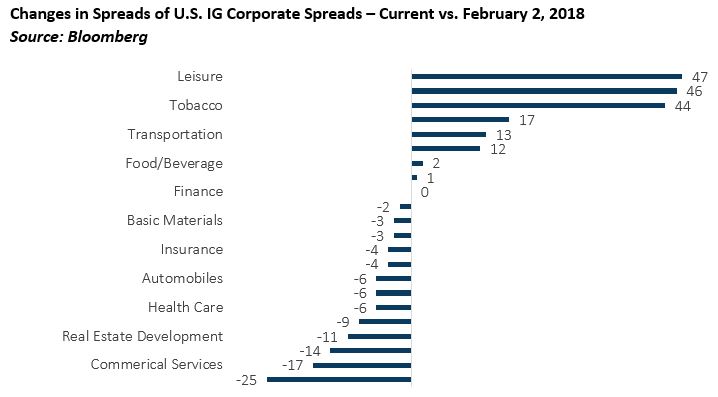

Opportunities Exist Despite Record Tight Corporate Spreads

The rapid pace of re-openings, particularly in travel during the summertime, could present a catalyst to the travel and leisure sector, which has attractive valuations (e.g., the leisure sector is 47 basis points cheaper than it was in 2018). For those investors focused on core investment grade fixed income, leisure/travel an example of good value.

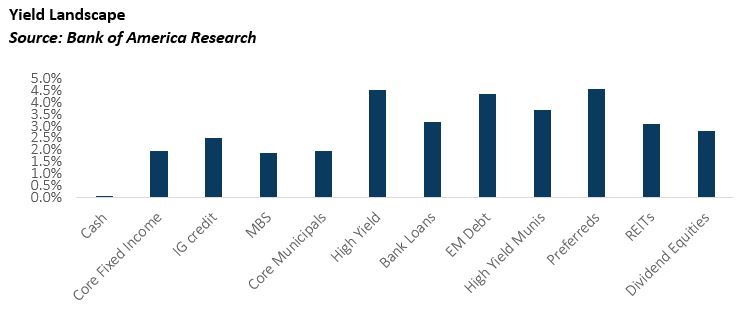

Take a Multi-Asset Approach

For those investors that have a higher risk tolerance and are not confined to core fixed income, a multi-asset approach is best. A risk-managed, multi-asset approach allows investors to diversify beyond rate-sensitive core fixed income into higher-yielding alternatives at a time when spreads should remain well supported. Given our macro and technical outlook, we find high yield, bank loans, and preferred stocks attractive. For tax-sensitive investors, municipals, both core and high yield, are in a very favorable position.

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.