While the U.S. economy is set for strong growth in 2021, the equity market valuations appear elevated. Still, there’s a positive outlook for the cyclical financials and energy sectors, in addition to impressively valued dividend payers. Based on the T. Rowe Price article, “What’s Next for Value Stocks,” by John D. Linehan Portfolio Manager, Equity Income Fund, the focus will remain on tracking underappreciated companies with intrinsic value.

As noted, there’s been an accelerated rotation from growth to value stocks during the first quarter of 2021. However, it’s becoming a question of durability when considering the rally in cyclical industries, revealing the question of whether or not value stocks will have more room to expand.

According to Linehan, “Much depends on the success of efforts to bring the coronavirus pandemic under control.”

This is not surprising, as the number of vaccination programs and the large fiscal stimulus injected into the U.S. economy has been encouraging. Additional spending on infrastructure in the years to come is also a good way to spur strong economic growth. Between the push upward and T. Rowe Price’s view of equity valuations, it appears the broader market may generate muted returns in coming quarters.

Linehan redirects here, stating, “Nevertheless, we are finding opportunities in select cyclical sectors, such as financials and energy, where we are attracted to quality companies that could benefit from a continuing recovery in the U.S. economy but also exhibit what we regard as a favorable valuation profile.”

What’s To Come From The Value Rally

In the first quarter of 2021, value stocks in the large-cap Russell 1000 Index outperformed their growth counterparts and the broader market. this was a way of benefiting from the turnaround on the pandemic-driven market dislocations that made up so much of 2020’s investment landscape. Given this development, the rotation out of secular rotation, there could be a release of pent-up demand, allowing for an earnings growth in cyclical industries.

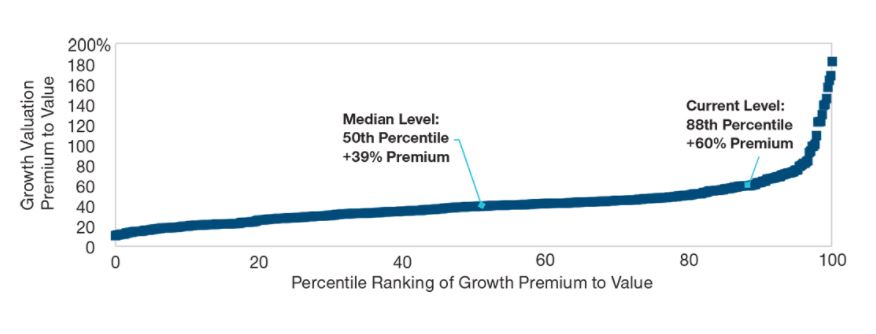

Percentiles of large-cap growth stocks’ valuation premium to value peers.

Based on historical data from December 31, 1978, to March 31, 2021. Past performance is not a reliable indicator of future performance. Source: T. Rowe Price analysis using data from Thomson Reuters and FactSet Research Systems Inc.

Given the first quarter excesses, the valuation premium remained elevated at the end of March 2021. With that in mind, this differential could narrow further through a rotation out of growth stocks and expansions in the valuation multiples that value stocks command.

This does signal the possibility for some cyclical sectors to fare well, should earnings growth accelerate and the multiples recover from recent compression. It’s a way to stand out against the broader market and growth equities, which would, in turn, set a high bar of expectations that corporate earnings would need to clear.

Additionally, as pointed out by Linehan, “In this environment, we see the potential for income-focused investors to gravitate toward dividend-paying equities1 because of the low yields available in the bond market.”

The Way To Find New Opportunities

Energy and financials were the strongest performers in the S&P 500 Index in the first quarter. However, T. Rowe Price believes these cyclical sectors could still offer compelling risk/reward profiles for discerning value investors. As stated, “Usually during downturns, cyclical stocks experience an increase in their price-to-earnings ratios because of the decline in profits that accompanies an economic contraction.” Last year presented additional challenges based on the pandemic-driven disruptions.

Coming from such low levels, valuations in both sectors are still appealing to T. Rowe Price. there is potential for companies’ earnings and cash flows to surprise to the upside if economic growth accelerates, interest rises, and pressures from inflation develop. Valuation multiples would improve as a result. Exposure to potential upside catalysts may also come from financials and energy holdings. This would provide a degree of confidence, were the macro tailwinds to head in a different direction.

Additionally, some banks may have the potential to increase their dividends or step up their share buybacks. There are also good feelings about the risk/reward profiles offered by select property and casualty insurers.

There are still long-term challenges the energy sector faces due to concerns about climate change. However, T. Rowe Price takes a constructive view of the energy sector, as prevailing valuations do not appear to reflect the potential that oil prices could be more supportive in the years to come. When it comes to oil and gas producers, there’s a preference for high-quality operators with strong balance sheets, capable management teams, and lower-cost assets.

“We are also finding opportunities outside of cyclical companies as relative valuations in defensive industries become more attractive,” the article continues, as many utilities feature appealing dividend yields, and are positioned to growth their rate bases through capital investments related to clean energy transition.

Linehan concludes, “Although we continue to favor cyclical names in the current environment, our valuation discipline and in-depth research into industries and individual companies remain our guides as we seek to take advantage of near-term market dislocations and evolving risk/reward profiles.”

For more news, information, and strategy, visit the Active ETF Channel.