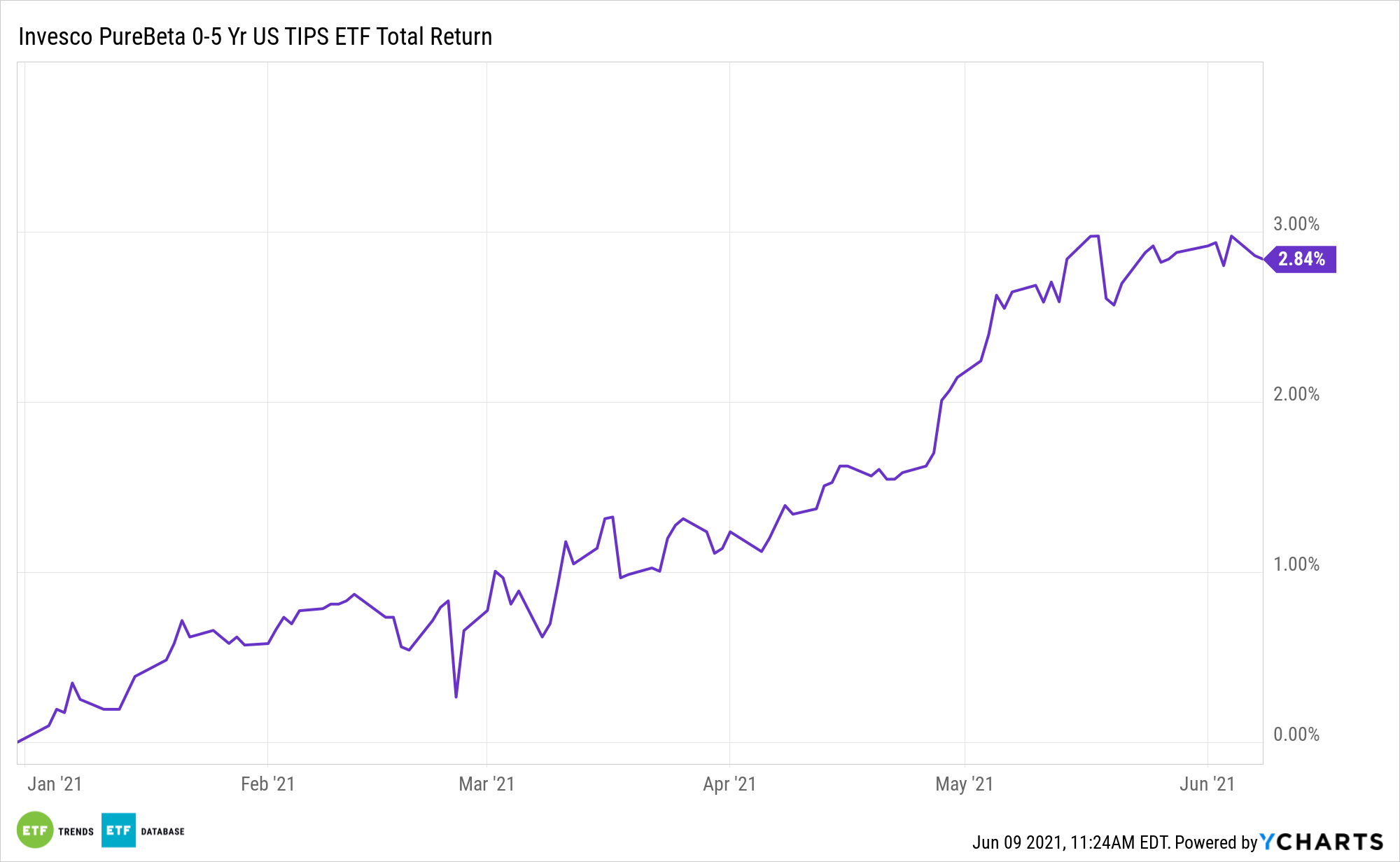

New inflationary concerns are putting ETFs like the Invesco PureBeta 0-5 Yr US TIPS ETF (PBTP) in focus.

With years of market experience under his belt, it’s safe to say that dealing with inflation concerns isn’t something new to Buffett. For example, a bond that pays 5% is ultimately yielding a negative rate of return if inflation is pegged at 6%.

“Warren Buffett has been thinking about inflation for a long time,” a Bankrate article said. “The legendary 90-year old investor had the dangers of inflation drilled into him by his Republican Congressman father, according to biographers, and has repeatedly commented on the subject throughout his investing career.”

The article mentioned that consumer prices are on the rise, jumping “4.2 percent in April 2021 compared to the prior year, the largest increase since September of 2008. The increase has unnerved investors, with some wondering if we could be headed for a return to the 1970s when inflation reached double digits.”

“We’re seeing very substantial inflation,” Buffett said during a Berkshire Hathaway annual meeting the previous month. “We’re raising prices, people are raising prices to us. And it’s being accepted.”

TIPS offer a way to help stem the tide of rising inflation. The principal balance of TIPS increases as inflation rises, and investors are paid the original balance or the inflation-adjusted balance, whichever is greater.

A TIPS ETF to Consider

PBTP seeks to track the investment results the ICE BofA 0-5 Year US Inflation-Linked Treasury Index. The fund generally will invest at least 80% of its total assets in the securities that comprise the underlying index.

The index is designed to measure the performance of the shorter maturity subset of the U.S. TIPS market, represented by TIPS with a remaining maturity of at least one month and less than five years. Less years means investors are less exposed to duration risk.

“Treasury Inflation-Protected Securities, or TIPS, is another investment endorsed by Buffett for investors who are concerned about rising inflation,” the Bankrate article noted. “TIPS pays investors a fixed interest rate twice a year, but the principal amount is adjusted for inflation, as measured by the Consumer Price Index.”

For more news and information, visit the Innovative ETFs Channel.