Chinese stocks offer plenty of promise and growth potential, but integral to allocating to the country is avoiding sources of controversy and geopolitical risk, including state-owned enterprises (SOEs).

For advisors, a prime destination for ensuring clients’ emerging markets exposures tilt toward quality while avoiding SOEs is WisdomTree’s emerging markets multi-factor model portfolio.

The exchange traded funds found in that model portfolio are diversified emerging markets plays, not dedicated Chinese funds. However, China is usually one of the largest geographic weights in diversified emerging markets funds and SOE risk is present throughout developing economies, underscoring the utility of the model portfolio.

There are mounting reasons why clients should want to eschew SOEs, such as Chinese smartphone manufacturer Xiaomi and telecom giant Huawei.

“Beyond those two firms, there are many more companies with close ties to the state that have gotten the attention of Western politicians,” said WisdomTree Head of Equity Strategy Jeff Weniger in a recent note. “In the waning days of the Trump administration, 44 Chinese companies with close ties to the People’s Liberation Army (PLA) were blacklisted. Notable among them are CNOOC, the energy giant, and China Mobile.”

2 ETFs to Avoid SOEs

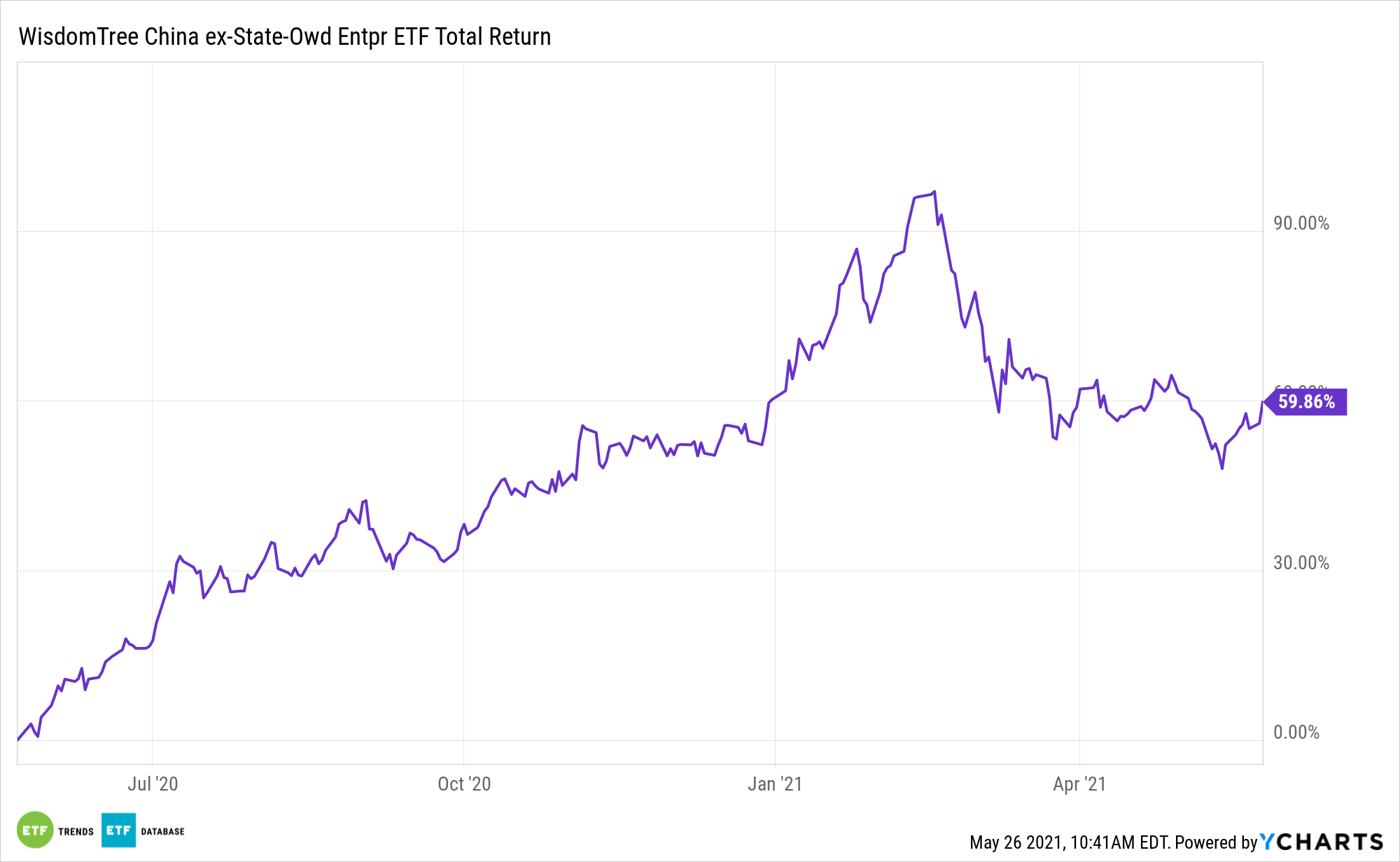

The WisdomTree Emerging Markets ex-State-Owned Enterprises Index and the WisdomTree China ex-State-Owned Enterprises Index exclude any companies in which governments hold stakes in excess of 20%.

