Advisors and investors don’t have to lean on Treasury inflation protection securities (TIPS) to beat inflation. In fact, it may be advisable to side with equities as a way of topping rising consumer prices.

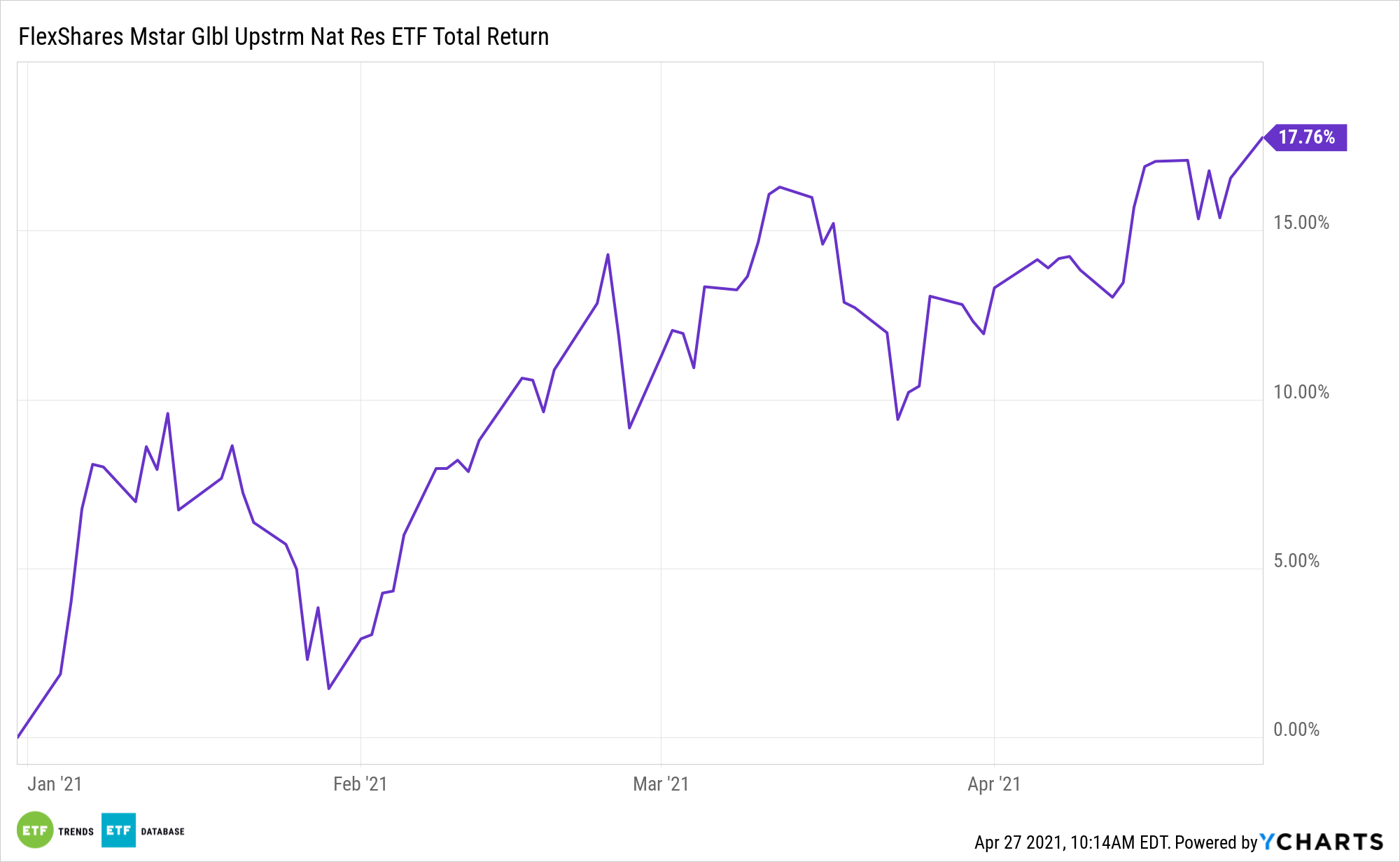

On that front, the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR) is a compelling exchange traded fund to consider.

