Investors can use exchange traded funds to target the growth equity style.

Technology and growth stocks pushed higher Tuesday after falling under pressure in recent trading sessions on concerns over a spike in inflation. Many are still concerned about whether or not the rising consumer prices will be temporary or more persistent, and whether the Federal Reserve will hike interest rates sooner rather than later.

“That always was the key risk: central banks taking away the liquidity punch bowl before the party has ended,” Brian O’Reilly, head of market strategy for Mediolanum International Funds, told the Wall Street Journal.

O’Reilly argued that inflation between 2% and 4% would be the “sweet spot” for stocks. The economic recovery that is lifting inflation will continue to support stocks.

“Inflation isn’t necessarily bad for equities, but there will be winners and losers in terms of [which ones]are better at passing on that inflation to the customer,” O’Reilly added.

While tech and growth stocks have taken the brunt of the hit from rising inflation concerns, some market observers see the recent pullback as a buying opportunity.

“Within tech, there are still some companies that look very cheap,” Jane Shoemake, client portfolio manager at Janus Henderson Investors, told the WSJ. “If you believe in the longer-term trends supporting these companies, you should be buying.”

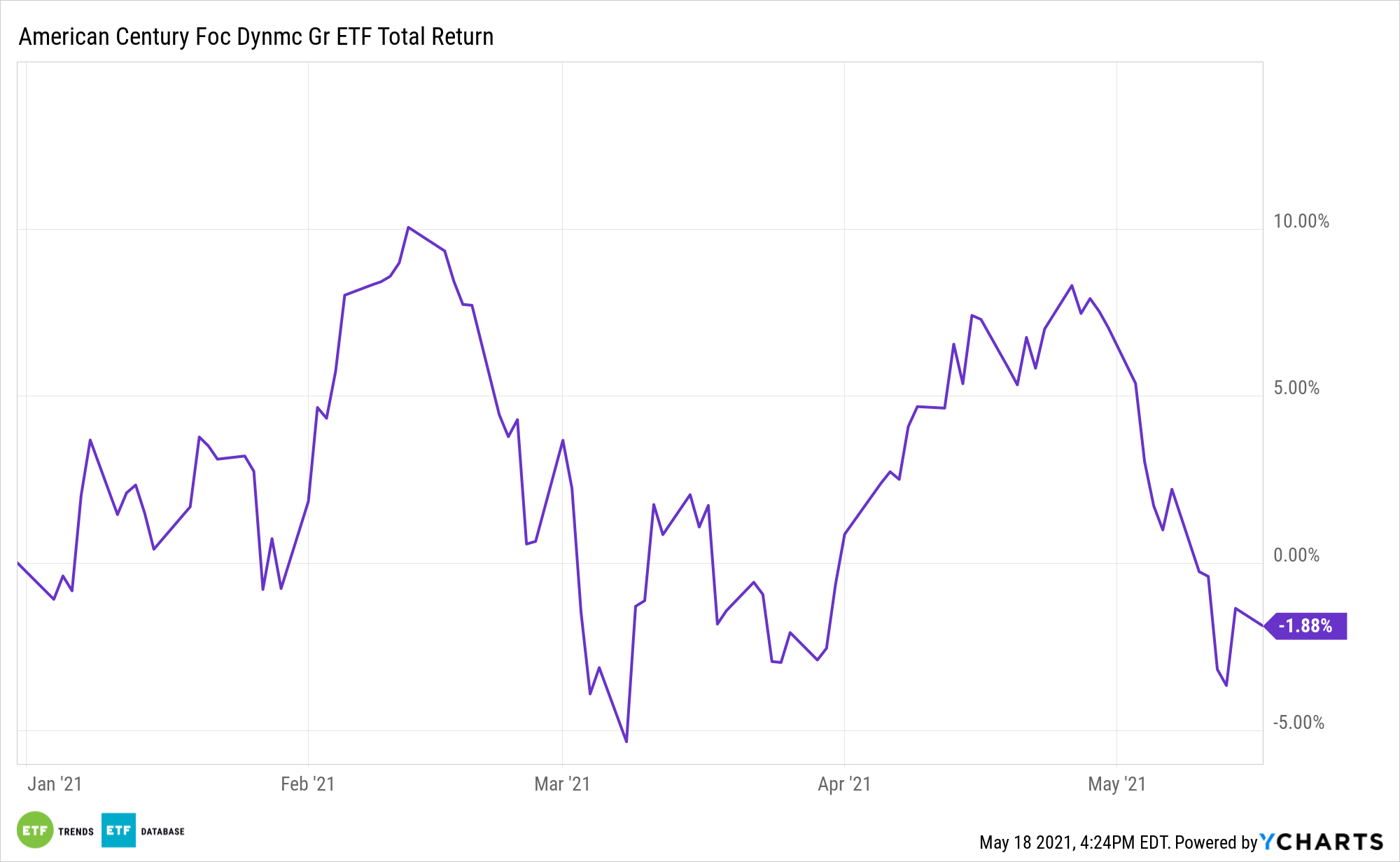

As the growth style rebounds from the pummeling it received from the inflation-induced selling pressure, investors can look to strategies like the Focused Dynamic Growth ETF (FDG), which is designed to invest in early-stage, high-growth companies. FDG is a high-conviction strategy designed to invest in early-stage, rapid growth companies with a competitive advantage, high profitability, growth, and scalability to sustain their leading positions.

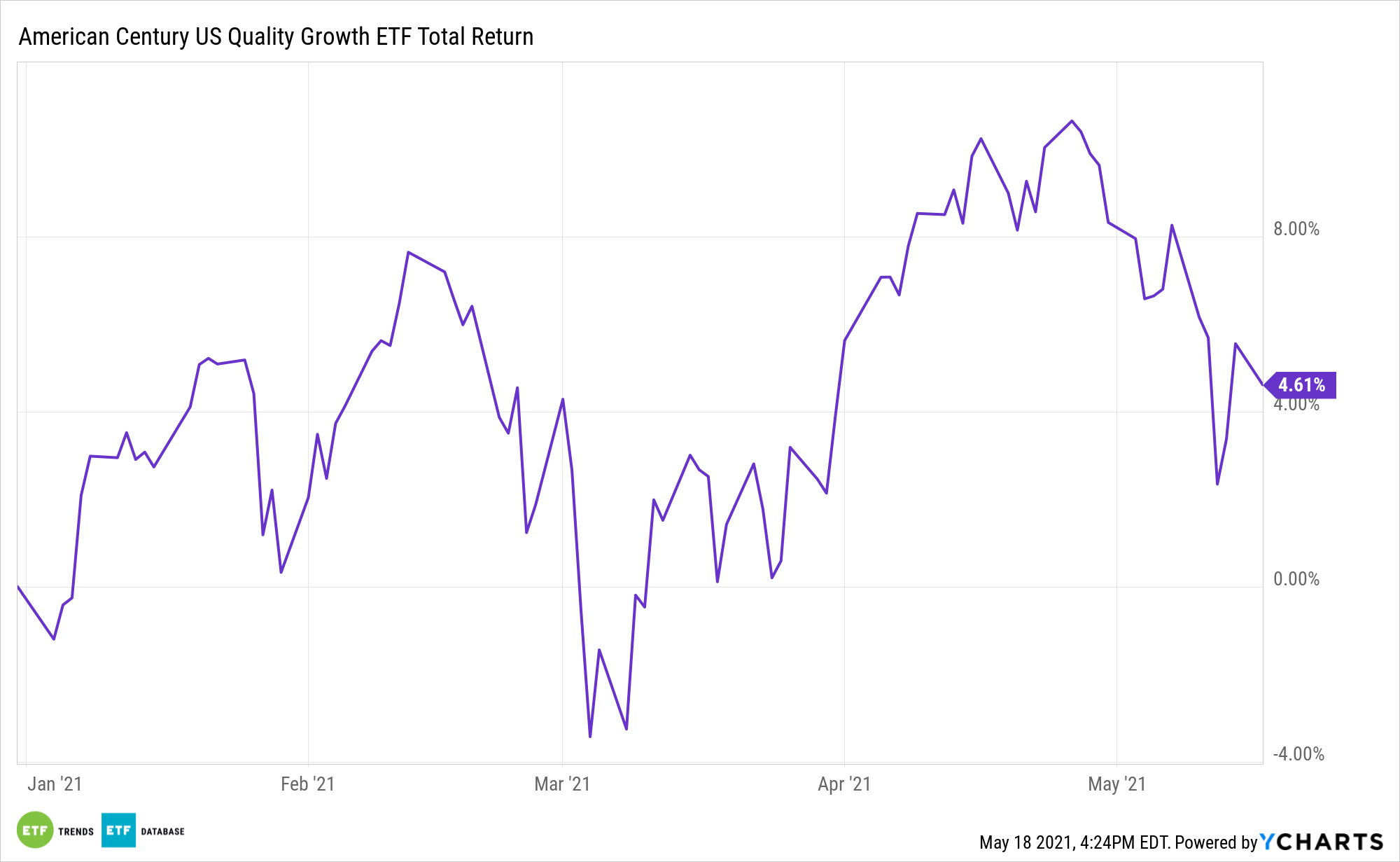

Additionally, investors can look into the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.