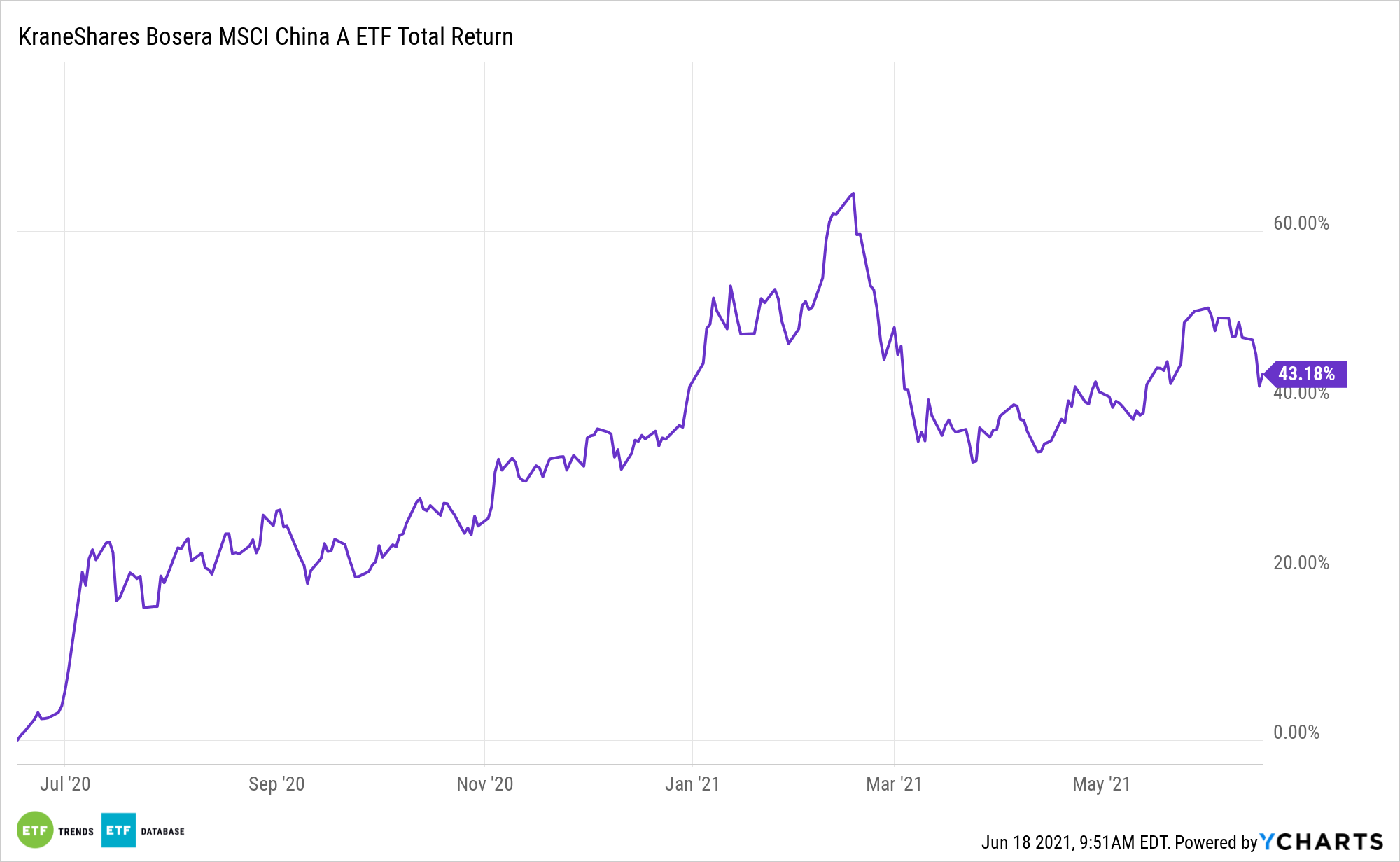

Investors looking for minimally volatile opportunities in China can consider A-shares exposure with the KraneShares Bosera MSCI China A ETF (KBA).

During last year’s pandemic chaos, A-shares exhibited relatively stable characteristics, even when markets went especially awry during March 2020.

“The comparative resilience of China A-shares is borne out in the data,” a Kiplinger article noted. “While the MSCI China A Onshore Index, a key benchmark for the asset class, was down through the end of March, A-shares have shown relative strength compared to the S&P 500 and MSCI Europe indices (Exhibit 1). They also have outperformed ‘offshore’ China companies (H-shares, traded in Hong Kong, and American Depositary Receipts traded in the U.S.)”

As for the fund’s description, KBA seeks to provide investment results that correspond to the price and yield performance of the MSCI China A Index (USD). The underlying index reflects the large- and mid-cap Chinese renminbi-denominated equity securities listed on the Shenzhen or Shanghai Stock Exchanges (A-Shares) that are accessible through the Shanghai-Hong Kong Stock Connect or Shenzhen-Hong Kong Stock Connect programs.

“China A-shares have historically been uncorrelated to other major equity indices,” the Kiplinger article also noted. “The correlation of A-shares with world equities was around 0.2 over the past decade, while the correlation with U.S. and European equities was even lower, according to Bloomberg data from the end of January 2020. That means including A-shares in a global portfolio might enhance optimization by generating a potentially better risk-return profile. Crucially, these low correlations have held up during the current crisis.”

A-Shares March to Beat of Their Own Drum

Getting uncorrelated assets via China A-shares give investors the ability to diversify outside of general global markets.

“China A-shares are largely shielded from global economic woes,” the Kiplinger article said further. “As the domestic Chinese economy gets back to full speed, that is especially beneficial for A-share firms. That’s because these companies typically generate 90% or more of their revenues domestically and engage in little foreign trade, therefore shielding them from economic weakness elsewhere.”

For more news, information, and strategy, visit the China Insights Channel.