The explosion of environmental, social, and governance (ESG) investing has become a worldwide phenomenon. This is spurring a rise in green bonds, with the next catalyst coming from a synergy between two parts of the globe, the European Union (EU) and China.

“Green investments have gone mainstream as portfolios divest themselves of fossil fuels to add green bonds and environmental, social and governance (ESG) investments instead,” a South China Morning Post article said. “Over the past decade, green issues have gone from being a niche investment to the centre of financial markets, with more than US$30 trillion estimated to be sustainably invested today.”

“But there are critical problems in driving green finance forwards,” the article added. “Among these are the dispersed standards applied across the world and the lack of innovative policies pushing markets in a green direction. The European Union and China are the most active in green finance, and it may be that their unique approaches can complement each other in addressing these two problems.”

Both China and the EU implement their own standards for addressing ESG compliance. China uses a more top-down approach to ESG standards while the EU employs a relatively bottom-up approach.

If both countries can combine their respective strategies and implement global standards using both approaches, they could set a more uniform standard for the world. As such, better ESG compliance could result in more quality green bonds in the debt market.

A Pair of ETF Opportunities

The explosion of ESG investing has roughly coincided with the rapid growth of ETF funds. Naturally, investors can find significant areas of overlap between the two.

For green bond exposure, there’s the VanEck Vectors Green Bond ETF (GRNB). GRNB seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond U.S. Dollar Select Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

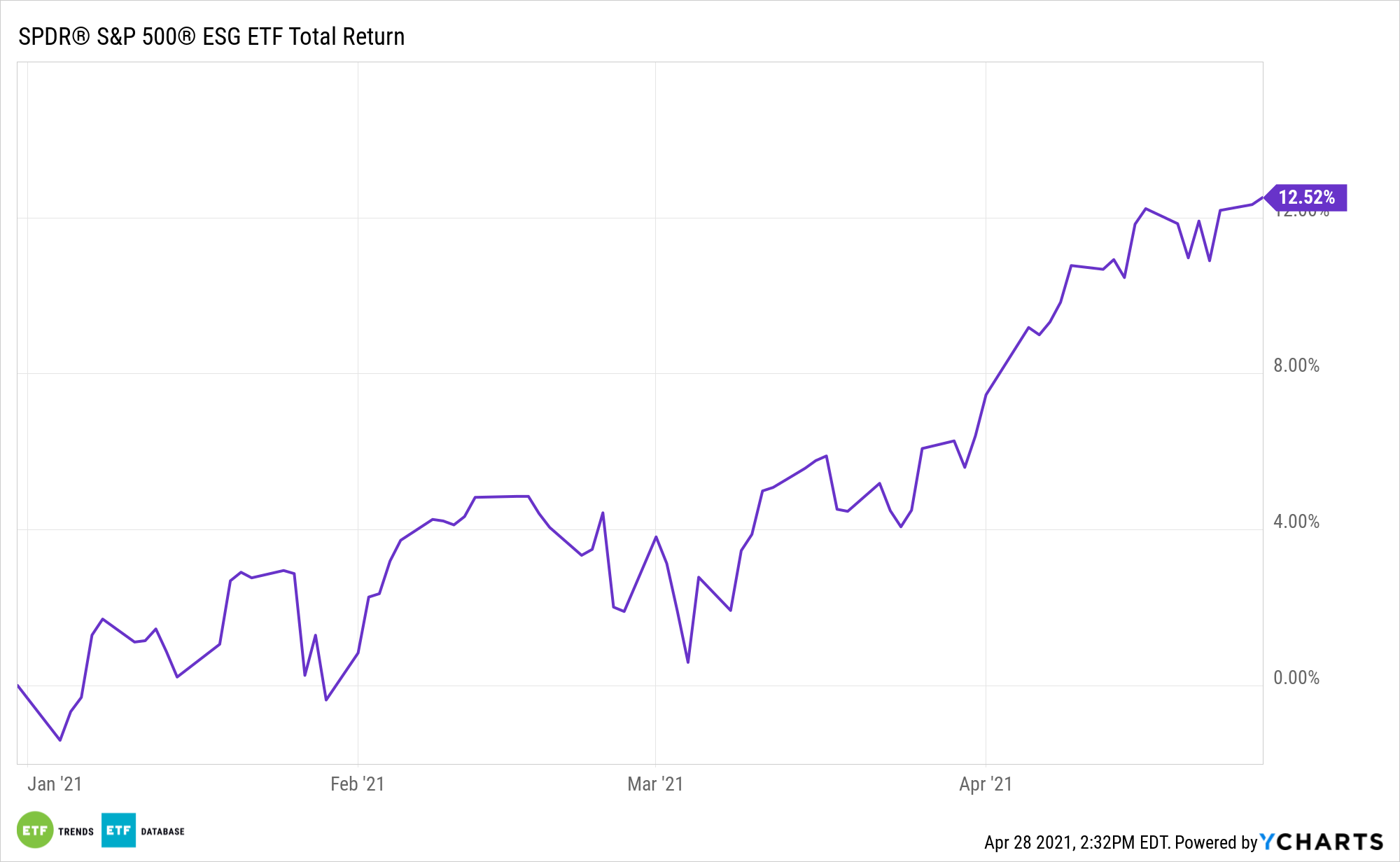

For broader exposure to ESG equities via the S&P 500, there’s the the S&P 500 ESG ETF (EFIV). EFIV comes with a low expense ratio of just 0.10%.

EFIV seeks to provide investment results that correspond generally to the total return performance of an index that provides exposure to securities that meet certain sustainability criteria (criteria related to ESG factors) while maintaining similar overall industry group weights as the S&P 500 Index.

In seeking to track the performance of the S&P 500 ESG Index, the fund employs a sampling strategy, which means that it is not required to purchase all of the securities represented in the index.

For more news and information, visit the ESG Channel.