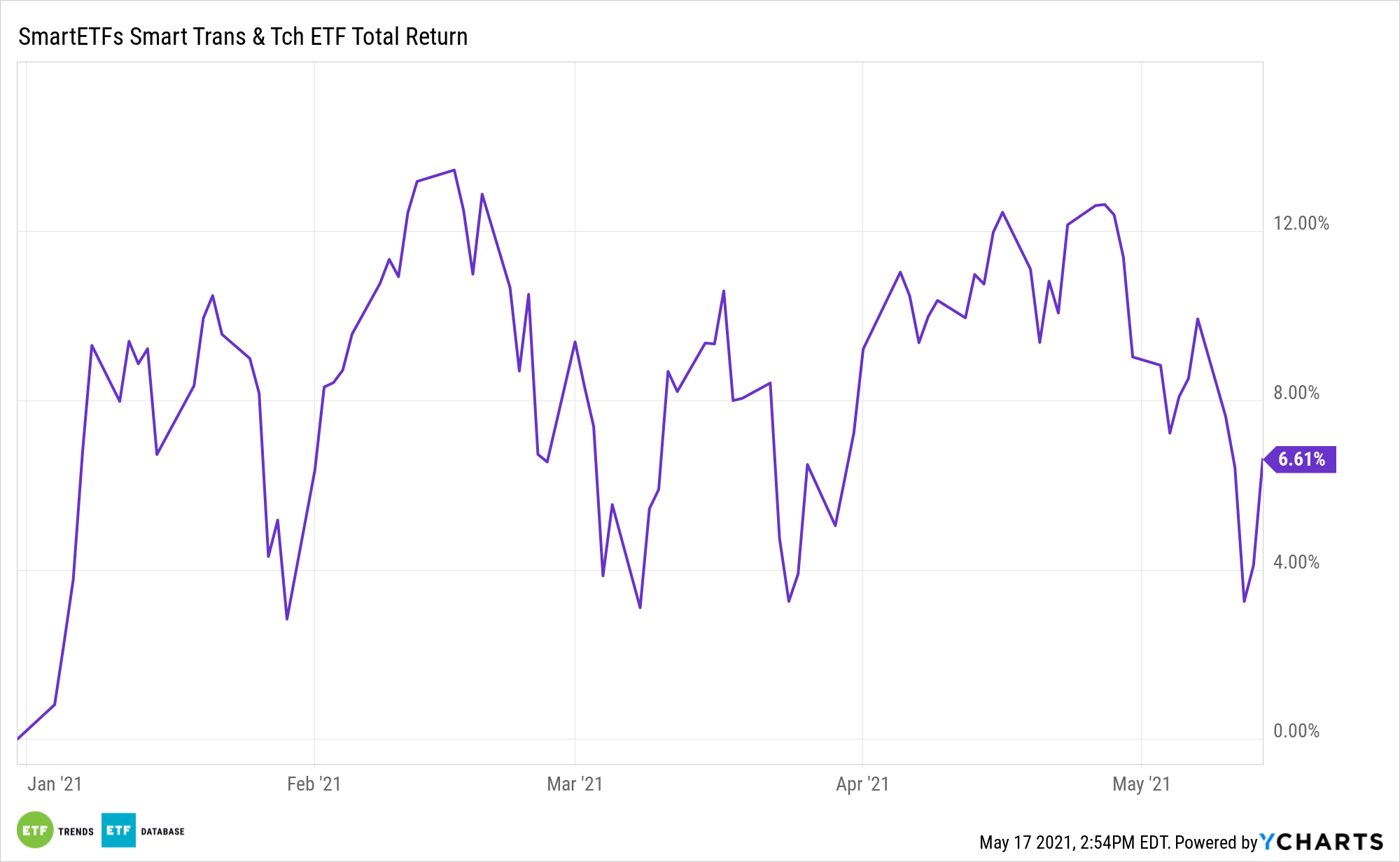

A chip shortage is threatening to slash revenues for automakers, but electric vehicles may see a much smaller speedbump with assets like the SmartETFs Smart Transportation & Technology ETF (MOTO).

As of now, however, the automotive industry must overcome a near-term obstacle. The global industry could take a $110 billion hit in revenue this year thanks to the chip shortage.

“The pandemic-induced chip crisis has been exacerbated by events that are normally just bumps in the road for the auto industry, such as a fire in a key chip-making fabrication plant, severe weather in Texas and a drought in Taiwan,” said Mark Wakefield, global co-leader of the automotive and industrial practice at AlixPartners. “But all these things are now major issues for the industry — which, in turn, has driven home the need to build supply-chain resiliency for the long term.”

Nonetheless, chip shortage or not, the movement to more electric vehicles is underway. U.S. president Joe Biden’s $2 trillion infrastructure plan includes a push towards clean energy, with electric vehicles playing a major role.

“On Jan. 25, Biden announced an executive order that will convert the US government’s 645,000-strong fleet of vehicles to battery-powered vehicles,” a CNET article noted.

“With a core focus on reducing emissions and setting an example for the country to shift to EVs, the EO also aims to bolster the US’ purchasing power to buy EVs from American businesses and US-made products,” the article added. “The administration hasn’t produced a timeline for the conversion just yet, and the next-generation mail delivery trucks have already challenged how serious the administration is with this commitment.”

A Smart Transportation Strategy

As an actively managed ETF, the goal of MOTO is to seek long-term capital appreciation.

Per the Smart ETFs website, the fund focuses on vehicles “which may be passenger or commercial or freight, and technologies and products relating to the underlying enabling services, ride sharing, vehicle technologies, battery or fuel production and storage, charging, smart grids, networks, efficiency technologies and other activities, services and products that enable or enhance autonomous or electric vehicles (both ground-based and airborne), and companies involved in related developments or technologies to support autonomous or electric vehicles including infrastructure, roadways, or other pathways.”

The fund isn’t heavy on any one stock. Its largest holding, Quanta Services Inc, does not exceed 4.27%. Tesla and Samsung round out its top three holdings at a combined 7.86% allocation.

For more news and information, visit the Smart Beta Channel.