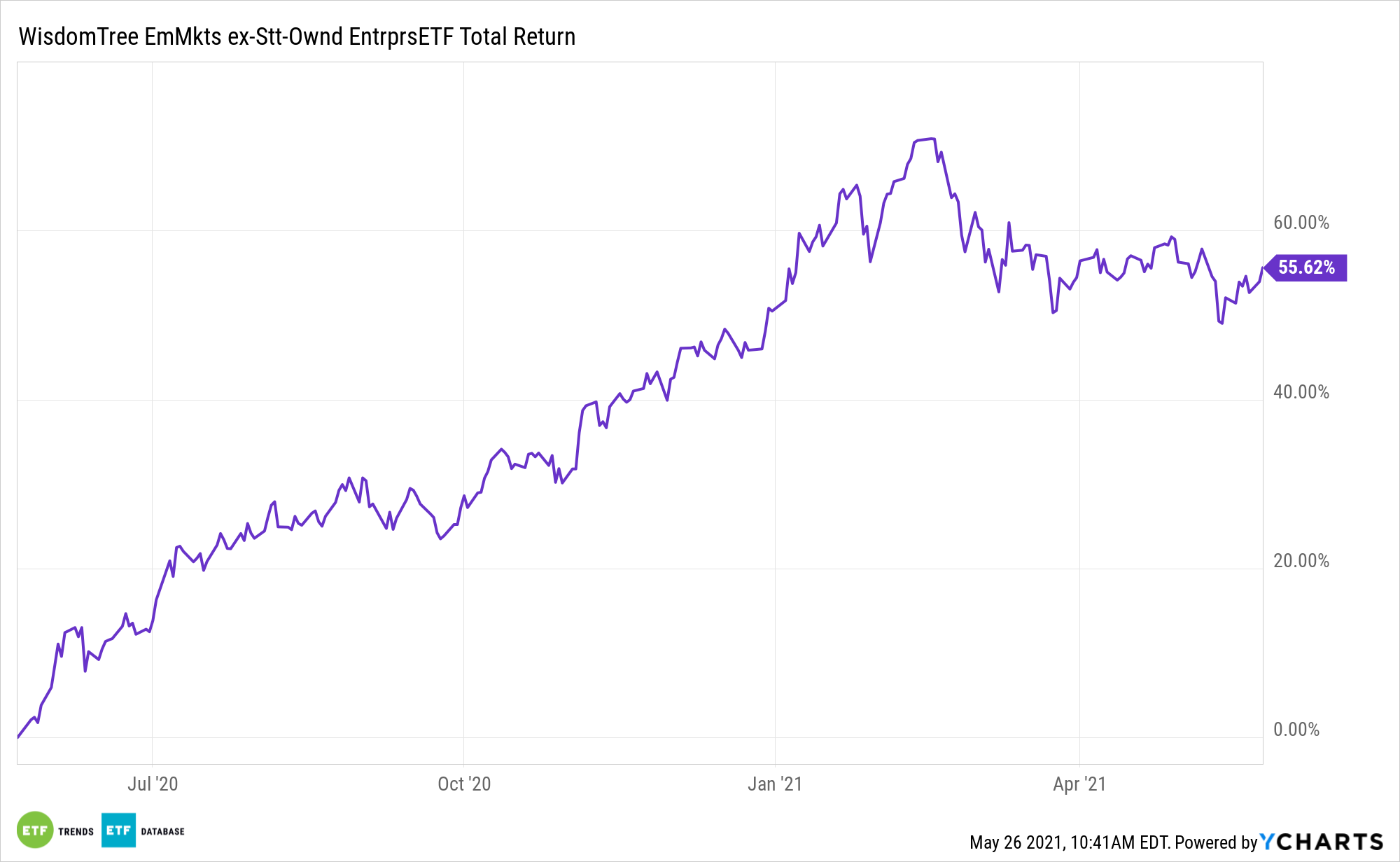

The former index is the underlying benchmark for the WisdomTree Emerging Markets ex-State-Owned Enterprises ETF (XSOE), a member of the aforementioned model portfolios. The China index is tracked by the WisdomTree China ex-State-Owned Enterprises Fund (NasdaqGM: CXSE).

As Weniger notes, those strategies were effective in accomplishing their objectives because neither index had exposure to the 44 PLA-affiliated companies. That’s an important selling point to clients, because when Chinese stocks are punished, it’s usually SOEs enduring the brunt of the harsh treatment.

That’s one reason to avoid SOEs. Another is that with the West turning closer attention to China’s human rights record, it’s scrutiny of SOEs intensifies, which heightens the risk of geopolitical-induced downside.

“Nevertheless, a venture into our kick-out-the-SOEs strategies will help keep you away from many of the PLA-linked firms,” said Weniger. “It will also separate your capital from China’s megabanks, an investment decision that may prove fortuitous if the US, EU and allies such as Japan, South Korea and India open the sanctions playbook.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.