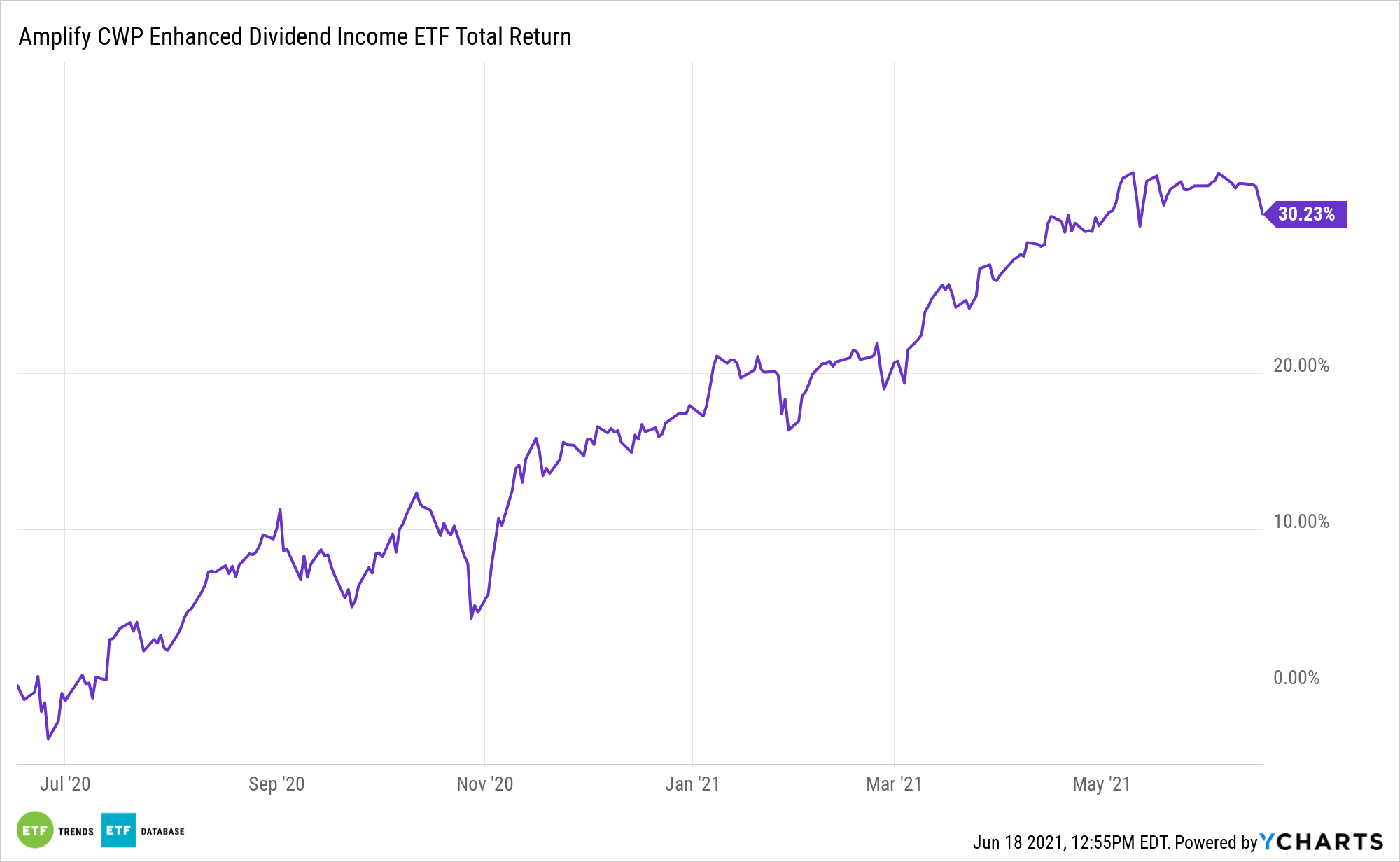

Data confirm advisors and investors are embracing actively managed exchange traded funds this year. One of the beneficiaries of that trend is the Amplify CWP Enhanced Dividend Income ETF (DIVO).

Not only is DIVO actively managed, but as its name implies, it’s an income-generating tool, which further enhances its status as a right-place, right-time ETF in 2021. Issuer Amplify ETFs said Thursday that DIVO, which debuted in December 2016, is now a member of the $500 million in assets under management club. To be precise, DIVO had $502.4 million in assets as of June 16.

“Income generation remains a challenge for many financial advisors in today’s low interest rate environment,” said Christian Magoon, CEO of Amplify ETFs, in a statement. “As the outlook for the economic recovery remains positive, we’re pleased advisors find value in DIVO’s dividend-focused approach to producing high-quality income.”

As of May 31, DIVO had a distribution rate of 5.28% and a 30-day SEC yield of 1.48%, according to issuer data. While the former implies DIVO is a high-dividend strategy, a deeper examination reveals the Amplify ETF is actually a quality dividend growth fund. That lofty distribution rate is enhanced by tactical covered call writing.

The fund writes covered calls on individual holdings, not an index. Selling covered calls involves selling options on underlying securities an investor already holds long positions in. The idea behind this strategy is to guard against downside in the underlying security, generate some profits in sideways markets, and bolster a portfolio’s income stream.

DIVO is a concentrated ETF with just 26 holdings. Its sector weights range from to 2.7% to 15%. Not surprisingly given the fund’s quality focus, DIVO is underweight last year’s dividend offenders, such as energy as well as high dividend sectors, like utilities.

Conversely, the Amplify ETF allocates almost 29% of its weight to technology and healthcare stocks – two groups that have been leaders regarding S&P 500 dividend growth. Top 10 holdings include Dow components Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Johnson & Johnson (NYSE: JNJ), each of which have impressive track records of dividend growth.

“DIVO also has a 5-star overall and 3-year Morningstar™ rating based on risk-adjusted returns among 43 funds in the Derivative Income Fund category as of 5/31/2021,” according to Amplify.

The fund charges 0.55% per year, or $55 on a $10,000 investment.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.