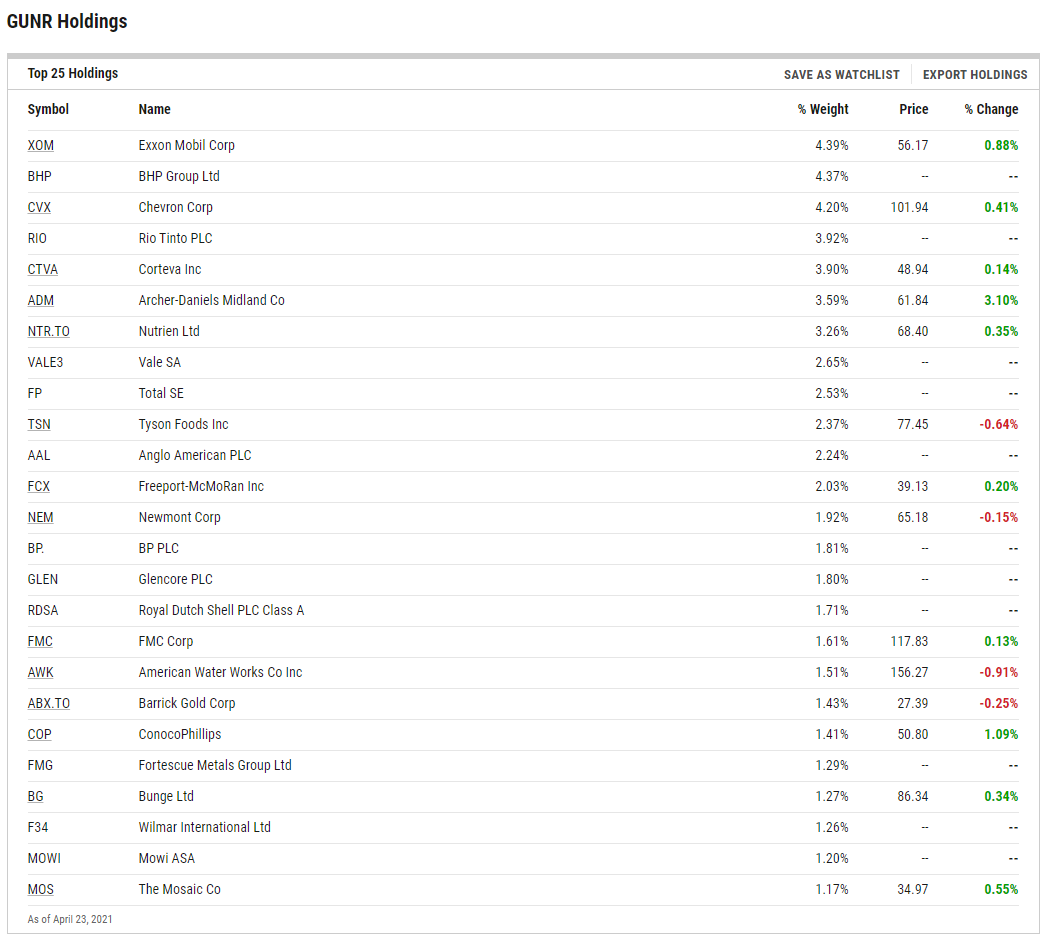

GUNR specifically identifies upstream natural resources equities based on a Morningstar industry classification system, with a balanced exposure to three traditional natural resource sectors, including agriculture, energy, and metals.

GUNR has history on its side when it comes to beating inflation.

“While TIPS can be an effective inflation hedge for the short-term, we believe a strategic allocation to natural resource equities has the potential to help address longer term inflation concerns,” according to FlexShares.

Inflation Benefits with Natural Resources

With TIPS, investors get a relatively low-risk option specifically designed to beat inflation. TIPS are fixed instruments so there’s income, though mostly of the modest variety.

All and all, TIPS are conservative instruments that can leave some investors wanting more, particularly if inflation accelerates in rapid fashion. GUNR can fill those gaps.

Natural resources futures and equities are often positively correlated with inflation, but the latter is the preferred option for many investors.

“At FlexShares, we’ve studied natural resource equities and found the favorable characteristics can be enhanced even further by focusing on companies operating in the upstream portion of the supply chain—companies that actually own assets on the ground. This may help increase an investor’s exposure to the positive impact of rising prices, potentially boosting the allocation’s efficacy as an inflation hedge,” adds FlexShares.

GUNR offers the added benefit of being a play on the value rebound, as nearly 53% of its components are classified as value stocks, according to issuer data. That’s more than triple the weight the fund assigns to stocks with the growth classification.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.